This article was first published by Duncan Hughes on the 9th Sept 2016 via afr.com.au | Image: An apartment in Pyrmont sold for $2.15 million five days after being announced for sale.Harold Cazneaux

Houses in coveted Sydney postcodes are selling in a few hours compared to more than six months for properties on suburban outskirts. That means buyers competing for the hottest properties are under increasing pressure to be ready to seal a deal quickly with a knock-out offer that catches competitors by surprise, say real estate and buyer’s agents.

Agents claim properties in select inner Sydney and Melbourne postcodes are being snapped up after the first inspection and often before they have time to erect a “for sale” sign. For example, an apartment in Sydney’s popular Pyrmont, which is about 2 kilometres from Sydney’s central business district, last weekend sold for $2.15 million, or about $200,000 above reserve, five days after being announced for sale.

“There is a serious lack of supply,” says Matthew Mifsud, a sales agent for Raine & Horne, who sold the property. A successful offer was made for the Pyrmont apartment after an open house attended by about 30 people and six private inspections.

Patrick Bright, a buyers’ agent for EPS Property Services, says there is a shortage around the inner ring surrounding Sydney up to 12 kilometres from the central business district.

Not enough sellers

Agents complain they have prospective buyers – but no sellers – for $10 million waterfront apartments, $7 million houses around Centennial Park and $3 million houses in Mosman.

Prices in select inner suburbs around inner Melbourne, which are easy commutes to the city and close to prestige schools, are also being boosted by a shortage of new listings.

For example, last weekend a buyer paid $1.2 million over reserve for a modest duplex in Hawthorn, which is about 7 kilometres east of Melbourne. A property in Deepdene, 15 kilometres east of Melbourne, beat reserve by $1.4 million.

“It’s a Catch-22,” says Christopher Koren, a buyers’ advocate for Morrell and Koren, a top-end buyers’ agency, about the supply shortage.

“Would-be sellers are very nervous because there is nothing to buy. Because there is nothing to buy they are not going to sell. They are terrified there won’t be anything to move into and the family will end up in a trailer park.”

On the other side of Australia, in Perth, some sellers are resorting to free raffles, coffee and entertainment to attract prospective buyers to visit a property and consider an offer.

Three months on the market

In former boom towns like Mandurah, about 72 kilometres south of Perth, it is typically taking about three months to sell a property because of a deep downturn caused by the end of the mining boom and over-supply.

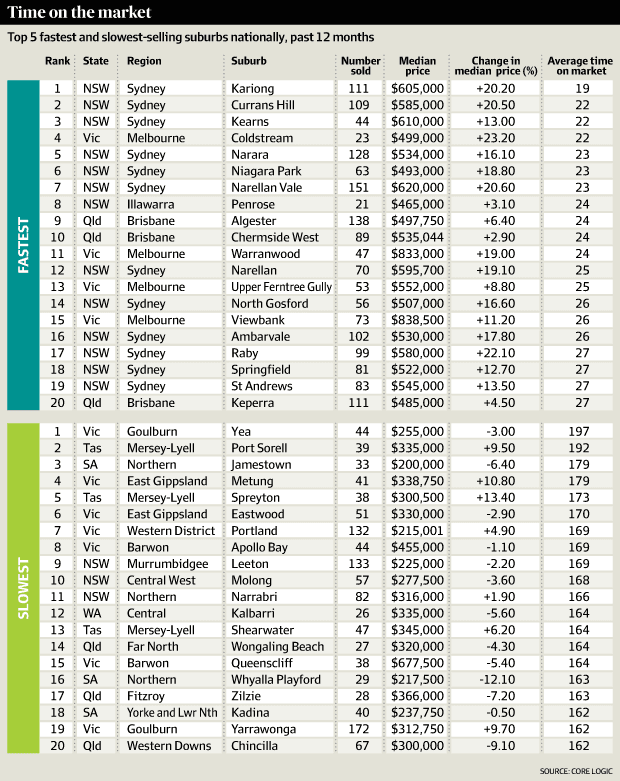

Yea, a scenic rural town in the foothills of the Victorian highlands, about 140 kilometres north-east of Melbourne, is the nation’s slowest-selling suburb, according to analysis (for the year to end-May) of the nation’s fastest and slowest selling suburbs.

Sellers typically take about 197 days – or more than six months – to find a buyer, despite median house prices having fallen by just over 3 per cent to $255,000 during the past 12 months.

“Historically it has been slow but demand is picking up because it is affordable,” says Adam Dennis, an agent for Yea real estate agency DA Robinson, about a township usually considered a coffee stop on the way to nearby snowfields.

Sydney and Melbourne, where inner suburban prices are highest, dominate the top 20 fastest selling suburbs’ list, mainly in outer suburbs where properties are more affordable.

Kariong – which is about 74 kilometres north of Sydney and where the median house price has jumped 20 per cent to about $602,000 in the past 12 months – boasts the shortest average time (for the year to end-May) on the market, 19 days.

NSW has 12 of the top 20 fastest selling suburbs, which are typically outer-suburban districts where median house prices are below $600,000 and buyers are trading-off affordability with a longer commute to Sydney.

Melbourne has four of the fastest-selling suburbs topped by Coldstream, which is 36 kilometres north-east of Melbourne where the median price is under $500,000, despite having increased by about 23 per cent in the past 12 months.

Another three outer suburban Melbourne postcodes are in the top 20, with the remainder surrounding Brisbane.

Advice for buyers

- A shortage of prestige properties means many buyers are under pressure to approach the seller before the auction date with a knock-out offer, says Koren, from Morrell and Koren. That means buyers need to be faster, more discreet and better prepared to secure the deal.

- Buyers’ agents recommend approaching the buyer confident the property represents fair value and not an inflated price pumped by market hype and irrational expectations of future growth.

- Owner-occupiers need to compare the price with recent sales in the same postcode and check with the local council about possible developments, such as nearby apartment complexes.

- Investors need to be confident about long-term rental prospects, which can also be heavily influenced by possible nearby developments, and long-term capital growth.

- Being ready to negotiate means involves having building inspections completed, funding arranged, deposit ready and contract terms and price reviewed by a lawyer.

- Be prepared to increase the original offer but also ask for concessions, such as including fixtures in the deal, as the price increases, specialists claim. “It is very rare to have the first offer accepted,” says Bright. “Make sure the first offer is sensible but not highest and best,” he says. “Otherwise the deal is going to go around and around on small print conditions. The real estate agent is also likely to shop your price around the market to get a higher result.”

- Tom Georgiou, a buyer’s agent for Beckett, says check on any deal deadlines and who has the first right to refuse, which gives the right to be the first allowed to purchase a specified property if it is offered for sale. The holder can also have the right to refuse the property. “Every agency is different, so you need to specify terms,” he says. “That means the selling agent can often be your best friend for information about the deal.”

- Specialists recommend being able to push through the deal as quickly as possible by making an unconditional offer – that is, not subject to any encumbrances, such as having to arrange finance. “Do not telegraph your shots, surprise them with your offer and then lock them in,” says Koren. “I like to set a deadline,” adds Bright. “Tell them the offer is good for 24 hours,” he says.