Latest News & Blog

“Mass exodus” from Sydney continues…Melbourne remains the most popular Australian city to move to in 2023

Dear Friend, The latest data from national removalist booking platform Muval has revealed Australians are continuing their exodus from Sydney, looking strongly in favour of Melbourne. Inbound enquiries show the laneway capital remains streets ahead of the rest According to the platform, Melbourne was the most popular city to move to in 2022, with the February figures showing the city accounted for the most eyeballs. 28% of all major metro inbound moving enquiries were for Melbourne. This is an increase from last January when Melbourne accounted for 24%. Brisbane took second place with 21%...

Chinese buyers return to Australia’s housing market and snap up properties sparking fears prices could rise even further!

Dear Friend, Did you know that foreign buyers are returning to the Australian property market, with fears they could drive up the cost of homes for Aussies already struggling to buy a home? China was the largest source of investment in Australian residential real estate, with $1.6 billion invested in the six months to the end of December last year, according to official figures. The Chinese government has also instructed its students to return to foreign campuses for face-to-face teaching. Chinese property experts believe that Australia is the most popular destination for people from...

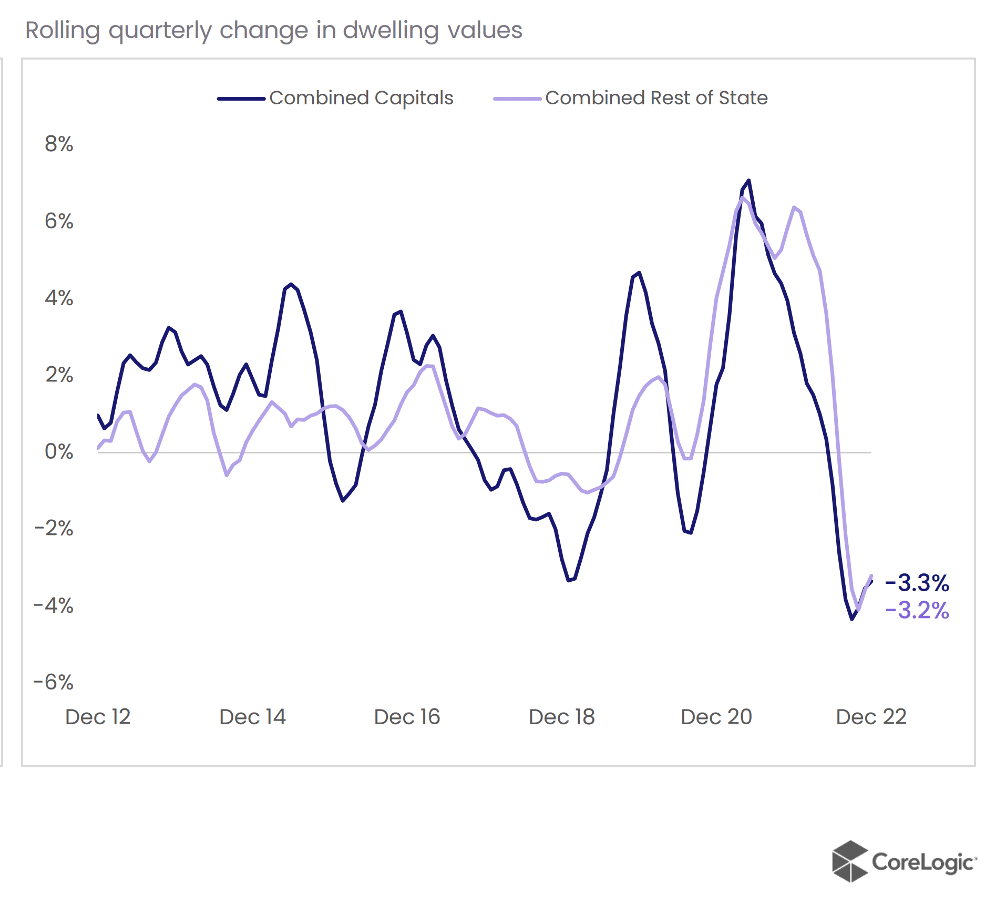

The best time to BUY from a ‘market timing’ perspective is NOW…

Dear Friend, Permit me to get straight to the point… The best time to BUY from a ‘market timing’ perspective is NOW… See below; The best time to BUY is NOW… Don’t say 2 years from now that I didn’t tell you so… I often get asked by property investors; ‘What’s more important; the timing of the market or time in the market?’, and my answer is, and has always been the same for the last 20 years… It’s always time in the market rather than the timing of the market, that will make you money, as property investing is a long-term game! Hence, don’t wait to buy an investment property, rather, buy...

