Dear Friend,

Permit me to get straight to the point…

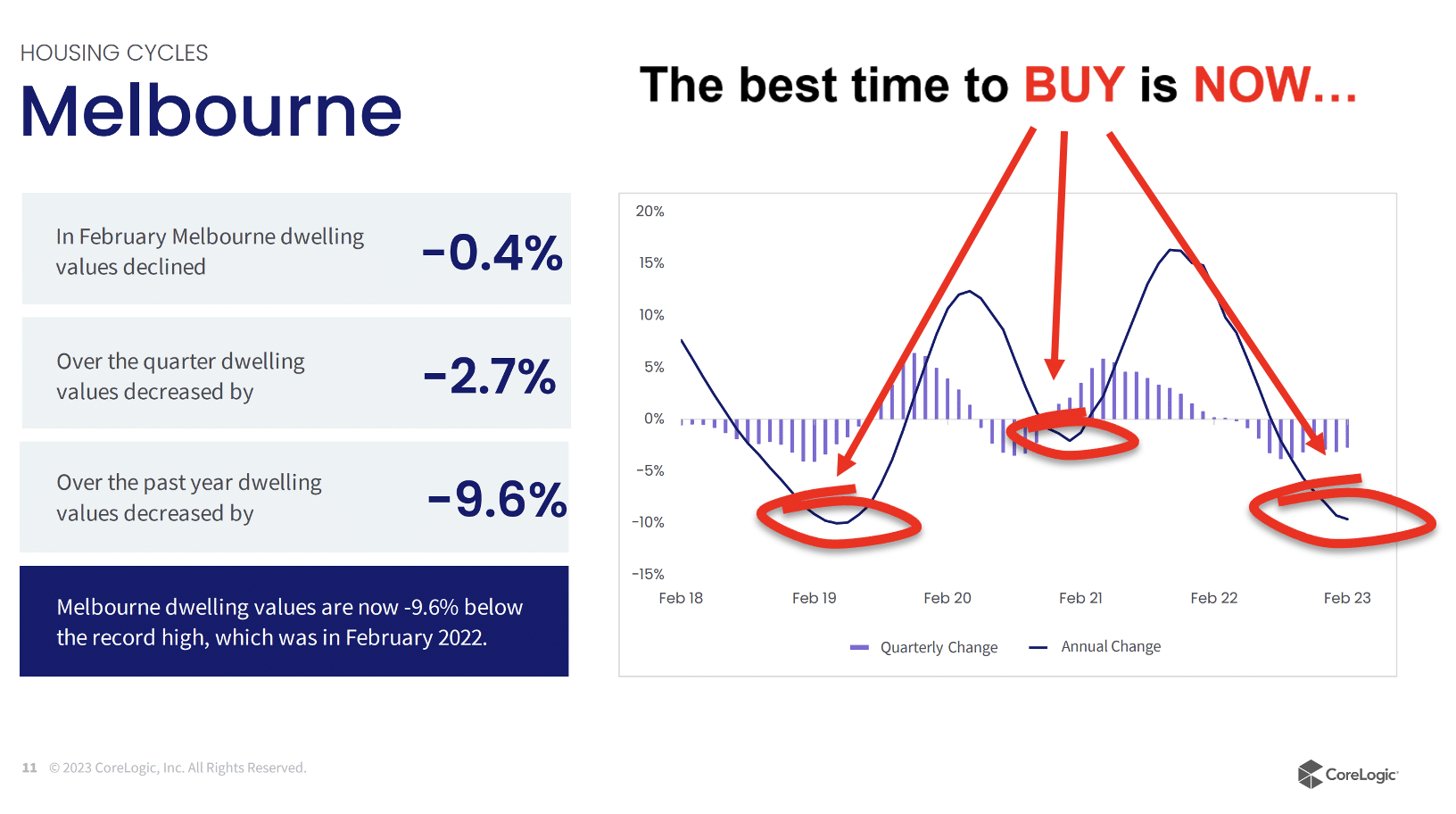

The best time to BUY from a ‘market timing’ perspective is NOW…

See below;

The best time to BUY is NOW…

Don’t say 2 years from now that I didn’t tell you so…

I often get asked by property investors; ‘What’s more important; the timing of the market or time in the market?’, and my answer is, and has always been the same for the last 20 years…

It’s always time in the market rather than the timing of the market, that will make you money, as property investing is a long-term game! Hence, don’t wait to buy an investment property, rather, buy an investment property and wait’…

Having said that, I am a big believer that you can combine the two if you want to significantly accelerate your property portfolio growth, but there is a twist to this…

And that is, practice counter-cyclical investing!

