Dear Investors,

Once again there is a lot of doom and gloom, Armageddon-type of media stories propagating the flawed assumption that increases in interest rates will be directly responsible for the imminent collapse of the Australian Residential Property Market.

And nothing could be further from the truth…

You see the most recent data from RPData Core logic tells us that the combined value of the Australian Residential Property Market as at June 2022 is $10 Trillion dollars, with ONLY $2.1 Trillion in outstanding mortgages!

That’s a LVR of ONLY 21%!

And here is the kicker:

This debt is unequally distributed across Australian suburbs. Most of which is concentrated in the fringe house and land estates located on the outskirts of the major capital cities, such as Melbourne, Sydney and Brisbane.

That’s why they call them ‘The Mortgage Belt Areas’…

And that’s why you don’t invest in these areas!

Compare that to the blue-chip suburbs, where there is very little mortgage exposure, not to mention, very high income per capita and household!

Keep reading…

Now, recent surveys show that most Australians are worried about the recent rise in interest rates and further increases of 1% or more on the cards…

In fact, consumer sentiment is at record low levels, similar to that of the Global Financial Crisis (GFC) of 2008…

And I don’t blame them, as most people simply buy into the hype and fail to do some basic research on the topic.

You see, I am here to tell you that history paints us a very different picture – quite the opposite to the common beliefs held by the public at large.

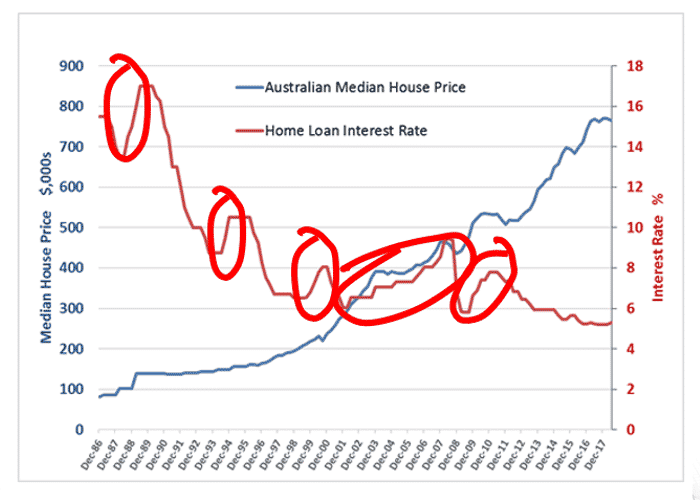

In the recent history, four times over in the last 30 years (where the RBA has aggressively implemented monetary policy of increasing interest rates), each period was followed by a property boom!

Case in point;

- Between August 1994 and December 1994 the RBA increased rates by 275 basis points.

- Between November 1999 and August 2000 the RBA increased rates by 250 basis points.

- Between May 2002 and March 2008 the RBA increased rates by 300 basis points.

- Between October 2009 and November 2010 the RBA increased rates by 175 basis points.

In each instance in the above four examples of aggressive interest rate increases, the Australian property experienced a major property boom!

This is NOT the doom and gloom apocalyptic picture that the main stream media wants you to believe.

The chart below depicts the Australian House Median price movement over the last 30 years and its relationship with interest rate movements over the same period.

Success, it seems, leaves clues.

You see, there is more money made at the bottom of each property market than at the top.

But here is the key distinction…

Wealth is ALWAYS transferred from the Uneducated to the Educated…

So, let me ask you a very serious question…

When is a good time to get educated?

Yours in Success,

KONRAD BOBILAK