Dear Property Investor,

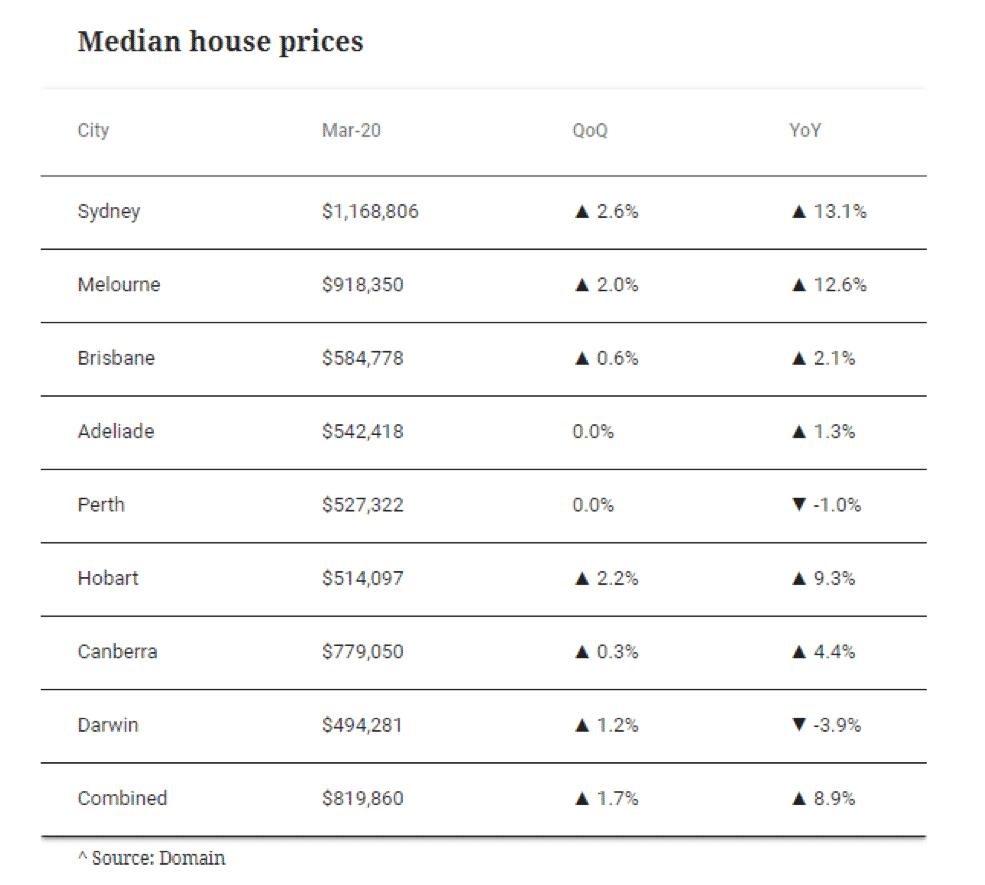

Did you know that despite the COVID-19 International Crisis, the Australia’s median house price has continued to rise, if only at a nominal rate, lifting 1.7 per cent over the quarter according to the latest data from property listing portal Domain.

Nationally, house and unit prices increased over the first quarter of 2020, however economists have warned growth will be likely short-lived.

Australia’s property market has traditionally fared relatively well during global economic shocks, with the market experiencing six falls over the past three decades.

Despite the history, market activity is likely to deteriorate in the coming months as economic uncertainty and job security fears heighten, with the extent of the impact on prices remaining a little less certain.

Domain senior analyst Nicola Powell point to four weeks leading to mid-April, where hesitant sellers began to withdraw listings causing a 20 per cent drop in new listings across capital cities.

“Despite homes selling quicker than last year, sellers are adjusting expectations, and auction prices have slipped,” Powell said.

“The slowdown aligns to the shutdown of non-essential services, the temporary ban on onsite auction gatherings and open inspections.”

