Dear Fellow Property Investor,

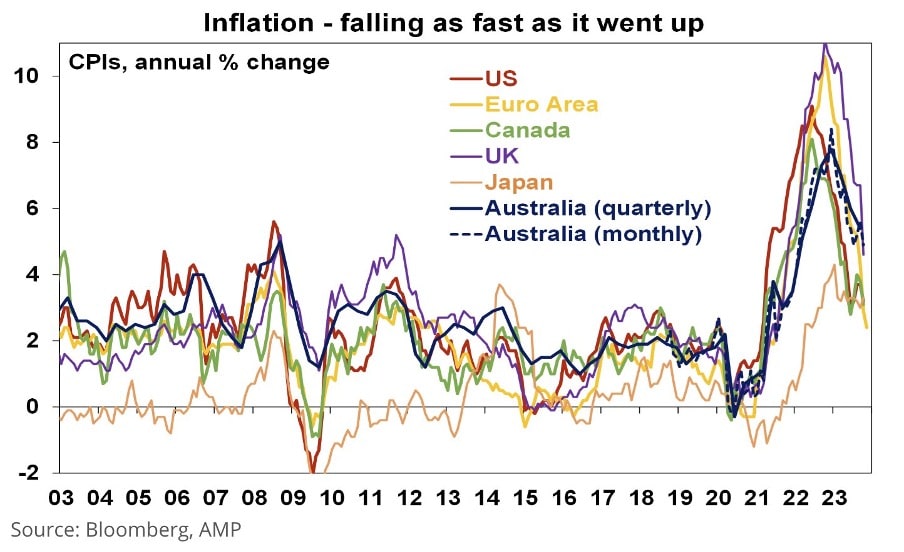

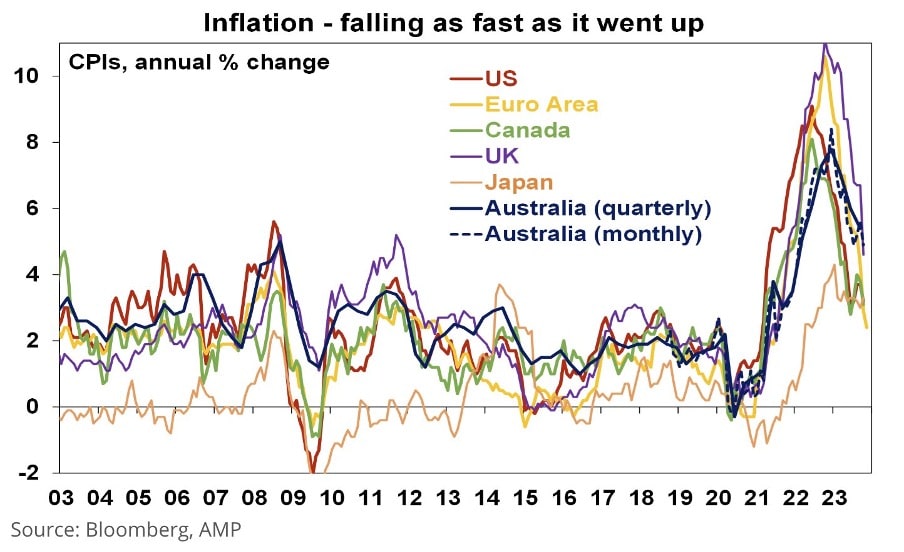

New figures show inflation has slowed to a two-year low of 4.3% leading many to speculate there will be no need for further interest rate rises.

Australian Bureau of Statistics figures for November, show inflation is down from 4.9% in October. This is down from a peak of 8.4% in December 2022.

The Commonwealth Bank is tipping a drop in interest rates of nearly 1 percentage point by the second half of 2024.

CBA chief economist Stephen Halmarick, believes cuts will start in September 2024, dropping rates to 3.6%. He also predicts a further 75 basis point drop in 2025 when inflation sits within the Reserve Bank of Australia’s target of 2% to 3%. This, he says, will bring the cash rate back to 2.85%.

This is excellent news for all property investors as blue-chip inner-city properties located in desirable suburbs will become cash-flow neutral, and in some instances positive!

This aspect of cash-flow positive blue-chip properties will be further accelerated by the current unprecedented increases in rental yields in ‘Key Suburbs’ around Melbourne and Sydney.

Imagine, buying a townhouse in Carlton, Yaraville, or St. Kilda and its cash-flow positive from Day 1!

But you have to have the specialised skills and understanding in order to unearth these rare gems?

Let me ask you something…

Do you have a game plan for 2024?

Or will you watch savvy, educated, market-ready investors snap up all the bargains at the bottom of the Melbourne property cycle (which in my opinion by the way has already bottomed out in November 2022).

Or will you join them?

So, what are you waiting for?

Reserve your place and join me and 55 like-minded property investors for the first Real Estate Investing Fast Track Weekend for 2024!

Click HERE to reserve your seat now!