This article was first published: Samantha Landy, Herald Sun

Picture: Nick, Kristina and Eva Ower outside their Pakenham home. Picture by: Jason Sammon

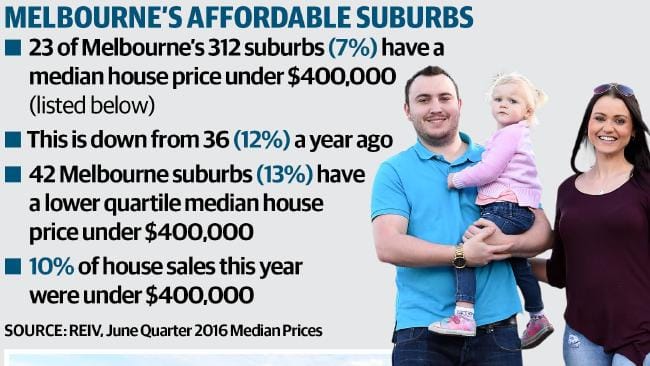

HOMEBUYERS on a budget have a shrinking number of Melbourne suburbs to choose from, with just 23 postcodes still offering affordable median house prices.

Real Estate Institute of Victoria figures show 7 per cent of the city’s 312 suburbs had median house prices below $400,000 at the end of the June quarter — down from 12 per cent a year ago.

Most are more than 20km from the CBD with Melton, 35km west, Melbourne’s cheapest suburb for houses, at a median of $256,000.

It is followed by nearby Melton South at $260,000 and Kurunjang at $295,000, then Millgrove in the Yarra Ranges, $299,500 and Frankston North, $325,000.

Just 10 per cent of Melbourne’s house sales this year have been under $400,000, compared with 27 per cent at the other end of the market, more than $1 million.

REIV figures also reveal the city’s million-dollar club has grown from 78 to 90 suburbs over the past year, recently welcoming Maribyrnong, Keilor and Yarrambat.

REIV chief executive Geoff White expects the affordable options to continue to decrease as first-home buyers and investors flock to the outer ring, with the number of million-dollar suburbs to rise to 100 within a year.

“It’s certainly harder at (the affordable) end of the market than it was a year ago,” Mr White said.

Several suburbs are already on the brink of leaving the $400,000 club due to strong annual price gains, notably Laverton (up 9.6 per cent to $397,500), Kings Park (16.9 per cent to $393,000) and Hoppers Crossing (13.8 per cent to $390,000).

Mr White recommended budget buyers consider house-and-land packages on Melbourne’s fringe, or units if they wanted to be closer to the CBD. Teaming up with a friend, family member or partner could also speed up saving for a deposit.

“It’s worth using these options as a stepping stone to get into the market, earn capital growth, and then upgrade,” he said.

“Interest rates are likely to be down for some time. Now’s a good time to lock in a property.”

Weekly mortgage repayments on a $360,000 loan would be about $465, according to the Commonwealth Bank home loan calculator.

Harcourts Pakenham’s Marcus Washington said many fringe suburbs were becoming attractive places to live, with improving infrastructure and family-friendly vibes.

Nick, 26, and Kristina Ower, 24, chose Pakenham for its affordability and family demographic, buying a three-bedroom house there in 2014 for $345,000.

It sold at auction yesterday for $382,500, with the young parents now planning to buy in Mount Waverley.