Overseas migration is frequently being called out as one of the primary factors influencing the housing market. In the face of high interest rates, low consumer sentiment and stretched housing affordability, values and rents continue to rise and vacancy rates plummet as net overseas migration has hit record highs.

National home values have increased 7.2% in the year-to-date, and rent values rose 6.0% in the same period. Heated discussions around migration are drawing more focus as housing affordability worsens. But there are many other factors driving values and the rental market, and long term, strategic migration policy should not be influenced by short-term volatility in migration and property markets. This report unpacks five key insights into migration and the housing market.

1. Housing tenure of migrants skew to rentals in the short term.

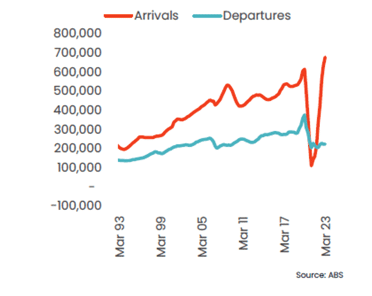

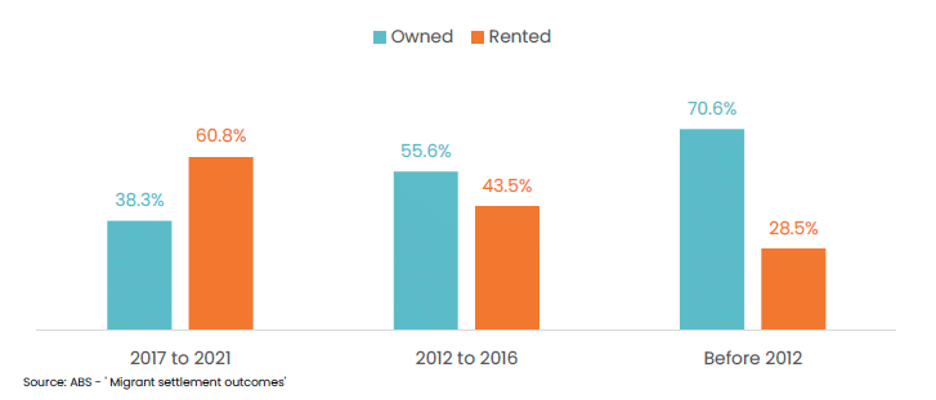

Fluctuations in overseas migration most immediately impact the rental market, rather than purchases. ABS data on permanent migrant settlement outcomes showed 60.8% of migrant arrivals in the five years to 2021 were renters. The incidence of home ownership was higher among permanent migrants who had been in the country for longer. As of 2021, this included 55.6% of arrivals between 2012 and 2016, and 70.6% of migrant arrivals before 2012 (figure 1).

Figure 1. Portion of permanent migrants renting or owning a dwelling, by year of arrival in Australia

For temporary migrants, 68.9% of temporary migrants 15 years and older were renters in 2021. This included 91.6% of temporary skilled visa holders, and 83.5% of student visa holders.

2. Part of the reason migration is so high right now is because it was temporarily restricted.

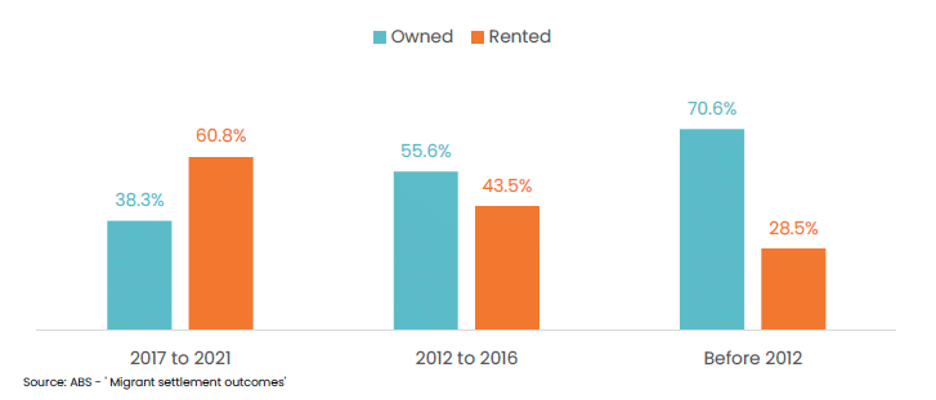

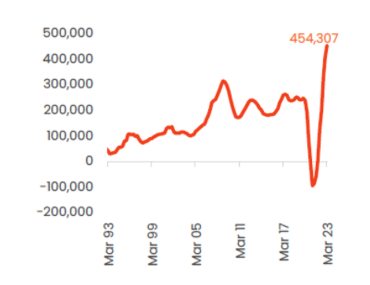

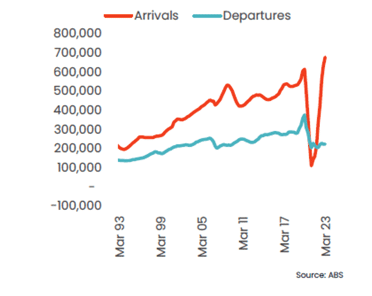

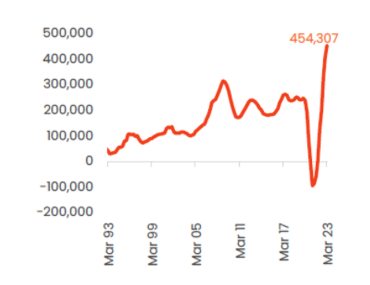

Australia closed its borders to all non-citizens and non-residents in late March 2020, and fully re-opened to vaccinated and non-vaccinated arrivals in July 2022. By March 2023, Australia’s annual population growth hit 2.17%, the highest rate since 2008. Net overseas migration, which is overseas arrivals minus departures[1], is currently at record highs annually, at 454,000 added to the population in the past 12 months. The pre-COVID decade average of annual net overseas migration is 217,000.

Figure 2a. Net overseas migration, rolling annual, Australia

Figure 2b.Overseas arrivals and departures, rolling annual, Australia

Figure 2b.Overseas arrivals and departures, rolling annual, Australia

Assuming the average household size of 2.49 people per dwelling in January this year, the year to March would have seen demand for around 182,000 additional dwellings, in a year when around 175,000 dwellings were completed. That’s not to mention new household formation domestically, as young Australians move out, buy first homes, or start their own families. Domestic household formation has increased substantially in recent years amid a reduction in average household size.

The bottom line is that this phenomenon of record-high overseas migration numbers will add substantial pressure on rents increasing in the major capital cities as well as pressure on capital growth increases in the housing sector.

Let me ask you something…

Do you have a game plan for 2023 and 2024?

Or will you watch savvy, educated, market-ready investors snap up all the bargains at the bottom of the Melbourne property cycle (which in my opinion by the way has already bottomed out in November 2022).

Or will you join them?

So, what are you waiting for?

Reserve your place and join me and 55 like-minded property investors for the last Real Estate Investing Fast Track Weekend for 2023! Click HERE to reserve your seat now!

Figure 2b.Overseas arrivals and departures, rolling annual, Australia

Figure 2b.Overseas arrivals and departures, rolling annual, Australia