Dear Fellow Property Investor,

These are the following reasons why NOW is the Perfect Storm!

1. Chinese buyers return to Australia’s housing market and snap up properties, sparking fears prices could rise even further! Foreign buyers are returning to the Australian property market; the fear is, they could drive up the cost of homes for Aussies already struggling to buy one.

China was the largest source of investment for residential real estate investment proposals by number and value ($0.6 billion), as it was in 2021-22 and 2020-21. The next two largest sources of residential investment were Hong Kong ($0.1 billion) and Vietnam ($0.1 billion).

The investment figures that were recently released by the Australian Government’s Treasury, in its Quarterly Report on Foreign Investment, cover the last quarter of 2022.

Total foreign investment in Australia fell sharply but Chinese buyers remained the most significant, with $600 million of approved investment, even though that was down $1 billion.

With Hong Kong investment included in the Chinese total, Chinese investment this quarter accounted for $700 million of Australian property. After China, the next largest investors were Vietnam, Singapore, and the United Kingdom, each of which invested $100 million in residential real estate.

In this quarter, the largest target sector for proposed investment for the quarter by value was commercial real estate, with a total value of $19.3 billion.

The United States was the largest source country for commercial investment proposals by number and value ($16.7 billion), as it was in 2021-22 and 2020-21. The next four largest source countries by value were China ($6.7 billion), Singapore ($5.2 billion), South Korea ($4.2 billion), and Canada ($3.8 billion).

While the overall numbers are down, the return of Chinese students to Australia, an end to pandemic travel bans, and warming relations between the two countries, are driving a rise in property inquiries from China.

Juwai IQI Co-Founder and Group Managing Director Daniel Ho said that at the current rate, China would invest an estimated $3.2 billion in Australian residential real estate this year, which would be up from $2.4 billion in 2021-22.

With the inclusion of Hong Kong, China would invest $3.8 billion, which would be up from $3 billion last year.

Source: Juwai IQI.

So, what are you waiting for?

Reserve your place and join me and 55 like-minded property investors at the next Real Estate Investing Fast Track Weekend!

Seats are strictly limited so book NOW in order to avoid future disappointment…

“In 2022 and so far this year, Australia is the most popular country for Chinese homebuyers, for the first time ever, according to Juwai IQI Chinese buyer enquiries,” Mr Ho said.

“In January, Chinese buyer inquiries for Australian real estate surged by 24 percent compared to December, due to the announcement that borders would be reopening.” The latest data from national removalist booking platform Muval has revealed Australians are continuing their exodus from Sydney, looking strongly in favour of Melbourne.

2. Inbound inquiries show the laneway capital remains streets ahead of the rest according to the platform; Melbourne was the most popular city to move to in 2022, with the February figures showing the city accounted for the most eyeballs. 28% of all major metro inbound moving inquiries were for Melbourne. This is an increase from last January when Melbourne accounted for 24%.

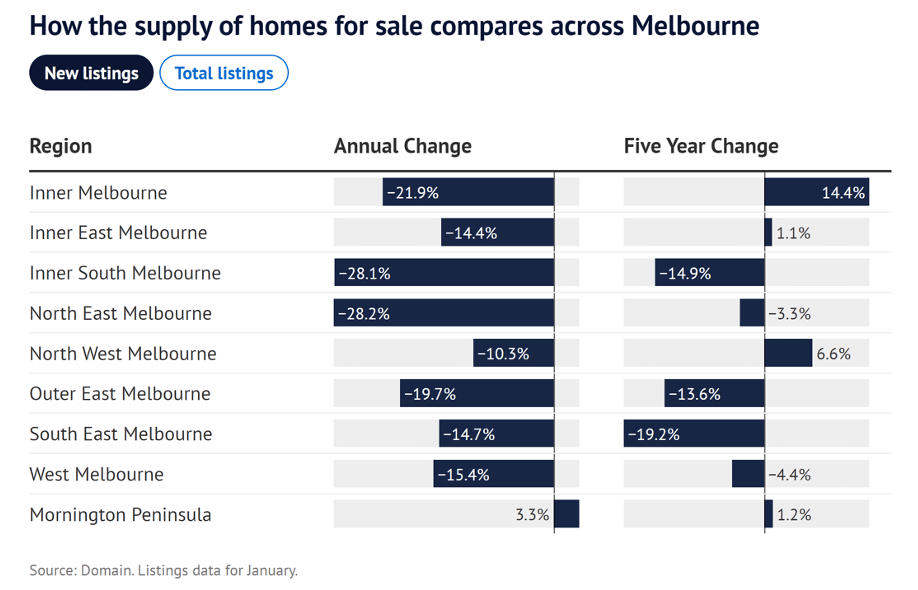

3. Melbourne homeowners are holding back from listing properties in the declining market, resulting in almost a 30 percent drop in the number of homes for sale in some regions year on year.

