Latest News & Blog

Don’t Wait to Buy Your Investment Property, Buy Your Investment Property and Wait!

Dear Fellow Property Investor, I often get asked by property investors what is more important; the timing of the market or time in the market? My answer has always been the same for the last 20 years… It’s always the time in the market rather than the timing of the market, that will make you real money, as property investing is a long-term game. Hence, don’t wait to buy an investment property - rather, buy and investment property and wait… Having said that, I am a big believer that you can combine the two if you want to significantly accelerate your property portfolio growth, but there is...

Do Australian house prices really double each decade? Here are the facts…

Dear Fellow Property Investor, It’s hard to imagine strong house price growth at a time when real estate values are falling in most capital cities, but the numbers tell a different story. One of property’s most popular sayings, that house prices double every 10 years, is more accurate than you might think. Despite real estate values falling this year in most cities, a MoneysaverHQ analysis of 40 years of Real Estate Institute of Australia data has found that a majority of state capitals have indeed doubled every decade. But it hasn’t been a smooth ride, often marked by many years of...

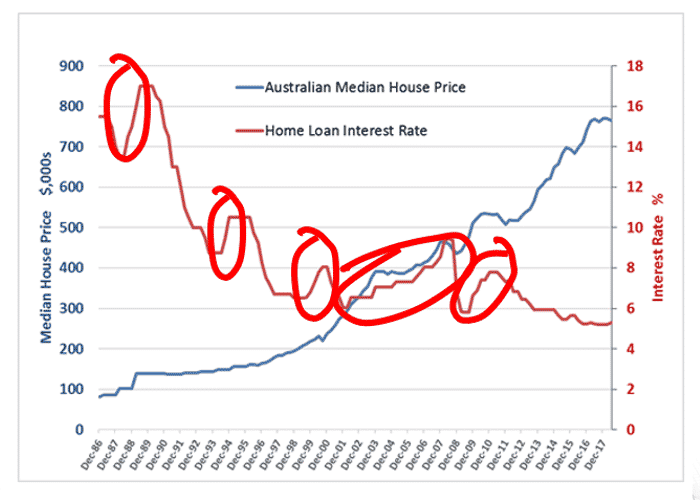

Worried about rising interest rates and the Australian property market correcting?

Dear Investors, Are you worried about the rising interest rates and their direct impact on house prices that could lead to an eventual collapse of the entire Australian property market? With national inflation levels currently running hot at 7% p.a, the RBA has flexed its muscles and just recently increased interest rates by an unprecedented 0.5%, with a further 0.5% cut looming in the not-too-distant future. As we all know, the effects of high inflation include high petrol and oil prices, soaring electricity bills, and increasing food prices just to name a few. The main concern with...

[NEW VIDEO]: 3 Biggest Lies About Fundamental Growth Factors Driving Capital Growth in Australian Suburbs in 2022

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. THE TWO BIGGEST LIES IN AUSTRALIAN REAL ESTATE INVESTING! 1. Population growth automatically creates capital growth; …wrong, time and time again I have seen high population growth areas on the fringes on all the major capital cities, as well as Ipswich in Queensland, displaying record high population growth and average-below inflation capital growth. Bottom line is that it’s always quality rather than quantity, that will have an impact on the capital growth of an area, and in this instance, I am referring to...

[NEW VIDEO]: Which Type Of Property Is The Best Investment Vehicle In 2022? (Apartments VS. Townhouses VS. House & Land)

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. Dear Fellow Property Investor, In further proof Australia’s real estate market has lost the plot, new figures have revealed the biggest property price jump on record. Aussie property prices have hit a new record, with the value of homes in our capital cities skyrocketing by 23.7 per cent over the past year. That’s according to the latest figures out of the Australian Bureau of Statistics (ABS), and it represents the biggest annual jump since records began in 2003. All eight capitals recorded a significant...

[NEW VIDEO]: Melbourne Residential Property Market Update 2022 & Melbourne’s Best 10 Suburbs To Invest In 2022

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. Dear Fellow Property Investor, It was lockdown’s hottest ticket: a home with easy access to the local beach, within five kilometres or less. Property prices have skyrocketed as much as 30 per cent in Melbourne’s bayside suburbs over the past year, Domain figures show, as inner-city families moved further out in search of space to work from home and drawcards such as beaches and parks. The trend has been a boon to home sellers, who are pocketing the gains to upgrade or make their own sea-change. Black Rock...

[NEW VIDEO]: 6 Top Fundamental Reasons Why Australian Houses Will Keep On Going Up In Price In 2021 & Beyond! – By Konrad Bobilak

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. Here are the 6 TOP FUNDAMENTAL REASONS WHY AUSTRALIAN HOUSES WILL KEEP ON GOING UP IN PRICE IN 2021 AND BEYOND! Access to ‘super’ cheap credit, Record High Population growth, Development Restrictive Planning controls, Australian Tax policy favouring property investors, Age Pension discouraging Australians from selling their homes, Australians are holding their houses longer and longer, limiting future stock. REMEMBER... AUSTRALIA’S IMPENDING PROPERTY BOOM: Average homes in Australia may cost up to $6.3...

[NEW VIDEO]: Melbourne’s Top 10 Best and Worst Capital Growth Performing Suburbs in 2021

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. Dear Fellow Property Investor, Melbourne’s outer suburbs have come into their own in the pandemic, with house prices rising by more than 20 per cent in some pockets as buyers leave the inner city for more space. Sellers are taking the opportunity to move locally, into regional Victoria or interstate, looking for their own change of scene after the long lockdowns. House prices jumped in the leafy north-eastern suburbs, up 27.5 per cent in Diamond Creek to a median $950,000 over the 12 months to September, the...

BREAKING NEWS! Melbourne’s Top 10 Best Suburbs To Invest In 2021-22

Dear Fellow Property Investor, Find out which suburbs in Melbourne made the top 10 list in Canstar’s Rising Stars Australian Property Market Report powered by Hotspotting. Despite being the place in Australia most disrupted by COVID-19, the Melbourne property market has remained strong throughout the past 18 months. It has delivered price outcomes that are below par for the pandemic boom but remarkably good in the circumstances. CoreLogic data found that Melbourne house prices overall have increased 18.0% in the year to 30 September 2021, including 1.1% in the month of September and 4.3%...

[NEW VIDEO]: How To Correctly Optimize Your Property Portfolio Structure In 2021

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. Dear Fellow Property Investor, Whilst a small percentage of the Australian population has managed to increase their wealth through property investing, very few are actually maximizing their returns and fewer still have worked out how to best optimize their financial structures. Whether or not you are aware of this, this is costing you money, and more importantly, the opportunity cost of time, and missing out on the potential of paying off your (non-tax deductible ‘bad debt’) home loan sooner, as well as...