So what is the No #1 most important aspect of maximizing your chances of succeeding in property investing, and turning your passion into profits?….

It’s knowing thy self, and then knowing thy strategy, and then matching the two up.

So, let’s explore knowing thy strategy first, before we tackle the knowing thy self.

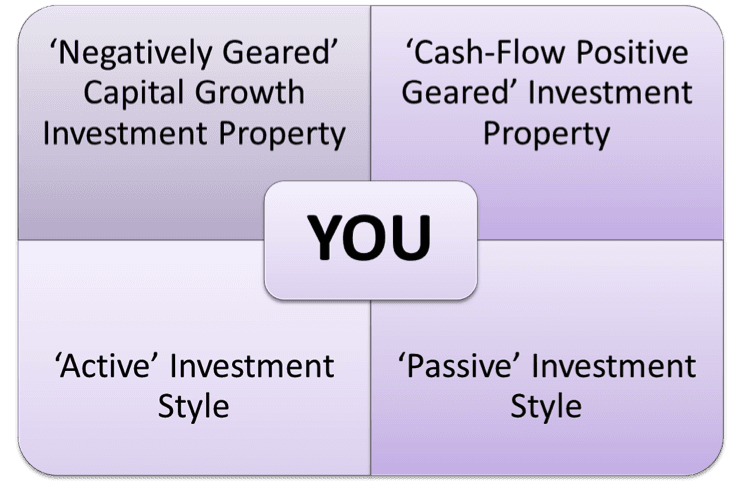

THE INTELLIGENT INVESTORS INVESTMENT MATRIX

As can be seen from the above INTELLIGENT INVESTORS INVESTMENT MATRIX, the diagram shows two distinctive types of investment properties;

- Negatively Geared Capital Growth Investment Property; which basically represents the majority of properties such as detached houses, townhouse, and apartments, located in close proximity of the major capital cities. In these scenarios there is a ‘negative’ gap between the rental yield, which is typically 3.5% to 4.5% and the cost of funding (interest only loans) 4% to 5% per year.

- Cash-Flow Positive Geared Investment Property; whilst traditionally cash-flow positively geared properties have been associated with regional and mining towns, whereby the rental derived from the property exceeds the interest loan repayments, i.e. rental yields 8% to 12% and cost of funding 4% to 5% p.a., there are more examples of cash-flow positively geared properties appearing in major capital cities such as in; dual income properties, dual occupancy properties, boarding houses, etc.

Furthermore, there are two distinctive styles of investing, or investing approaches that can be implemented by property investors;

- The Active Investment Approach, or active style of investing involves getting your hands dirty, to some level or degree. With this type of hands-on-approach, the level of Activity can vary drastically from strategy to strategy. This style of investing refers to a scenario whereby the investor actually adds-value to the existing property by altering the building, or adding value to the land by having it rezoned into a higher usage. Here are some examples;

- The least active investment approach is to simply buy a property, and apply for a higher zoning of that property. Generally speaking, the lowest value zoning is rural zoning, followed by residential, then high density residential, followed by commercial, and mix usage high density residential and commercial.

- Another example of active investment approach could be strata- titling, whereby an investor buys an entire block of apartments on one title, and then proceeds to strata-title then by setting them individually on separate titles. This process adds a significant amount of value to the property, without actually physically altering the nature of the property itself.

- One of the most popular types of Active investment approaches, one that has had extensive media coverage in the recent years is property renovations. Property renovations can literally add tens of thousands to hundreds of thousands of dollars, to the right property, by the right investor. At the same time they can create losses if the renovation was completed by the wrong investor, the wrong level (i.e. ‘over-capitalisation), the wrong property, or in the wrong area. Renovations can also vary drastically in terms of the level of transformation, from cosmetic renovations, whereby the improvements are paint and new carpets, to highly intensive structural renovations, wherein the investor is adding more rooms or level to the existing property.

- Property Subdivisions have also become popular in recent times, whereby investors are buying land, with or without an existing dwelling on it, and go through the process of dividing the land into pieces that are easier to sell or otherwise develop. This process can be highly lucrative if executed correctly in the right area.