So what is counter-cyclical investing?

Well, in essence, it is doing the exact opposite of what the vast majority of property investors are doing in the market.

When the consumer sentiment is low, characterized by low clearance rates of 50% or lower, smart investors buy. When the market is booming, which is usually the shortest part of the property cycle, sophisticated investors focus their energy on revaluing their properties and locking in their lines of credit (LOC) at the highest possible level, waiting once again for an opportunity to snap up a bargain at the low point in the market.

Essentially, your job as a property investor is to watch the market for any higher references of properties that have sold in the last 90 days or less, in the same postcode, similar in size and architectural style. Once you find a higher reference in the market, you have the ability to request a valuation via your lender, based on the new comparable sale, to have your investment property revalued and subsequently increase your line of credit (LOC) or redraw facility, freeing up more equity to buy more property.

This practice of counter-cyclical-investing will take discipline but you will gain more confidence as you become financially literate. Perhaps the best example of counter-cyclical investing is that of the infamous Warren Buffett who, by age 79, built Berkshire Hathaway into a $198 billion company, averaging an annual growth of 20.3% in book value to its shareholders for the last 44 years, while employing large amounts of capital and minimal debt. Warren’s famous style of investing was encapsulated in a quote;

“I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.”

– Warren Buffett

Remember that the risk always lies with you, not with the market. The market is simply a vehicle that transfers wealth from the uneducated to the educated. The sooner you gain the necessary skills and education to take advantage of the property market, the sooner you will be making money and taking advantage of rare opportunities such as what the current property and share markets are presenting right now.

So, what are you waiting for? Reserve your place and join me and 55 like-minded property investors at the next Real Estate Investing Fast Track Weekend!

Seats are strictly limited so book NOW in order to avoid future disappointment…

Here’s a Sneak Preview of What You Will Discover By Attending This Unique 2 Day Live Event:

- The likely impact of tighter lending controls brought about by APRA and how this will impact your serviceability as the RBA continues to increase interest rates.

- What you need to know about Australia’s housing market’s ability to perform in an inflationary and rising interest rate environment.

- Why now is the ‘PERFECT ECONOMIC STORM’ for property investors and learn what you need to do NOW to make sure you collect your slice of the profits that will be made by savvy property investors in Australia.

- How to understand property cycles, state by state, and how to hone in, with laser-like precision, on Melbourne’s Hot Spots in 2023 and beyond.

- Learn how to identify the exact type of properties (Apartments, Townhouses or Detached Houses) you should be buying in different areas in order to maximize capital growth in the shortest period of time…

- The exact way to build, structure and automate your property portfolio, that is virtually the exact opposite of what the banks and lenders want you to do.

- Learn the exact formula that is used by all the banks to assess your borrowing capacity, the DSR Ratio (Debt Serviceability Ratio), and understand the importance of buying a combination of Cash-Flow Positive Properties and Negatively Geared Growth Properties. This alone will save you years and even decades of frustration, and countless possible rejections from banks and lenders.

- The huge difference between property ‘OWNERSHIP’ and ‘CONTROL’ via the use of corporate trustees and trusts, that the rich exploit and the poor do not…

- Learn which properties to buy first, Cash-Flow Positive Properties OR Negatively Geared Growth Properties; this is essential if your plan is to continuously buy property year after year. If you get this wrong you will hit a brick wall with banks and lenders very quickly. The order that you buy them in will determine how quickly you can build your property portfolio and achieve your financial goals.

- And truckloads MORE insider secrets to catapult your property investing success….

Seats are strictly limited so book NOW in order to avoid future disappointment…

Kind regards,

KONRAD BOBILAK