Dear Investors,

Are you worried about the rising interest rates and their direct impact on house prices that could lead to an eventual collapse of the entire Australian property market?

With national inflation levels currently running hot at 7% p.a, the RBA has flexed its muscles and just recently increased interest rates by an unprecedented 0.5%, with a further 0.5% cut looming in the not-too-distant future.

As we all know, the effects of high inflation include high petrol and oil prices, soaring electricity bills, and increasing food prices just to name a few.

The main concern with rising interest rates is that it will cost more to take on a mortgage which could result in a reduced number of willing buyers. As individual borrowing capacities are reduced, there may be an abundance of properties on the market, thus resulting in an overall housing market slump.

Right???

Makes logical sense…

Except it’s wrong.

Keep reading…

—————————————————————–

Join me and 250 like-minded property investors at the upcoming live

4 Day Property Portfolio Accelerator Summit 2022.

(12th to 15th August 2022)

Seats are strictly limited so book NOW in order to avoid disappointment…

—————————————————————–

You see, I am here to tell you that history paints us a very different picture – quite the opposite to the commonly held beliefs by the public at large.

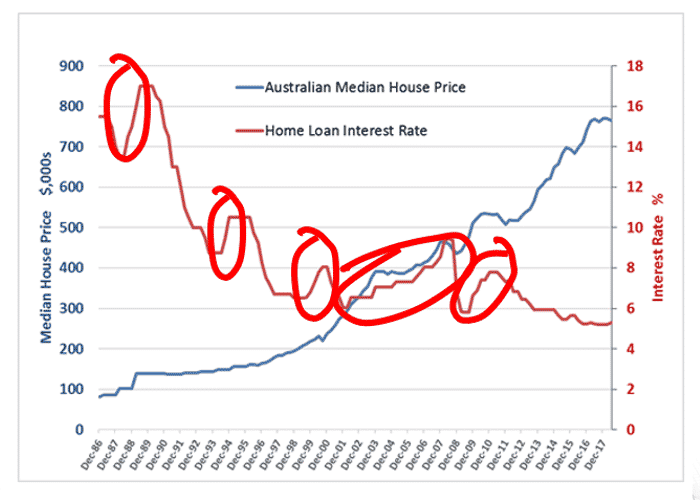

The chart below depicts the Australian House Median price movement over the last 30 years and its relationship with interest rate movements over the same period of time.

As you can see, there have been many instances where the RBA has aggressively increased interest rates (dark red line) and the Australian housing market (blue line) has experienced a boom at the same time (red circles).

Doesn’t make sense, right?

It’s counter-intuitive?

And if held unchecked, these and many other myths and commonly held beliefs about the key drivers of the Australian property market can end up costing you tens of thousands, even hundreds of thousands of dollars wasted in letting opportunities slip through your fingers…and your wallet!

So, let me ask you a very serious question…

Do you know why this has occurred over the last 30 years?

Why is it that aggressive RBA interest rate rises took place on a background of a booming Australian housing environment?

This, plus many other historical and current topics, will be unpacked that the upcoming live 4 Day Property Portfolio Accelerator Summit 2022.

So, reserve your tickets NOW!

—————————————————————–

Join me and 250 like-minded property investors at the upcoming live

4 Day Property Portfolio Accelerator Summit 2022.

(12th to 15th August 2022)

Seats are strictly limited so book NOW in order to avoid disappointment…

—————————————————————–

By attending the 4 Day Property Portfolio Accelerator Summit 2022, you will learn a proven system that has worked for thousands of successful property investors to successfully build large property portfolios….

So, if you have been sitting on the sidelines watching other property investors around you going from strength to strength, then you need to book yourself into the upcoming live 4 Day Property Portfolio Accelerator Summit 2022 now.

I look forward to meeting you at the event!

Yours in Success,

KONRAD BOBILAK