This article was first published: businessinsider.com.au by DAVID SCUTT MAY 9, 2016, 11:49 AM

If last Tuesday’s rate cut from the Reserve Bank of Australia was going to send a flood of money into Australia’s residential property market, it’s yet to be seen in auction clearance rates.

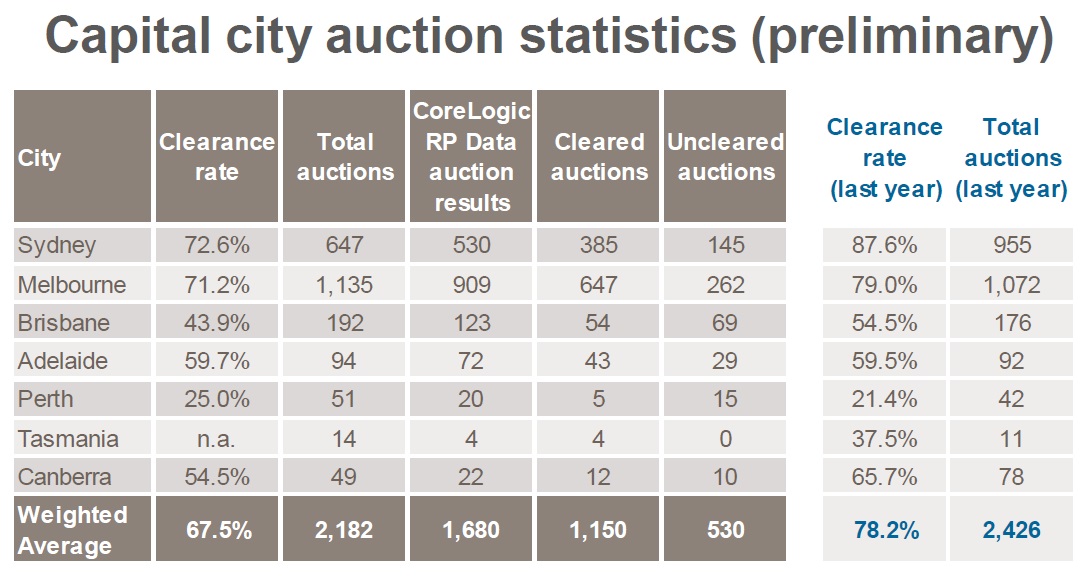

According to data released by CoreLogic RP data, Australia’s preliminary auction clearance rate fell to 65.7% last week.

Of the 1,680 results received, 1,150 properties were sold. In total there were 2,182 auctions held across Australia’s capitals, with CoreLogic scheduled to release the final result on Thursday this week.

The figure was well below the 78.2% rate of the same corresponding week a year earlier, and down marginally on the 69.4% level seen in the final week of April.

The table below, supplied by Corelogic, reveals the auction clearance rate for each capital city, comparing the results to those of a year earlier.

The group notes that all cities excluding Sydney and Brisbane saw a week-on-week fall in clearance rates.

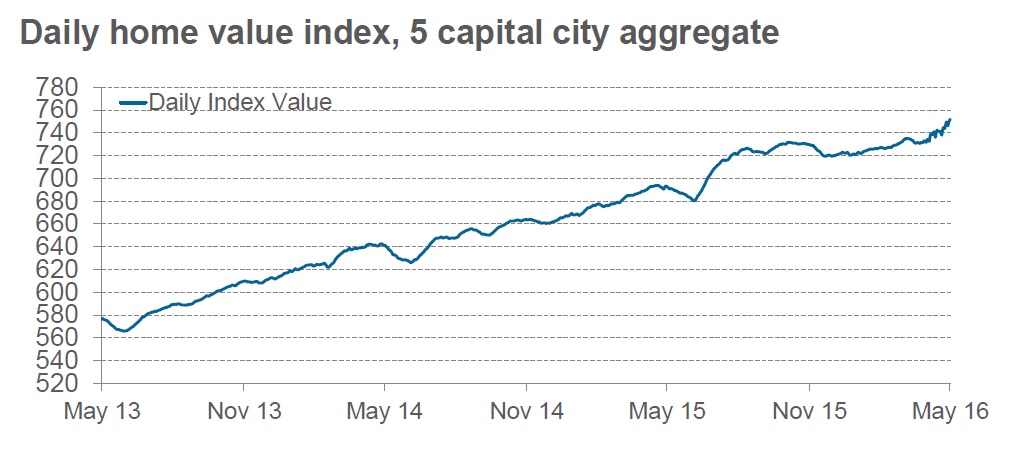

While auction clearance rates were soft, that was yet to translate to weakness in prices. If anything, they’re continuing to accelerate, particularly in Sydney, Melbourne and Brisbane, Australia’s largest housing markets.

According to the separate capital city house price index, capital city house prices rose by 1.1% last week, extending the increase already seen in May to 2.6%.

In just the past eight days, prices in Sydney rose by 3.5%, outpacing gains of 2.8% and 2.2% in Melbourne and Brisbane.

Year to date prices have risen by 6.6% in Sydney, topping gains of 4.6% and 4.3% in Adelaide and Melbourne. Perth is the only capital city surveyed to register a fall over the same period with prices down 2.0%.

Going off CoreLogic’s chart below, it certainly appears that house prices are accelerating after a small period of consolidation earlier in the year.

It’s something that will no doubt add to the debate over the housing affordability, particularly with the election campaign now officially under way.