House hunters have fewer properties to choose from as falling property prices prompt vendors to rethink plans and some to delay selling until the market improves.

Buyers in Melbourne’s north-east have seen the biggest drop in homes on offer, as new listings in January – properties marketed for 30 days or less – were down 28.2 percent year on year. This fall was closely followed by the inner south, where new listings dropped by 28.1 percent.

The inner region was down 21.9 percent, the outer east 19.7 percent, and the west 15.4 percent.

New listings were down more than 10 percent across Melbourne, but the number of homes hitting the market on the Mornington Peninsula rose 3.3 percent.

The total number of homes for sale was also down in most Melbourne regions except in the northwest and west of the city, where numbers were up 13.9 percent and 8.2 percent respectively. In the Mornington Peninsula, they were up 27.8 percent.

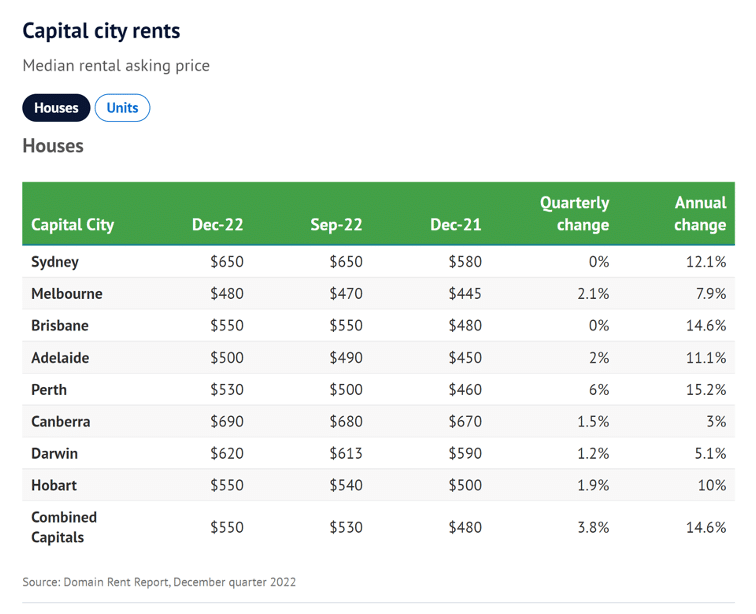

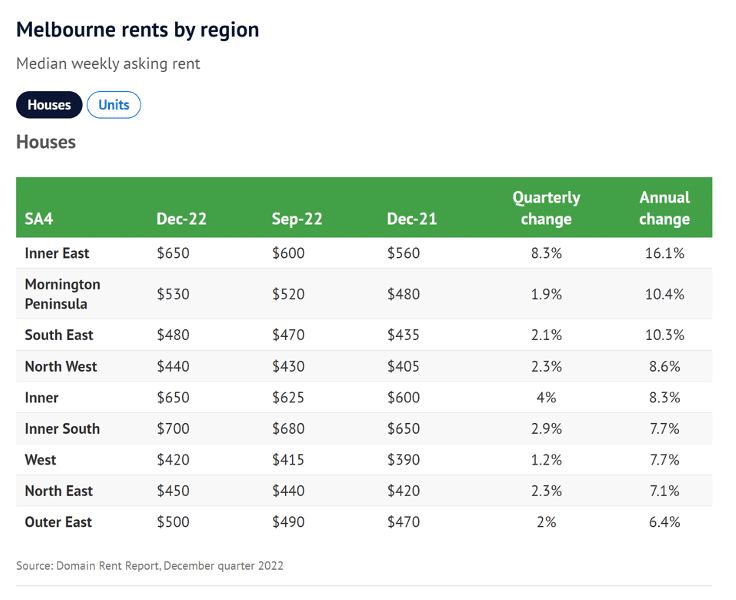

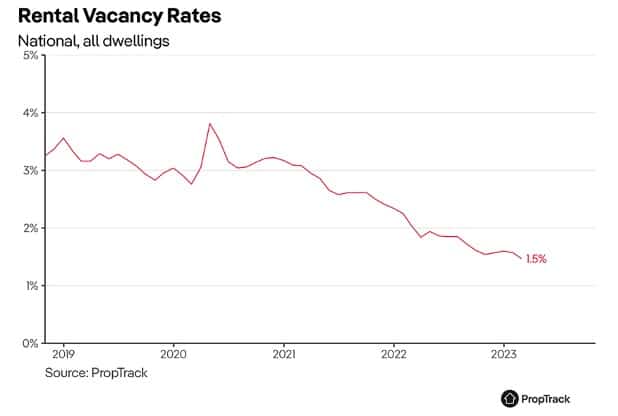

4. Melbourne rents have rocketed to record highs, jumping as much as 20 percent in a year and prompting fears of homelessness and housing stress for low-income households. In fact, there has never been a tougher time to be a renter in Melbourne, where vacancy rates are just 1.4 percent and rents have hit record highs.

