Despite the negative headlines about falling house prices, a reversal of recent strength in building approvals and the prospect of higher interest rates arriving this year, sentiment towards Australia’s property market remained elevated in the first quarter of 2018, at least among those who work in the sector.

The ANZ-Property Council of Australia Confidence Index came in at 137.7 in the latest survey, just below the record-high of 139.5 struck in the final quarter of 2017.

At 137.7, that means a large majority of those working in the sector remain confident about what lies ahead.

“The March quarter ANZ-Property Council Survey shows that sentiment in the property sector remains elevated,” said David Plank, head of Australian Economics at ANZ Bank.

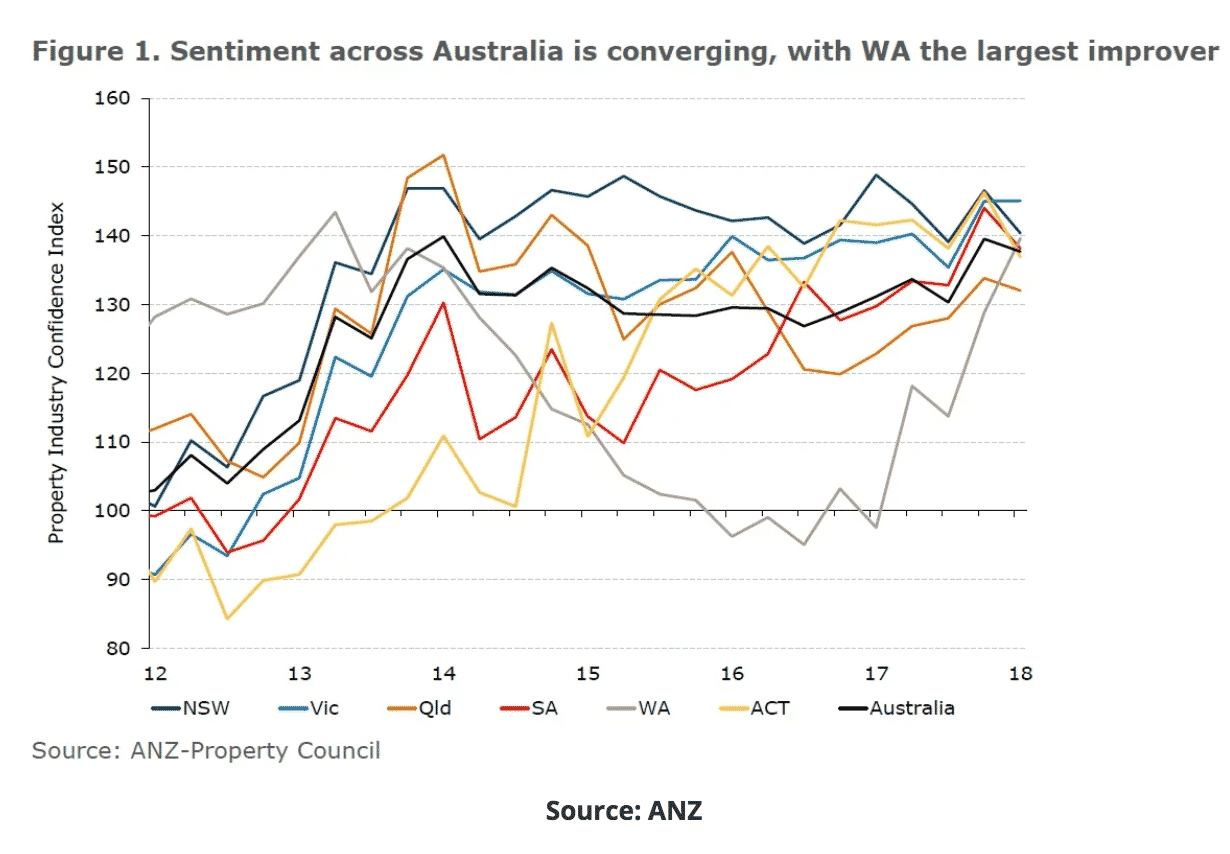

Plank said the highlight of the report was the encouraging convergence between the mining and non-mining parts of the country with confidence levels in Western Australia rising to similar levels seen in Australia’s eastern states.

“Confidence in Western Australia has improved dramatically over the past 12 months. We are getting closer to the end of the post-mining boom adjustment.”

This chart from ANZ shows confidence levels of property industry experts by state, revealing that confidence is now elevated and broad-based across the entire nation.

Helping to explain why confidence levels remain strong, most experts said they expect official interest rates to remain unchanged over the next 12 months, a starkly different view to that held in the middle of last year.

“Despite the positive outlook for economic growth and the labour market, property businesses are not convinced that interest rates will rise this year,” ANZ says.

