Dear Fellow Property Investors,

Property values are rising in four out of five suburbs around the country, as the property market upswing broadens despite rising interest rates.

But the pace of growth has started to slow in Sydney and Melbourne, and last week’s interest rate hike casts a cloud over the outlook for the market.

Values rose over the past three months in 83.1 per cent of house markets analysed and 80.6 per cent of unit markets, CoreLogic research found.

Sydney recorded rises in 91.4 per cent of house markets and 87.4 per cent of unit markets over the past three months to October.

The biggest rises were for houses in Five Dock, Oyster Bay, Penshurst, Concord West and Concord, which all gained more than 8 per cent in value in the quarter.

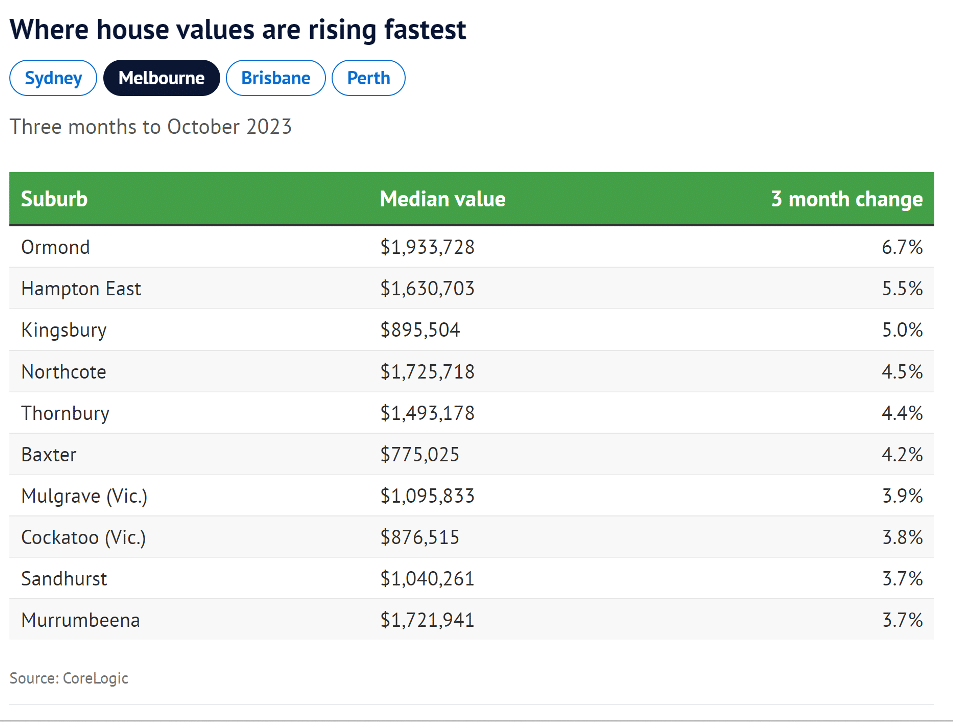

In Melbourne, 80.8 per cent of house markets rose and 75.4 per cent of unit markets rose over the same period.

The fastest increases were for houses in Ormond, Hampton East, Kingsbury, Northcote and Thornbury, which rose between 4.4 per cent and 6.7 per cent.

CoreLogic head of research Eliza Owen said prices have been rising despite higher mortgage repayments because there is more demand for housing than supply, as household sizes have reduced since the pandemic and the immigration program has returned.

“Even though there is a lot of pessimism about the state of inflation and weakening economic conditions, there are also a lot of people with the capacity to buy despite higher interest rates,” she said.

“Some of the upsizers who might be participating in the market may have had longer term capital gains they’re able to spend on the next purchase. Wealthier households and cash buyers such as downsizers are able to participate in the market despite rising rates as well.”

Even so, he said Sydney prices have been slowing a bit and Melbourne has lagged relative to elsewhere, while Perth, Brisbane and Adelaide prices stay at record highs.

Auction clearance rates have fallen since autumn, and there is a question mark over the outlook, he said.

“There’s an increasing risk that high interest rates with the still high risk of another hike may start to get the upper hand,” he said.

HSBC chief economist Paul Bloxham said strong population growth, particularly from overseas, was helping to push house prices higher.

Let me ask you something…

Do you have a game plan for 2023 and 2024?

Or will you watch savvy, educated, market-ready investors snap up all the bargains at the bottom of the Melbourne property cycle (which in my opinion by the way has already bottomed out in November 2022).

Or will you join them?

So, what are you waiting for?

Reserve your place and join me and 55 like-minded property investors for the last Real Estate Investing Fast Track Weekend for 2023!

Click HERE to reserve your seat now!