The median weekly cost of renting an apartment in Melbourne last week hit $450 – a 20 percent increase on 12 months earlier – while in inner Melbourne rents have reached a weekly median of $490 a week, according to the Domain Rent Report for the December quarter.

The most recent Australian Bureau of Statistics figures, taken in August, showed the median weekly income in Melbourne was $1300 (across Victoria the median was $1250). Rental stress is defined as paying more than 30 percent of one’s income in rent, meaning for a single renter on a median wage in Melbourne, anything more than $390 a week would put them in rental stress.

For houses, the median rent reached a record high of $480 and grew 7.9 per cent in the 12 months to December.

The increase comes amid growth in demand as tenants make pandemic living habits permanent and eschew share houses for their own space, at the same time as international borders reopen.

While rental increases are bad news for tenants, its great news for landlords, especially for those who purchased their investment properties in the inner east and Bayside where rental yields have increased over 16 and 17 per cent respectively, far beyond any increases in interest rates over the same time period.

5. Record Low Vacancy Rates;

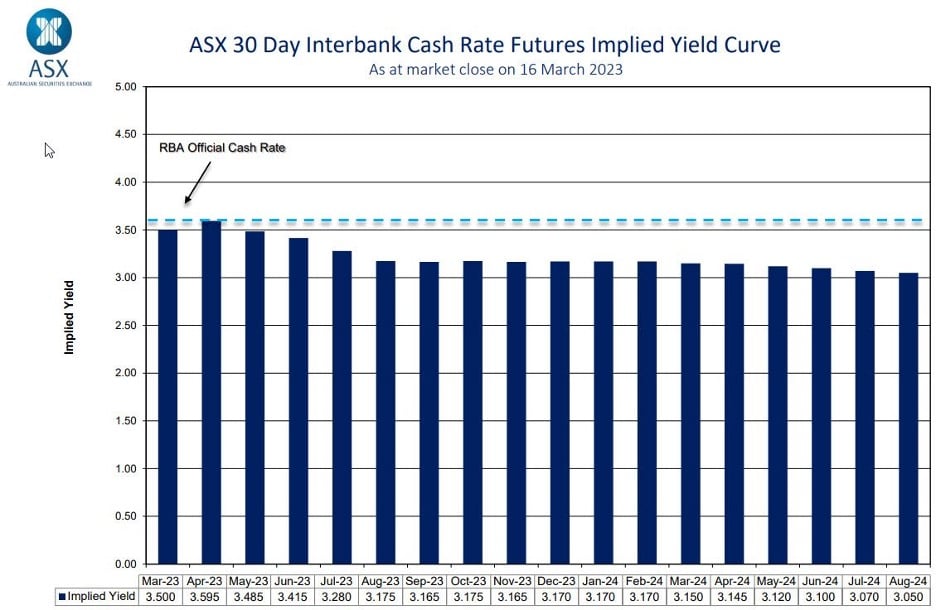

6. Financial markets think rate hikes are done… now pricing is in a rate cut through the second half of the year.

So, in summary, despite the ‘Doom and Gloom’ portrayed by the media, we have the following factors that make this a perfect buying opportunity for savvy, educated, and market-ready property investors;

We have record levels of foreigners coming to Melbourne to live and buy property, record high rental increases in key suburbs, combined record low vacancy rates of 1.2 percent, coupled with a low volume of current stock available for sale, some 30 percent less than the same time last year.

To further aggravate the situation, there is a record low volume of a future stock in the pipeline, as developers and builders keep shelving future projects indefinitely, due to uncertainty in the ever-escalating cost of materials, critically low number of skilled labor, and the risk associated with entering into fixed contracts for off-the-plan sales, not knowing if there is going to be any profit upon completion of new projects.

Plus, it is highly probable that we are approaching the peak of the interest rate cycle, and as soon as Australian inflation is under control, which it will be, the RBA will start to cut interest rates to their recent low levels!

This will be great news for property investors as their investment properties will soon become cash-flow neutral and then positive!