BREAKING NEWS! Australia’s high-end regional markets prices go back to pre-COVID-19 levels. (hate to say I told you so)

Dear Fellow Property Investor, Australia’s COVID-induced whirlwind love affair with the country’s hottest regional cities has run its course with values declining sharply as vendor discounts climb and days on market blow out. CoreLogic’s Regional Market Update, which examines Australia’s 25 largest non-capital city regions, shows 13 areas recorded an increase in house values over the year to January 2023, down from 21 over the year to October 2022. The South East region in South Australia, which includes areas such as Kangaroo Island, the Fleurieu Peninsula and the Limestone Coast, was...

[NEW VIDEO]: Melbourne Property Market Update February 2023

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. Dear Fellow Property Investor, Deepest house price falls on record won’t make property more affordable: The deepest housing downturn on record is unlikely to make the property market more affordable over the next 12 months because mortgage repayments are rising so fast, experts warn. The rising cash rate will reduce buyers’ borrowing power more deeply than house prices fall, economists predict, leaving many still unable to get into the market because of rising repayments. Many recent home buyers will also be...

BREAKING NEWS! The Australian Housing Market Has Just Hit The Bottom Of The Property Cycle And Is Moving Up!

Dear Fellow Property Investor, According to the latest The CoreLogic Research Monthly Report, the Australian Housing Market Has Just Hit The Bottom Of The Property Cycle And Is Starting to Moving Up! See below. What are you going to do about it?

[NEW VIDEO]: The Melbourne Residential Property Market Update December 2022

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. Why landlords will be LAUGHING next year as property prices increase and a housing shortage continues to push up rents! SQM Research is expecting strong property price rises in 2023 as rate rises stop Reserve Bank was also tipped to cut interest rates in second half of next year This could see Sydney's median home prices rise by 8 to 12 per cent in 2023 Managing director Louis Christopher said tight rental market to spur recovery Investor landlords are set to benefit next year as house prices start rising...

Learn 5 Ways To Buy Property with Virtually No Money Down!

Dear Fellow Property Investor, Let me ask you a high-level question… Is your ability to come up with the initial 10% deposit on your investment property leaving you locked out from the property market? If the answer is YES, then you need to book yourself into the live 2-Day Real Estate Investing Fast-Track Weekend. By attending this unique live 2-Day event, YOU’LL LEARN 5 WAYS TO BUY PROPERTY WITH NO MONEY DOWN, which include; 10% Deposit rebate from the developer at the settlement of the property. 10% Gifted deposit from the developer when buying property. Long term settlement,...

Learn To Pay Off Your Home Loan In 10 years Or less, And Use The Savings To Build Your Very Own Property Empire!

Dear Fellow Property Investor, Let me ask you a question; Are you concerned or even stressed about the recent interest rate hikes? Many Australians are… You see, one of the most important concepts that you can learn in your lifetime is how to correctly structure your personal finances and create a system that enables you to pay off a typical 30 year principal and interest home loan in 10 years or less. And whilst this process is ‘simple’ to set up and implement, (once you know how), the vast majority of Australians still have no idea how it works, or who to turn to for the right advice on...

[NEW VIDEO]: The Melbourne Residential Property Market Update 2022

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. Dear Fellow Property Investor, As Australia’s rental market continues to tighten to record levels, the pace of rental growth has started to ease, suggesting affordability constraints are having an impact. CoreLogic’s Quarterly Rental Review for Q3 2022, released today, shows the national rental index had its smallest monthly increase this year, up 0.6% in the month to September and 2.3% over the September quarter, a 60 basis point decrease on the three months to June (2.9%). The quarterly trend in national...