This article was originally published by Daniel Gradwell and Joanne Masters, Senior Economists at ANZ Research on Sep 25 2017 via bluenotes.anz.com.au

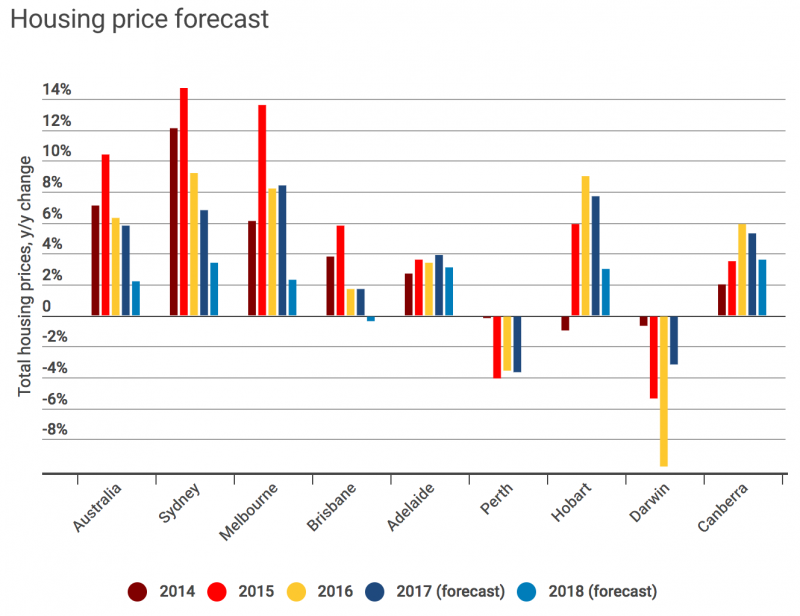

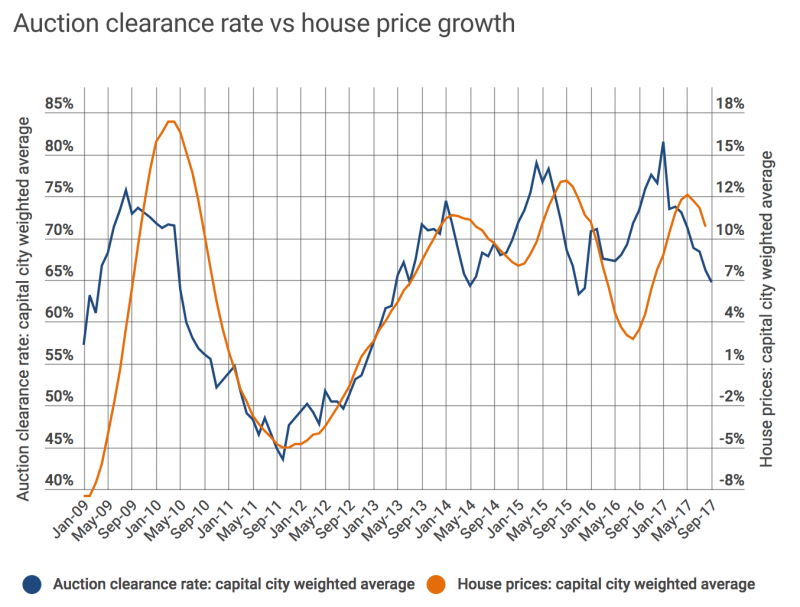

The housing market is down – but not out. At ANZ, we see evidence the market is cooling with weaker auction results pointing to slower price growth through 2017. Additionally, tighter borrowing conditions and higher interest rates are likely to weigh on price growth into the New Year.