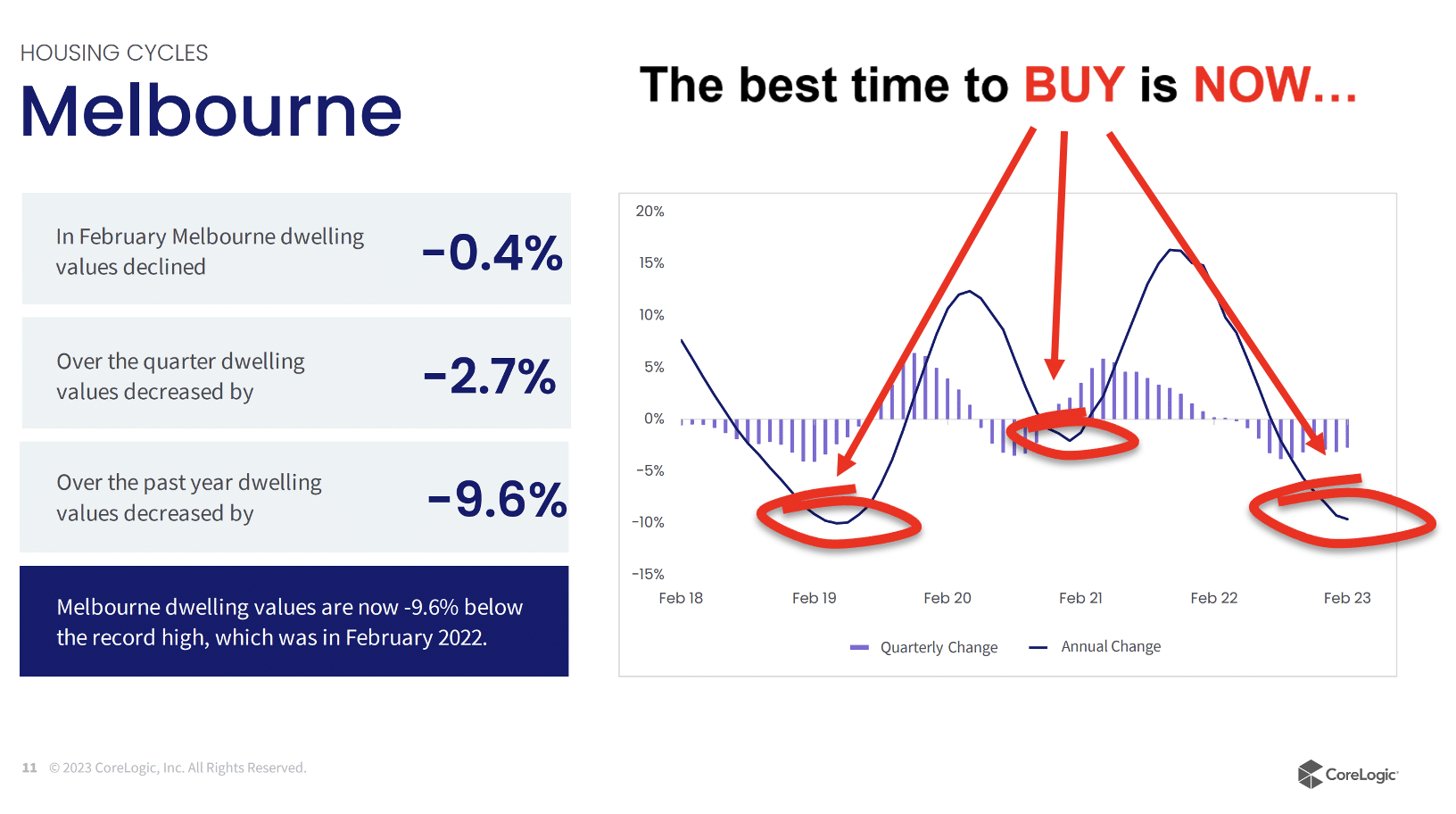

All these factors have contributed to a unique situation wherein savvy educated and market-ready investors have taken advantage of the prevailing circumstances and are going in hard, negotiating deals, and securing investment properties at the very bottom of the Melbourne property cycle…

Permit me to get straight to the point…

The best time to BUY from a ‘market timing’ perspective is NOW…

See below;

The best time to BUY is NOW…

In fact, I believe, that many property investors who are currently staying out of the property market will look back retrospectively and realize that November and December 2022 were in fact the lowest and most opportune times to enter the Melbourne property market from a ‘Market Timing Perspective’…

So, what are you waiting for?

Reserve your place and join me and 55 like-minded property investors at the next Real Estate Investing Fast Track Weekend!

Seats are strictly limited so book NOW in order to avoid future disappointment…

Kind regards,

KONRAD BOBILAK