It’s one of nature’s greatest phenomenon: the stampede of desperate home buyers into Australia’s property market.

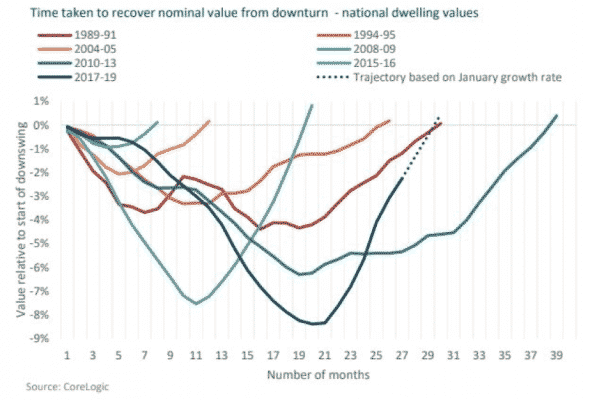

National prices may have nosedived off their 2017 peaks, but are now bouncing at a blistering rate, kickstarting what research group CoreLogic is calling “the fastest market recovery on record” given the depth of the downturn.

“Since national dwelling values bottomed out 8.4% below their peak at June 2019, the Australian dwelling market has quickly recovered 6.7%,” head of residential research Eliza Owen said this week in a CoreLogic note.”

“If growth rates continue at the January trajectory – of 0.9% value growth per month – Australia’s dwelling market would make a full nominal recovery by April, marking a 10 month recovery period since values found a floor last June,” Owen said.

A history of Australia’s property recoveries

While that trajectory is hardly guaranteed, it would mark an extraordinary turnaround if it did come to pass. The closest comparable bounce was registered more than a decade ago in the depths of the global financial crisis (GFC). As panic gripped overseas markets, property values in countries like the US, Spain and Ireland imploded. While Australia got off relatively lightly, prices dropped sharply over the course of 11 months before soaring back into positive territory.

Compare that to this downturn, which saw prices decline for the better part of two years before jolting back following the May federal election and consecutive rate cuts by the RBA.

“Most recovery periods match the length of time it takes to go from peak to trough. However, in 2020, the market recovery could be half the length of the downswing,” Owen said.

Owen said unlike in other instances, it’s actually home buyers supporting price growth, with “housing finance data from the ABS shows much more activity from first home buyers, upgraders, and down-sizers in this recovery.”

Those groups have dominated lending, with owner-occupiers representing almost three-quarters of all new loans in the last seven months, excluding refinancing. For reference, leading up to the market’s peak in 2017, these groups made up less than 60% of new loans, albeit over a much longer time frame.

While Owen acknowledges investors could be enticed back into the fold this year, so far recovery has rested firmly on the shoulders of home buyers unable to resist their narrow buying window, characterised by low-interest and falling prices.

“Reduced mortgage rates and the decline of investor participation may have further enabled first home buyers in the past 7 months,” Owen said. “Millennial movement through the typical first home buyer aged cohort is likely to have increased owner-occupier demand over the past ten years or so.”

So let me ask you a question, do you have the skills and knowledge to correctly identify the very best long term capital growth areas in Melbourne right now?

Join me and 40 likeminded property investors at the next Real Estate Fast Track Weekend!

Yours in Success!

KONRAD BOBILAK

CEO & FOUNDER

Investors Prime Real Estate