This article was first published by DAVID SCUTT on

Australian home loan lending — whether measured in dollar terms or number — fell modestly in July, partially reflecting fewer property transactions taking place despite recent house price gains.

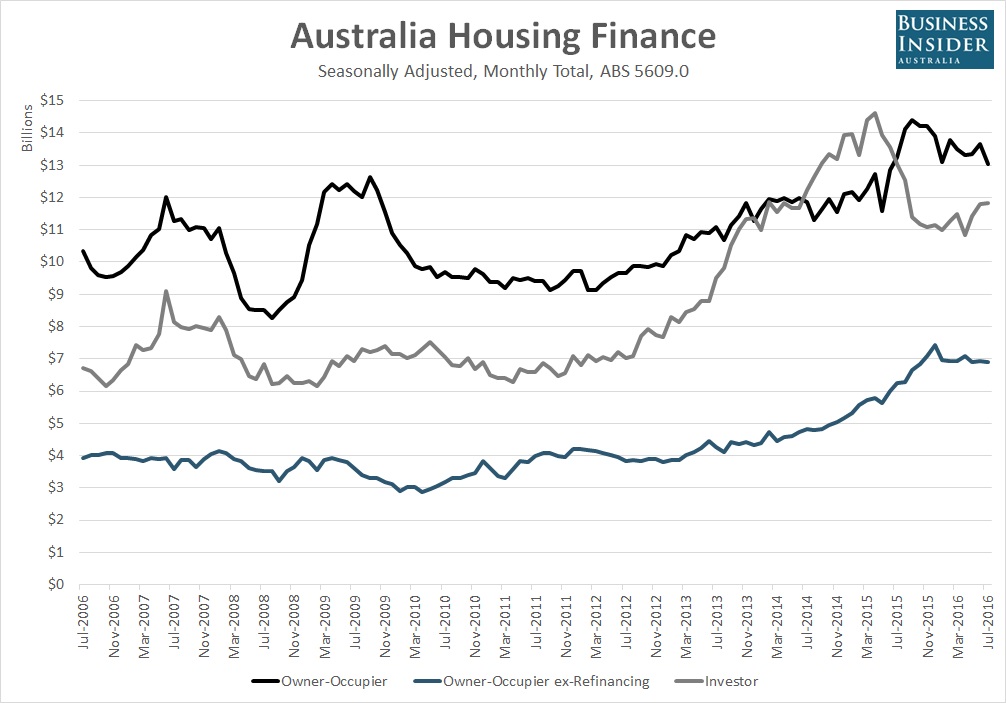

According to data released by the Australian Bureau of Statistics earlier today, the value of housing finance dipped by 1.8% to $31.788 billion in July in seasonally adjusted terms, leaving it down 2.4% on the levels of a year earlier.

By type of borrower, the value of loans to owner-occupiers fell by 3.1% to $19.946 billion.

Excluding refinancing, new lending tumbled by 4.5% to $13.047 billion. It was the smallest total since June 2015, and the largest percentage decline since January this year.

It was 1.5% lower than the level in July 2015.

The value of owner-occupier refinancing came in at $6.9 billion, down 0.5% on June. The value of refinancing grew by 10.4% from a year ago, reflecting lower interest rates and fierce competition from lenders.

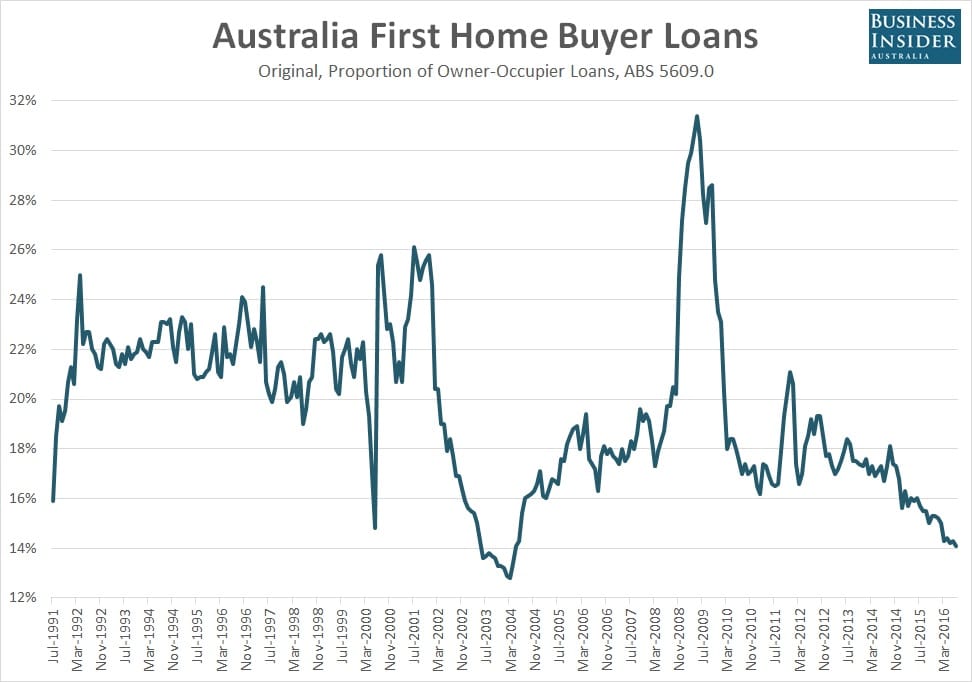

However, lending to investors continued to increase as the proportion of owner-occupier loans to first home buyers fell to the lowest level on record.

According to the ABS, the value of investor lending rose by 0.5% to $11.842 billion, the highest level since August 2015.

The value of lending to investors has now risen for three consecutive months, and in five of the past six. Compared to a year earlier, the value of lending fell by 9.3%, although that decline has narrowed sharply from the 25.9% year-on-year drop seen in April of this year.

Australian housing investors, at face value, appear to be returning to the market after a regulator-led slowdown in the second half of last year.

Mirroring the decline in total dollars lent, the number of home loans to owner-occupiers also fell.

In overall terms, there were 55,010 owner-occupier loans issued during the month, down 4.1% from June. Loans to purchase an existing house slid by 4.1% to 46,888. New loans for the construction of a home, and to purchase a new dwelling, skidded by 5% and 3.4% to 5,493 and 2,629 respectively.

The ABS does not release the number of home loans issued to investors.

In original terms, the number of loans to first home buyers as a percentage of total owner-occupier loans fell to 14.1%, the lowest level since May 2004.

The ABS stresses that first home buyers are defined as people entering the home ownership market as owner-occupiers for the first time, with first-time investors excluded from the data.

In other words, first-time buyers purchasing for investment purposes, rather than to occupy, are not captured in the data.

To Tapas Strickland, an economist at the National Australia Bank, the weak July result, at the margin, “adds to evidence that risks in the housing market have abated”.

“The RBA reiterated those sentiments in September, noting: ‘supervisory measures have strengthened lending standards in the housing market. Separately, a number of lenders are also taking a more cautious attitude to lending in certain segments’,” he said.