“A majority (70%) of respondents believe interest rates will remain the same over the next 12 months, compared to 40% as recently as June 2017. This likely reflects ongoing subdued wages growth and inflation that is still below the RBA’s target.”

Given that view, it’s perhaps unsurprising that most experts think property prices will continue to rise this year, including in the housing sector.

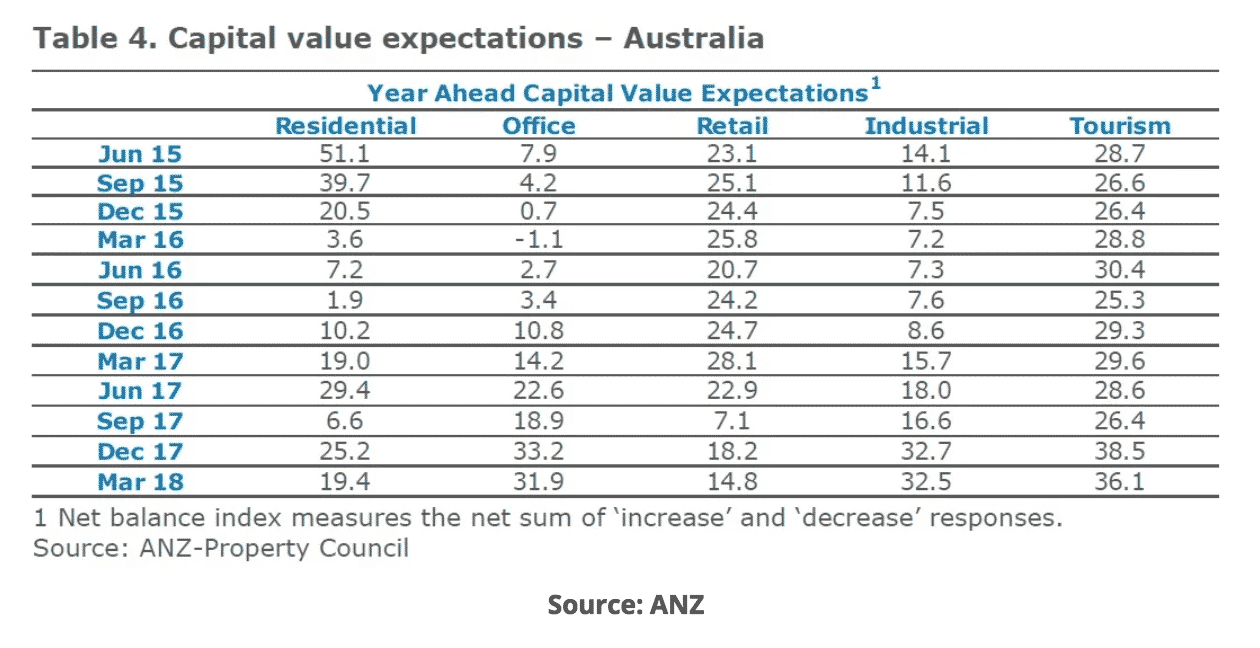

This table shows the net balance of view on prices in the year ahead

A positive figure indicates a majority of experts think prices will rise over the next 12 months.

For residential property, a net balance of 19.4% think prices will be higher in a year’s time, slightly below the 25.2% level seen in the previous survey.

