This article was originally published by SAM JACOBS on FEB 15, 2018 via businessinsider.com.au

Research by property analysts RiskWise Property Review has highlighted specific Australian suburbs where housing investors should be particularly wary about off-the-plan (OTP) apartment developments.

RiskWise focused on suburbs with a combination of low economic growth and excess supply — the two main drivers of investment under-performance in OTP apartments, they said.

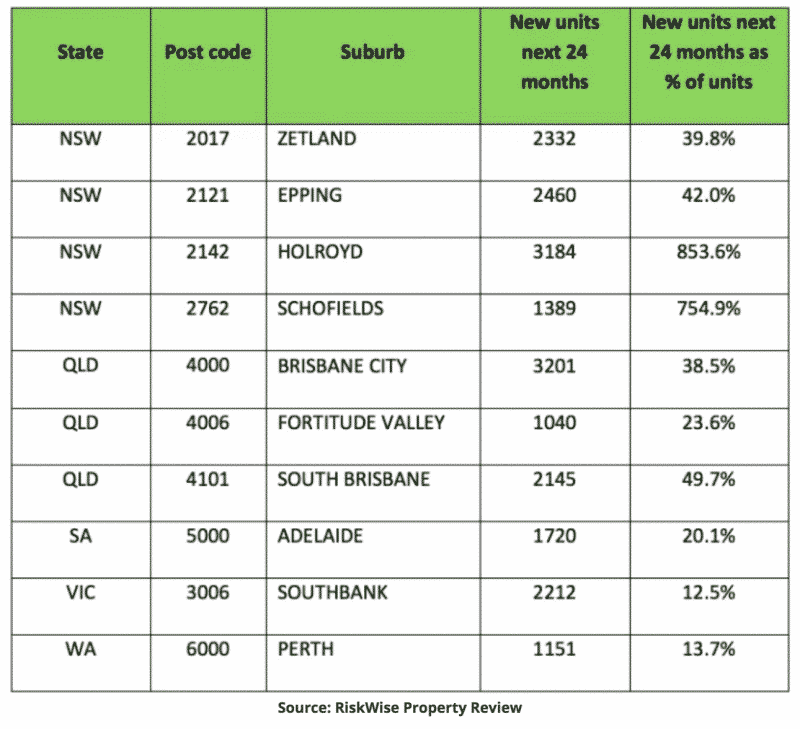

The analysts applied their criteria to 3,000 Australian suburbs and filtered a list of 100 “Danger Zone” suburbs which are more susceptible to lower returns.

Here are the Top 10 they deem most at risk:

In the wake of Australia’s residential construction boom, the narrative around apartment developments has grown increasingly negative — particularly as Australia’s housing market has cooled in recent months.

“The widespread oversupply issue is universally acknowledged by banks, including the Reserve Bank of Australia, who have all compiled ‘blacklists’ for postcodes that are suffering from potential unit saturation,” RiskWise said.

“Lenders will either require a much higher deposit as security on their loan, or they may turn down a loan application entirely.”

In addition to oversupply, RiskWise said investors should also conduct due diligence on the rate of economic growth in the surrounding area.

“Unit oversupply is the key factor after the economic growth,” RiskWise CEO Doron Peleg told Business Insider.

“Where the economic growth is very poor such as Perth, even an addition of a small rate of new units have a strong downward pressure.”

“In Sydney, with strong economic growth, you need a significantly higher addition — in both percentage and absolute terms — to have a similar degree of downward pressure.

Polog said RiskWise based their economic growth research on the Statistical Areas Level 4 (SA4’s) — the geographical regions designated by the ABS for the composition of Census and labour market data.

RiskWise noted that despite concerns around the market for new apartment developments, “more than 315,000 units have been approved for constrcution over the next two year”.

That includes an unexpected spike in approvals last November, driven by a surge of new activity in the Melbourne market.

Polog also noted the increased degree of settlement risk in the current environment — where the value of the property upon completion of construction will be lower than when the initial contract was signed.

“Also, in addition to the current lending restrictions and ‘black list suburbs’, the lenders regularly review their lending standards, and can set even tighter lending restrictions by the settlement day,” Polog said.

“We would advise any investors looking at off-the-plan purchases to know what to look for and the degree of risk involved.”

“Buyers should arm themselves with an in-depth analysis on the suburb’s ability to absorb the new unit supply, and the potential impact on future capital gains.”