Whilst there is a lot of other types of Active Investment Approaches for property investors, which is beyond the scope of this report, additionally there are variations within each strategy. However, the most important aspect of these types of approaches is that the investor is not relying on the market to move up in order to make capital growth. Rather, the investor is adding value to the property by altering the nature of the property, and creating capital growth irrespective of market conditions.

- The Passive Investment Approach, is mainly based on the ‘buy and hold’ strategy, whereby investors purchase property with the notion of holding the property medium to long term, relying on natural capital growth to occur during the holding phase. Whilst this approach might not be as exciting as property developing or doing subdivisions, this is the most popular strategy that is being practiced by the majority of aspiring property investors in Australia, 72.8% of whom own only one investment property according to ATO statistics.

Generally speaking, virtually all investment properties can be categorised as either Negatively Geared investment properties, or Cash-flow Positive Investment properties.

- Negatively Geared Growth Properties, are usually located in close proximity to the CBD (Central Business District) of Australia’s major capital cities. These properties, consisting of detached houses, townhouses and apartments, are characterised by consistent historical capital growth of 7% to 10%, with a rental return of 3.5% to 4.25%. The three biggest of these cities being Sydney, Melbourne and Brisbane, closely followed by Adelaide and Perth and, to a lesser extent, Canberra and Hobart.

Negatively Geared Growth properties leave the owner or landlord with an out of pocket cash deficit after taking account of all associated holding and running costs of the property. The primary intention of investors securing Negatively Geared Growth properties is that, historically, they have doubled every seven to ten years since 1901, providing they are located in the right areas.

- Cash-Flow Positive Properties are typically located away from the CBD of Australia’s major capital cities on the fringes of major cities, in regional centres or mining towns, though there are exceptions to the rule. These properties typically consist of detached houses, townhouses and apartments, but have very diversified characteristics and histories of capital growth, from flat capital growth in outer regional centres ranging from 5% per annum to 8% per annum, right up to sporadic capital growth of 15% to 24% per year at peaks in mining towns, such as Gladstone in QLD or Port Headland in WA. These properties tend to display cash-flow positive net scenarios of 8% to 10% plus per year rental yields, which means that they leave a net cash surplus for the owner or landlord after taking into account all associated holding and running costs.

There are also examples of Cash-flow positive properties that are located in the major capital cities, wherein investors have altered the property by adding additional rooms, thus increasing in the rental yield on the property , or turned the property into student accommodation, corporate leasing, holiday leasing, etc.

The most important aspect associated with the Passive Investing approach is that the investor is making money by holding the property medium to long term, and solely relying on the time in the market to increase the value of the property. Thus, they make a capital gain on the property, providing that it was purchased at the right time, at the right price and most importantly in the right location.

What’s really interesting is that while the vast majority of Australian property investors practice the Passive Investment Approach, most fail to go beyond their second purchase, and subsequently fail to achieve their ultimate goal of financial independence. According to ATO figures from 2013, only a small fraction, 0.8% of all Australian property investors own 5 or more investment properties.

So what are the main reasons why so many Australians fail to achieve their goals when it comes to building large investment property portfolios?

The answer simply is that most fail to correctly align their;

- time,

- money,

- financial literacy and,

- skill resources,

… with a correlating investment strategy, and hence, most fail before they start.

In essence, most property investors choose an investment strategy, usually based on its perceived rewards, that is completely incongruent with the amount of time, money and actual skill resources that the investor possesses, and ultimately tread water or fail during the implementation process. In fact, some will spectacularly get this wrong and be forced to sell at the wrong time and/ or price and lose money!

You see, your ability to correctly align your available time, money and actual skills with the right strategy will ultimately determine your success in the property game!

I know this may seem harsh, and some might say that ‘anything is possible as long as you have faith and belief in yourself’.

Always remember that the very definition of Success is when opportunity meets preparation…

Best of luck in your investing endeavours, Konrad Bobilak CEO investors prime real estate (www.investorsprime.com.au)