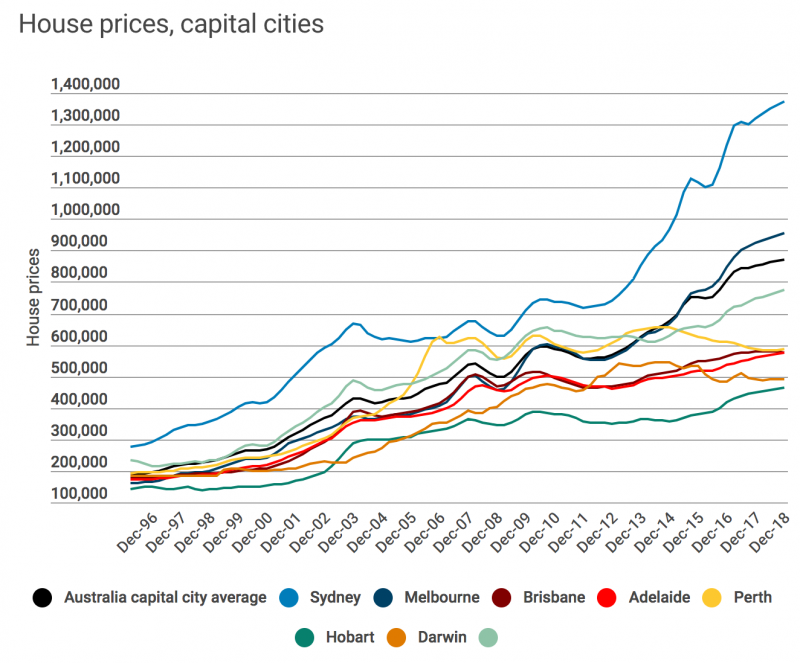

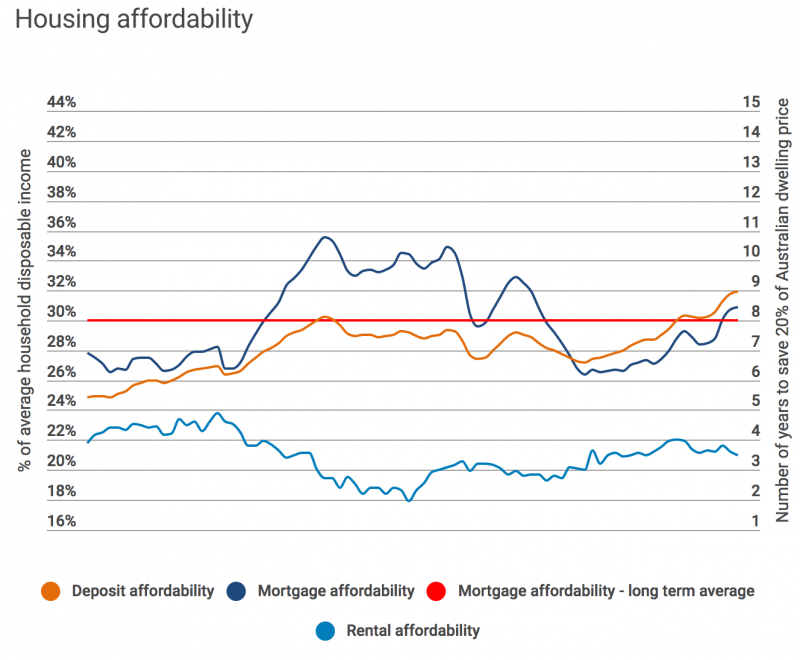

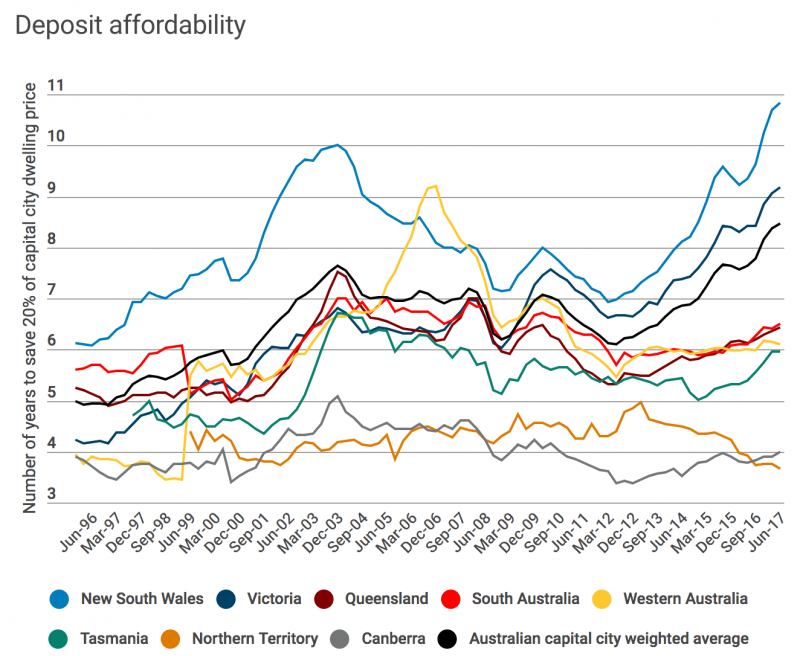

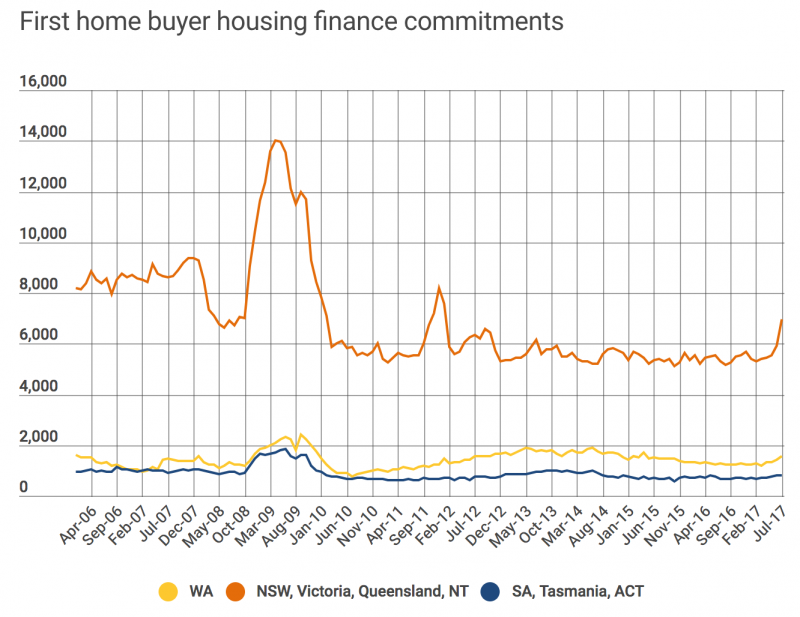

Housing affordability has been steadily worsening, especially in Sydney and Melbourne. First-home buyers have been priced out of the market, with an average income earner now needing a full decade to save a deposit for a house in Sydney.

Rising house prices and a broad willingness to take on more debt mean that