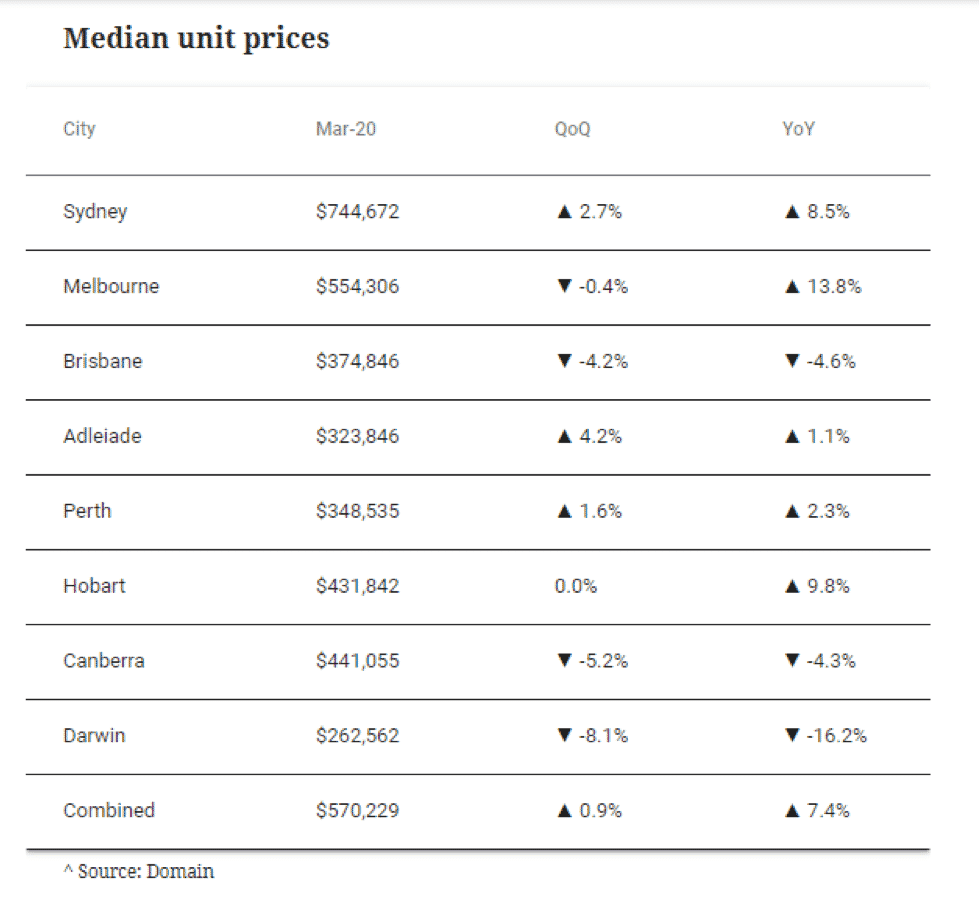

Sydney, which has seen the strongest annual growth since mid-2017, saw houses prices life by 13.1 per cent and units 8.5 per cent over the year thanks in part to low mortgage rates and improved borrowing capacity fuelling buyer demand.

Worryingly, quarterly house price growth has slowed to less than half, and unit price growth one-third lower than the previous quarter.

“Early signs suggest that the rate of price growth had peaked before the coronavirus pandemic hit,” Powell said.

“A combination of weak wages growth and rising prices had once again stretched affordability for some buyers, while a rise in new listings early in the year had helped to service demand.”

New listings also began to fall from mid-March, along with 14 per cent of listings have had prices revised in March, up from 5 per cent in late 2019.

In Melbourne house prices have now risen for four consecutive quarters, pushing annual gains to double-digits for the first time since 2017.

Unit prices, while hadn’t seen double-digit annual growth in almost a decade, surged by 13.8 per cent over the year.

Despite this, new listings also dropped about 11 per cent over mid-March through to mid-April, suggesting few forced sales.

Powell noted that the rapid cautionary response from sellers will be counterbalanced against a drop in the buyer demand and in turn result in property prices faring better than transactions over the coming months.

Brisbane saw house prices nudging up 0.6 per cent over the first quarter to a record $584,778 and lifting 2.1 per cent higher than last year.

However, the city’s unit prices recorded the steepest annual fall in almost two decades, down 4.6 per cent and 9.8 per cent below the 2016 peak.

Despite South Australia holding the highest unemployment rate in the nation, Adelaide was one of only three capital cities to record stable or rising prices for houses and units, along with Sydney and Hobart.

The modest 1.3 per cent annual growth pushed house prices to a new high of $542,418 while unit prices jumped 4.2 per cent over the quarter.

Hobart, which remains heavily exposed to the economic shock of the coronavirus pandemic due to its heady reliance on tourism, saw house prices rise to a new record high over the first quarter of 2020, up 2.2 per cent with unit prices holding.

House prices flatlined over the quarter in Perth and values sitting 14.4 per cent below the late-2014 peak.

“The slow recovery of Perth’s housing market over the past six months could be stalled by the economic fallout from the coronavirus pandemic,” Powell said.

“The ability to pause mortgages will be a lifeline to some homeowners, reducing the number of distressed sales.

“Perth will also benefit from WA’s two biggest exports, with iron ore exports expected to hit a high this year and gold prices at an all-time high.”

In the nation’s capital, values lifted slightly by 0.3 per cent over the quarter while unit’s dropped by 5.2 per cent.

Powell said Canberra would remain somewhat insulated to the economic shock due to its high proportion of government works, where job losses have been minimal to date.