Latest News & Blog

[NEW VIDEO]: The Long-Term Impact of Interest Rates on Australian House Prices

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. Dear Fellow Property Investor, Suburbs struggling the most to pay mortgages as Australia’s cost of living crisis worsens. Some Australians have fallen more than 30 days behind their mortgage repayments as the worst suburbs are named and shamed. An estimated one in five mortgage holders – or 551,000 Australians – will struggle to pay back their mortgage if interest rates continue rising as expected. Comparison site Finder found a whopping 20 per cent of mortgage holders will be in serious mortgage distress if...

[NEW VIDEO]: How To Improve Or Fix Your Credit File

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. Claim your free credit consultation today with CRS ► https://www.crsolicitors.com.au/ Contact Pasha directly at pasha@crsolicitors.com.au or call them on 1300 004 912. For more information regarding everything Credit, subscribe to their YouTube channel https://www.youtube.com/channel/UCtkDRj5oTcwl6PbyUJKuQEA CRS: JUST YOUR ORDINARY EVERYDAY CREDIT SUPER HEROES! As seen in The Australian, Herald Sun, Money Magazine and News.com.au, The team at CRS help improve your credit reports and raise your credit scores...

[NEW VIDEO]: Has the Apartment Market in Melbourne Bottomed Out Yet? Is It A Good Time To Buy?

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. Dear Fellow Property Investor, Did you know that one-bedroom flats in the big cities have missed out on Australia's property boom despite interest rates being at record lows? National home prices last year surged by 22.1 per cent - the fastest annual growth for a calendar year since 1989. House values in some capital cities went up by a third in just one year as two and three-bedroom units had double-digit annual price growth. But one-bedroom apartments hardly increased in value at all, especially in cities...

YOU WILL ONLY GET ONE OR TWO REAL ESTATE BUYING OPPORTUNITIES LIKE THIS EVERY 18 YEARS! The Next 12 Months Represents One of Them!

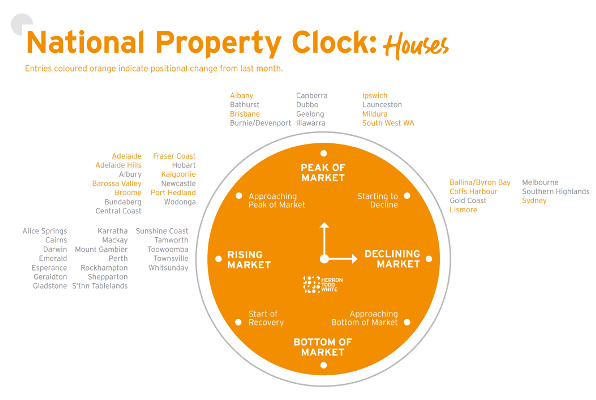

Dear Fellow Property Investor, I know it can be difficult in a market where property prices in Sydney and Melbourne are going backwards, to see things as they really are. Seeing the bigger picture can be difficult for the average Australian whose education comes from the media. But, for those of us who know our history, we have seen this all before. You see, the Melbourne and Australian property market is cyclical in nature, and hence quite predictable, but only to people who have taken the time to educate themselves. Here is the Australian Property Clock depicting the exact location we...

The Melbourne property market is in the decline phase of the property cycle…Now what?

Dear Property Investor, Did you know that the Melbourne property market has moved in the decline phase of the property cycle? Melbourne’s median house price fell 0.9 per cent in the June quarter, Domain’s latest house price report showed, to $1,074,369. That followed a similar 0.9 per cent drop in the March quarter. And as such, here are the suburbs that have declined the most over the last quarter; The biggest fall in house prices was in exclusive Toorak, where the median fell 16.9 per cent over the year to June, to $4.57 million. In Lower Plenty, where people fled during Melbourne’s...

See the suburbs where Investors Prime’s clients made a killing in 2021!…

Dear Property Investor, Here are the Melbourne suburbs that I was personally focusing 90% of my property sourcing efforts in over the last few years making our clients RICH! These are the exact suburbs that my clients were buying townhouses in the last 3 years! More importantly, the chart below depicts the actual capital growth history of these suburbs for the December quarter 2020 to December quarter 2021! I keep telling people to stop investing in Point Cook and Truganina and buy in Melbourne’s Bayside suburbs! Permit me to ask you a question… Are you getting anywhere near to these...

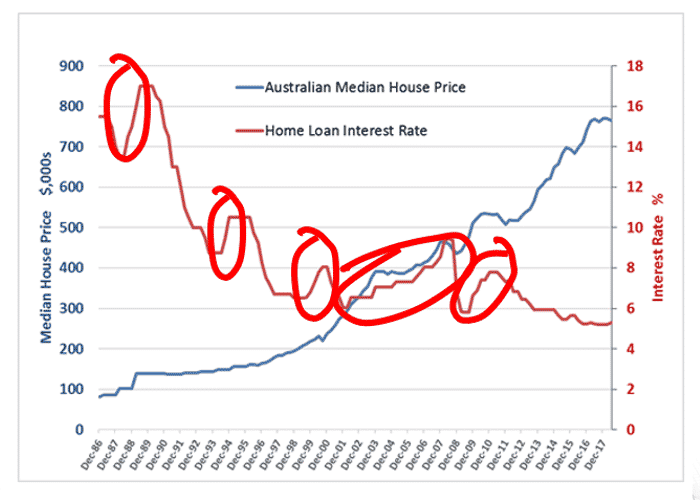

What the Media and Academic Experts are NOT telling you about interest rate increases…

Dear Investors, Once again there is a lot of doom and gloom, Armageddon-type of media stories propagating the flawed assumption that increases in interest rates will be directly responsible for the imminent collapse of the Australian Residential Property Market. And nothing could be further from the truth… You see the most recent data from RPData Core logic tells us that the combined value of the Australian Residential Property Market as at June 2022 is $10 Trillion dollars, with ONLY $2.1 Trillion in outstanding mortgages! That’s a LVR of ONLY 21%! And here is the kicker: This debt is...

Don’t Wait to Buy Your Investment Property, Buy Your Investment Property and Wait!

Dear Fellow Property Investor, I often get asked by property investors what is more important; the timing of the market or time in the market? My answer has always been the same for the last 20 years… It’s always the time in the market rather than the timing of the market, that will make you real money, as property investing is a long-term game. Hence, don’t wait to buy an investment property - rather, buy and investment property and wait… Having said that, I am a big believer that you can combine the two if you want to significantly accelerate your property portfolio growth, but there is...

Do Australian house prices really double each decade? Here are the facts…

Dear Fellow Property Investor, It’s hard to imagine strong house price growth at a time when real estate values are falling in most capital cities, but the numbers tell a different story. One of property’s most popular sayings, that house prices double every 10 years, is more accurate than you might think. Despite real estate values falling this year in most cities, a MoneysaverHQ analysis of 40 years of Real Estate Institute of Australia data has found that a majority of state capitals have indeed doubled every decade. But it hasn’t been a smooth ride, often marked by many years of...

Worried about rising interest rates and the Australian property market correcting?

Dear Investors, Are you worried about the rising interest rates and their direct impact on house prices that could lead to an eventual collapse of the entire Australian property market? With national inflation levels currently running hot at 7% p.a, the RBA has flexed its muscles and just recently increased interest rates by an unprecedented 0.5%, with a further 0.5% cut looming in the not-too-distant future. As we all know, the effects of high inflation include high petrol and oil prices, soaring electricity bills, and increasing food prices just to name a few. The main concern with...