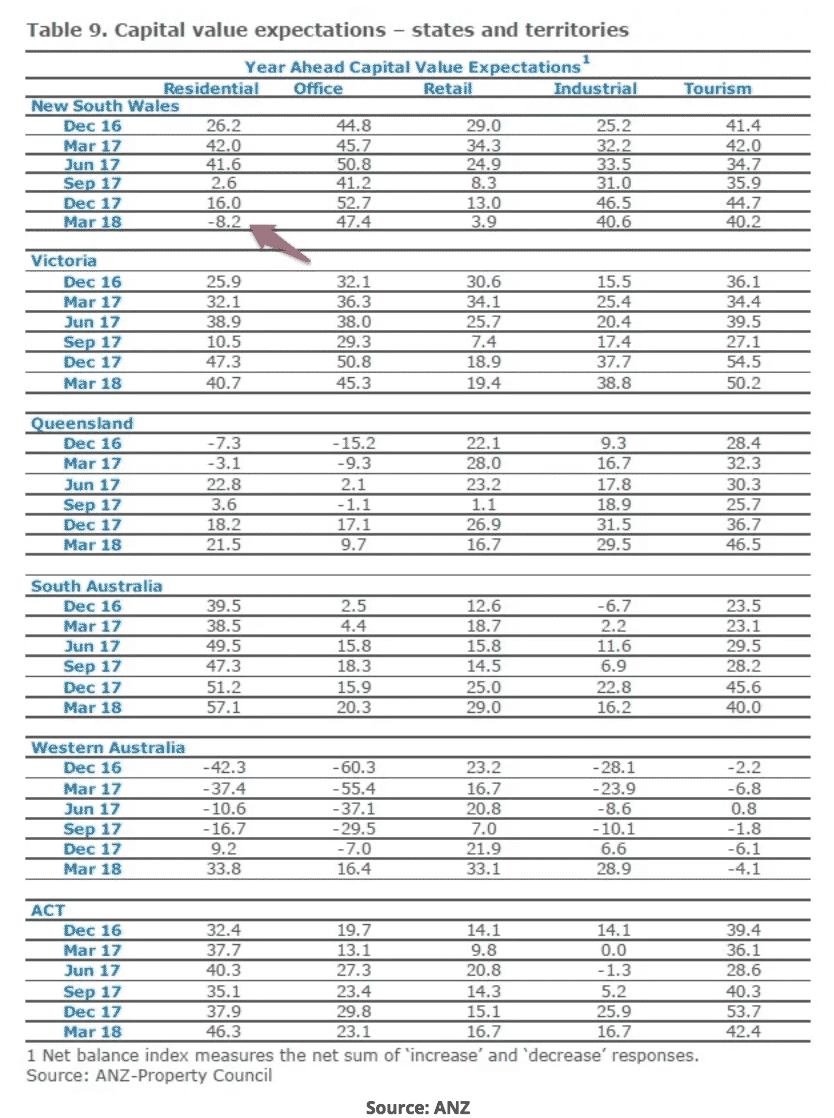

As for individual housing markets, prices are expected to rise in all states and territories aside from New South Wales where a net 8.2% of respondents suggested prices will fall over the next 12 months.

The vast majority of respondents in Victoria, South Australia, Western Australia and the ACT expect prices to increase over the year.

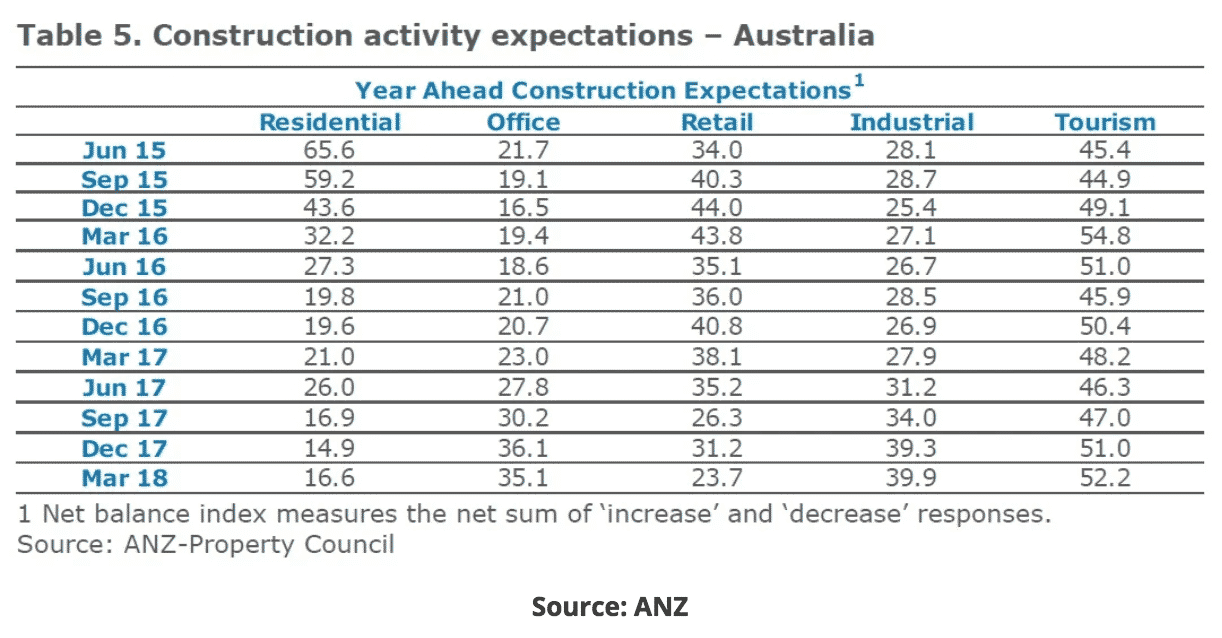

Like the view on property prices, most experts also expect construction levels to improve over the next 12 months, especially in the office, industrial and tourism sectors where a net 35.1%, 39.9% and 52.2% of respondents expect activity levels to increase.

The latest survey canvassed the views of over 1,100 respondents including owners, developers, agents, managers, consultants and government workers across all major industry sectors and regions.

So there’s more than a little bit of vested interest behind the results, something that should be considered when interpreting the results.