Latest News & Blog

Macquarie Bank names risky suburbs for apartments

This article was first published on www.theaustralian.com.au | 12:00AM MAY 24, 2016 by Kylar Loussikian and Ben Wilmot Macquarie Bank has listed almost 50 risky postcodes for apartment buyers, restraining its lending in more than 100 suburbs across the country’s capital cities. The inner-city postcodes across Sydney, Melbourne and Brisbane, as well as on the Gold Coast and in Adelaide, Perth and Darwin, are most at risk from an oversupply of units in a slowing market. Macquarie yesterday advised mortgage brokers of new requirements, with buyers having to provide at least 30...

Melbourne property market: buyers limited by low stock

This article was first published by Chris Tolhurst on the 22nd May 2016 via www.domain.com.au Sellers had the upper hand on Saturday with a significant drop in auction numbers in Melbourne forcing buyers to compete for fewer offerings. About 730 properties went under the hammer, well below the 995 auctions held on the same weekend last year. But the slide in listings on Saturday did not result in a big improvement in the clearance rate. The Domain Group reported a clearance rate of 74 per cent from 582 reported auction results, which suggests that a solid contingent of buyers are...

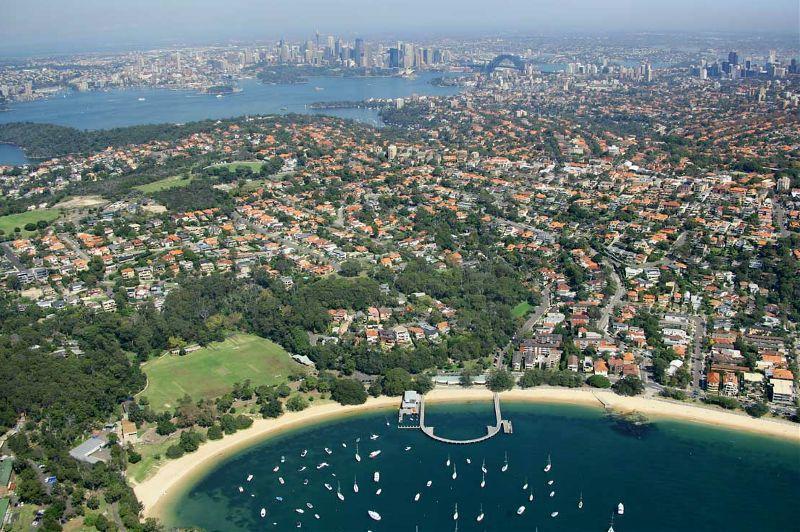

Generation Rent forever: great Australian dream becomes a financial nightmare

This article was first published by Kirsten Robb,Jennifer Duke on the 20th May 2016 via www.domain.com.au If Generation Rent fails to get a foothold in the property market, they face something no other generation has collectively experienced before – renting in retirement. Sydney is fast turning into a city of renters with fewer first-home buyers purchasing now than ever before. While older Australians already have an 85 per cent rate of home ownership, the number of first-home-buyer has halved in the past 10 years, latest Australian Bureau of Statistics data shows. ...

Melbourne real estate: Median house prices could be $1m in five years

This article was first published on www.heraldsun.com.au by SAMANTHA LANDY Property reporter on 14th May 2016 MELBOURNE could have a million-dollar median house price in as few as five years, property experts say. Real Estate Institute of Victoria figures show househunters already struggle to spend less than seven figures within 10km of the CBD, which had a median house price of $1,256,500 at the end of March. The same will soon be the case for Melbourne’s middle ring, where the median is $827,500 and rising. The city’s overall median house price is $713,000. ...

Home loan demand falls overall, but investors return to property market

This article was first published on www.abc.net.au by business reporter Sue Lannin Demand for home loans fell in March, although the value of investor loans rose, suggesting investors have headed back to the market despite a crackdown by banks and regulators. The data from the Bureau of Statistics showed the number of loans taken out by owner-occupiers dropped by 0.9 per cent over the month to 56,316, seasonally adjusted, although they are up by 3.8 per cent over the year. Economists surveyed by Bloomberg had expected a fall of 1.5 per cent in March. The total value...

Melbourne’s middle suburbs offer affordable buys with good growth

This article was first published on www.afr.com by Michael Bleby May 11 2016 at 9:23 AM Melbourne still offers buyers affordable homes within 20km of the city centre, despite the past few years of strong price growth, research from PRD Nationwide says. Fawkner in the north, Heidelberg Heights in the northeast and Sunshine West on greater Melbourne's western side are three suburbs with house prices within reach of the CBD with houses that are in reach of the buyers taking out the average Victorian loan of $405,048, the real estate agency's latest Melbourne Hotspots report...

Australian house prices are marching higher again, even with softer auction clearance rates

This article was first published: businessinsider.com.au by DAVID SCUTT MAY 9, 2016, 11:49 AM If last Tuesday’s rate cut from the Reserve Bank of Australia was going to send a flood of money into Australia’s residential property market, it’s yet to be seen in auction clearance rates. According to data released by CoreLogic RP data, Australia’s preliminary auction clearance rate fell to 65.7% last week. Of the 1,680 results received, 1,150 properties were sold. In total there were 2,182 auctions held across Australia’s capitals, with CoreLogic scheduled to release the...

Budget 2016: trifecta keeps house prices safe

This article was first published on The Australian | May 5, 2016 12:00AM by Turi Condon Property Editor Sydney Price growth across Australia’s $6 trillion housing market will be stoked by the trifecta of this week’s interest rate cut and the budget double that left the negative gearing tax break intact and super looking less favourable, according to industry executives. The events would elongate the rise in the housing market rather than reignite the boom conditions of last year, said Mark Steinert, chief executive of Australia’s largest residential developer, Stockland....

Controversial New eBook Shows How You Can Turbo Charge Your Borrowing Capacity!

Dear Investors, Did you know that Melbourne is now Australia's new hottest housing market having just overtaken Sydney for the fastest growing property prices? In fact property prices in Melbourne grew 2.5 per cent in January 2016 compared to Sydney's 0.5 per cent rise, according to the latest CoreLogic RP Data figures. In the past 12 months, Melbourne's housing market grew 11.8 per cent while Sydney's growth was 10.5 per cent. So permit me ask you a question… Is your serviceability (the amount of money you can borrow) stopping you from entering the property market, or buying your next...

If you aim at nothing, you will hit it with great accuracy, every single time. (How to triumph at New Year’s Resolutions) By Konrad Bobilak

Did you know that according to surveys only 8% of people successfully achieve their New Year's resolutions, which means that 92% fail to keep their promise. The majority of these resolutions revolve around health and fitness, dieting, and quitting smoking, and to a lesser extent creating wealth. While New Year's resolutions are well-intentioned, unfortunately most people fail to keep them, and in a very short period of time, they ultimately go back to their old habits. Before they know it, they find themselves in the exact same situation or set of circumstances they were in the...