highly indebted households are sensitive to future interest rate movements. Importantly, though, households still have a good savings buffer.

” The effects of worsening affordability have been most keenly felt by first-home buyers.”

Slow

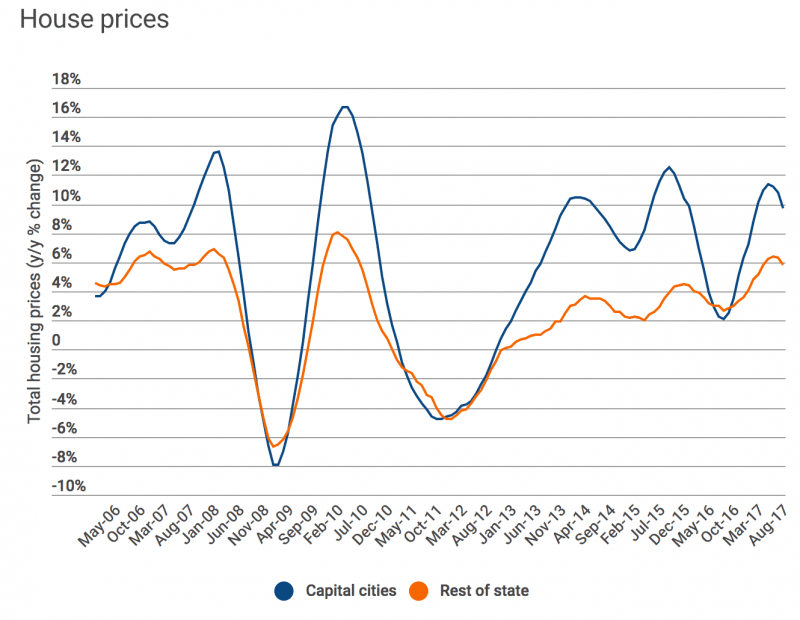

House price growth has continued to slow down and it appears tighter regulation is having the desired impact. At the national level, dwelling price growth has slowed over the past three months.

