Latest News & Blog

Learn 5 Ways To Buy Property with Virtually No Money Down!

Dear Fellow Property Investor, Let me ask you a high-level question… Is your ability to come up with the initial 10% deposit on your investment property leaving you locked out from the property market? If the answer is YES, then you need to book yourself into the live 2-Day Real Estate Investing Fast-Track Weekend. By attending this unique live 2-Day event, YOU’LL LEARN 5 WAYS TO BUY PROPERTY WITH NO MONEY DOWN, which include; 10% Deposit rebate from the developer at the settlement of the property. 10% Gifted deposit from the developer when buying property. Long term settlement,...

Learn To Pay Off Your Home Loan In 10 years Or less, And Use The Savings To Build Your Very Own Property Empire!

Dear Fellow Property Investor, Let me ask you a question; Are you concerned or even stressed about the recent interest rate hikes? Many Australians are… You see, one of the most important concepts that you can learn in your lifetime is how to correctly structure your personal finances and create a system that enables you to pay off a typical 30 year principal and interest home loan in 10 years or less. And whilst this process is ‘simple’ to set up and implement, (once you know how), the vast majority of Australians still have no idea how it works, or who to turn to for the right advice on...

[NEW VIDEO]: The Melbourne Residential Property Market Update 2022

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. Dear Fellow Property Investor, As Australia’s rental market continues to tighten to record levels, the pace of rental growth has started to ease, suggesting affordability constraints are having an impact. CoreLogic’s Quarterly Rental Review for Q3 2022, released today, shows the national rental index had its smallest monthly increase this year, up 0.6% in the month to September and 2.3% over the September quarter, a 60 basis point decrease on the three months to June (2.9%). The quarterly trend in national...

[NEW VIDEO]: The Long-Term Impact of Interest Rates on Australian House Prices

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. Dear Fellow Property Investor, Suburbs struggling the most to pay mortgages as Australia’s cost of living crisis worsens. Some Australians have fallen more than 30 days behind their mortgage repayments as the worst suburbs are named and shamed. An estimated one in five mortgage holders – or 551,000 Australians – will struggle to pay back their mortgage if interest rates continue rising as expected. Comparison site Finder found a whopping 20 per cent of mortgage holders will be in serious mortgage distress if...

[NEW VIDEO]: How To Improve Or Fix Your Credit File

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. Claim your free credit consultation today with CRS ► https://www.crsolicitors.com.au/ Contact Pasha directly at pasha@crsolicitors.com.au or call them on 1300 004 912. For more information regarding everything Credit, subscribe to their YouTube channel https://www.youtube.com/channel/UCtkDRj5oTcwl6PbyUJKuQEA CRS: JUST YOUR ORDINARY EVERYDAY CREDIT SUPER HEROES! As seen in The Australian, Herald Sun, Money Magazine and News.com.au, The team at CRS help improve your credit reports and raise your credit scores...

[NEW VIDEO]: Has the Apartment Market in Melbourne Bottomed Out Yet? Is It A Good Time To Buy?

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. Dear Fellow Property Investor, Did you know that one-bedroom flats in the big cities have missed out on Australia's property boom despite interest rates being at record lows? National home prices last year surged by 22.1 per cent - the fastest annual growth for a calendar year since 1989. House values in some capital cities went up by a third in just one year as two and three-bedroom units had double-digit annual price growth. But one-bedroom apartments hardly increased in value at all, especially in cities...

YOU WILL ONLY GET ONE OR TWO REAL ESTATE BUYING OPPORTUNITIES LIKE THIS EVERY 18 YEARS! The Next 12 Months Represents One of Them!

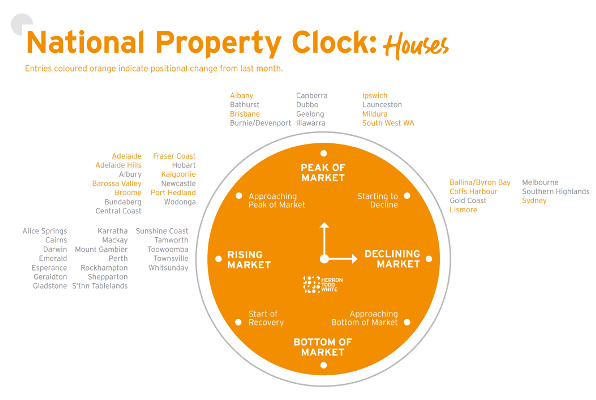

Dear Fellow Property Investor, I know it can be difficult in a market where property prices in Sydney and Melbourne are going backwards, to see things as they really are. Seeing the bigger picture can be difficult for the average Australian whose education comes from the media. But, for those of us who know our history, we have seen this all before. You see, the Melbourne and Australian property market is cyclical in nature, and hence quite predictable, but only to people who have taken the time to educate themselves. Here is the Australian Property Clock depicting the exact location we...

The Melbourne property market is in the decline phase of the property cycle…Now what?

Dear Property Investor, Did you know that the Melbourne property market has moved in the decline phase of the property cycle? Melbourne’s median house price fell 0.9 per cent in the June quarter, Domain’s latest house price report showed, to $1,074,369. That followed a similar 0.9 per cent drop in the March quarter. And as such, here are the suburbs that have declined the most over the last quarter; The biggest fall in house prices was in exclusive Toorak, where the median fell 16.9 per cent over the year to June, to $4.57 million. In Lower Plenty, where people fled during Melbourne’s...

See the suburbs where Investors Prime’s clients made a killing in 2021!…

Dear Property Investor, Here are the Melbourne suburbs that I was personally focusing 90% of my property sourcing efforts in over the last few years making our clients RICH! These are the exact suburbs that my clients were buying townhouses in the last 3 years! More importantly, the chart below depicts the actual capital growth history of these suburbs for the December quarter 2020 to December quarter 2021! I keep telling people to stop investing in Point Cook and Truganina and buy in Melbourne’s Bayside suburbs! Permit me to ask you a question… Are you getting anywhere near to these...

What the Media and Academic Experts are NOT telling you about interest rate increases…

Dear Investors, Once again there is a lot of doom and gloom, Armageddon-type of media stories propagating the flawed assumption that increases in interest rates will be directly responsible for the imminent collapse of the Australian Residential Property Market. And nothing could be further from the truth… You see the most recent data from RPData Core logic tells us that the combined value of the Australian Residential Property Market as at June 2022 is $10 Trillion dollars, with ONLY $2.1 Trillion in outstanding mortgages! That’s a LVR of ONLY 21%! And here is the kicker: This debt is...