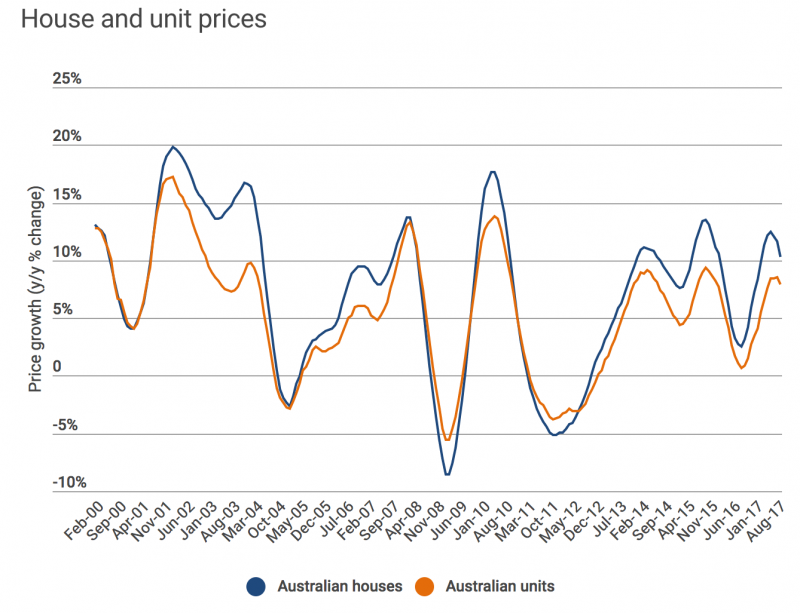

Price growth has slowed across most capital cities and regional areas and across detached houses and the unit/apartment market.

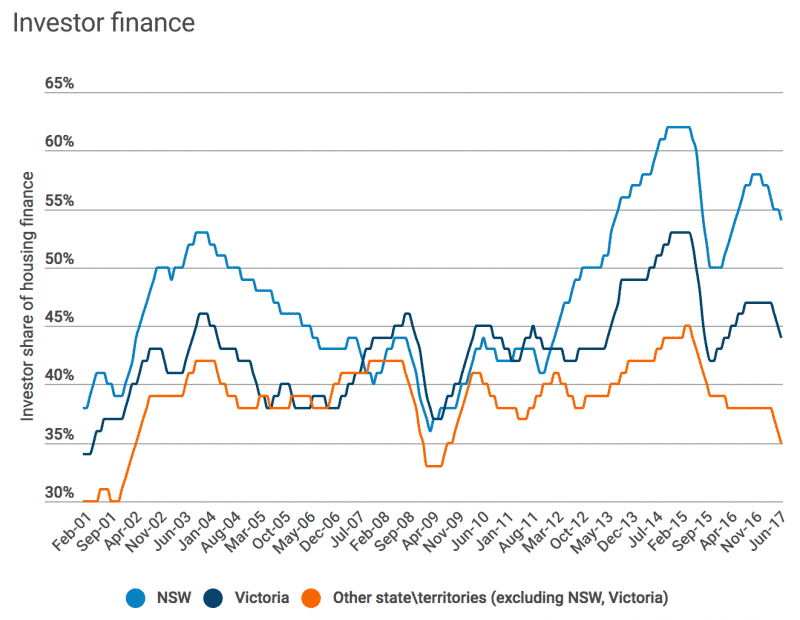

Much of this slowdown appears to be caused by a retreating investor presence in the market, in line with recent regulatory changes (without this statement the chart on investor finance is irrelevant).

ANZ believes this broad slowdown in price growth will continue. Weaker auction results point toward slower price growth through the remainder of 2017.

Tighter borrowing conditions and higher interest rates for investors are also likely to weigh on house price growth through 2018.

Housing affordability is still a significant issue. That’s especially true for first home buyers, although rental affordability is much more manageable

The effects of worsening affordability have been most keenly felt by first-home buyers. The time taken to save a deposit for an average priced house in Sydney, for someone earning an average income, has sharply increased to over ten years. And that assumes that prices rise no faster than income in that time.

Stamp duty incentives are helpful for a select few, but we do not expect they will address the long-term structural issues (without this comment the chart on first home owner finance is somewhat irrelevant).

On the other hand, rental affordability looks much better. Rental growth has been subdued for an extended period, although stabilising vacancy rates may see rental returns improve somewhat.

Daniel Gradwell and Joanne Masters are Senior Economists at ANZ Research

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.