Latest News & Blog

The Melbourne Property Market Is Beginning To Boom On Two Fronts… Capital Growth and Rental Yields!

Dear Fellow Property Investor, Did you know that despite the recent 11 interest rate increases from the Reserve Bank of Australia, which has seen official rates rise by 3.75 percent over the last twelve months, property prices in Melbourne are on the rise? That’s right, we are witnessing the next phase of the 7 to 10-year property cycle, and it’s the beginning of the next bull run… But unlike in the previous property cycle, the Boom in Melbourne is occurring on two fronts simultaneously…capital growth appreciation and record-high rental yield increases! In fact, the latest data by NAB...

The Melbourne property market is going to BOOM! So, what’s really stopping you from investing right now?

Dear Fellow Property Investor, Let me get straight to the point… The best time to BUY from a ‘market timing’ perspective is NOW… When the market booms in 12 to 24 months from now, don’t say I didn’t tell you so! So, let me ask you; what’s really stopping you from investing in real estate, right now? See, for most people it’s simply a lack of knowledge and lack of financial literacy. Basically, it’s all a matter of education! What you need to take heed of, is that in order to take advantage of opportunities and prevailing market trends, you must first become EDUCATED! So, here are two of...

[NEW VIDEO]: Melbourne’s Best Growth Suburbs Experiencing Gentrification in 2023

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. Dear Fellow Property Investor, Did you know that Melbourne and Sydney have officially entered the beginning of the growth part of the next property cycle? This CoreLogic graph perfectly captures the cyclical nature of the Australian property market – and suggests we may be entering another growth phase. The share of Australian suburbs that recorded price growth over a rolling three-month period rose from 18.7% in December to 34.6% in March. As the graph shows, the market started booming in late 2020, and, by...

Are you Market-Ready for the Next Australian Property Boom?

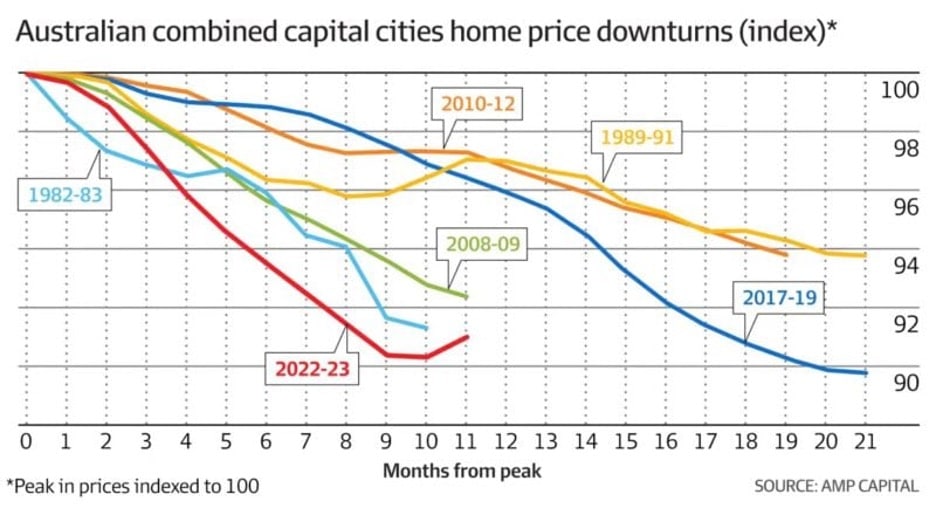

Dear Fellow Property Investor, This CoreLogic graph perfectly captures the cyclical nature of the Australian property market – and suggests we may be entering another growth phase. The share of Australian suburbs that recorded price growth over a rolling three-month period rose from 18.7% in December to 34.6% in March. As the graph shows, the market started booming in late 2020, and, by early 2021, almost every suburb in Australia was experiencing quarterly growth. The market then cooled sharply from early 2022, but this downturn appears to have bottomed out in October when 16.5% of...

[NEW VIDEO]: Melbourne Property Market Update – April 2023

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. CoreLogic Home Value Index: National home values up 0.6% in March, breaking a 10-month streak of falls. After remaining virtually flat in February (-0.1%), CoreLogic’s national Home Value Index (HVI) posted the first month-on-month rise since April 2022, up 0.6% in March. Dwelling values were higher across the four largest capital cities and most of the broad ‘rest-of-state’ regions, led by a 1.4% gain in Sydney. CoreLogic’s Research Director, Tim Lawless, put the rise down to a combination of low advertised...

Melbourne and Sydney housing prices are climbing…again…

Dear Fellow Property Investor, Guess What? Did you know that SQM Research managing director Louis Christopher said the rapidly improving auction markets and increasing asking prices by vendors, were also clear signs the Sydney and Melbourne housing markets have bottomed out. Asking prices for Sydney homes had climbed by 2.7 per over the past four weeks ended April 11. They increased by 0.9 per cent in Melbourne and lifted by 0.7 per cent nationwide according to SQM Research. Clearance rates also stayed firm, with the combined capital cities’ clearance rate averaging 65.4 per cent in the...

It’s Official! Sydney, and Melbourne housing markets have bottomed!

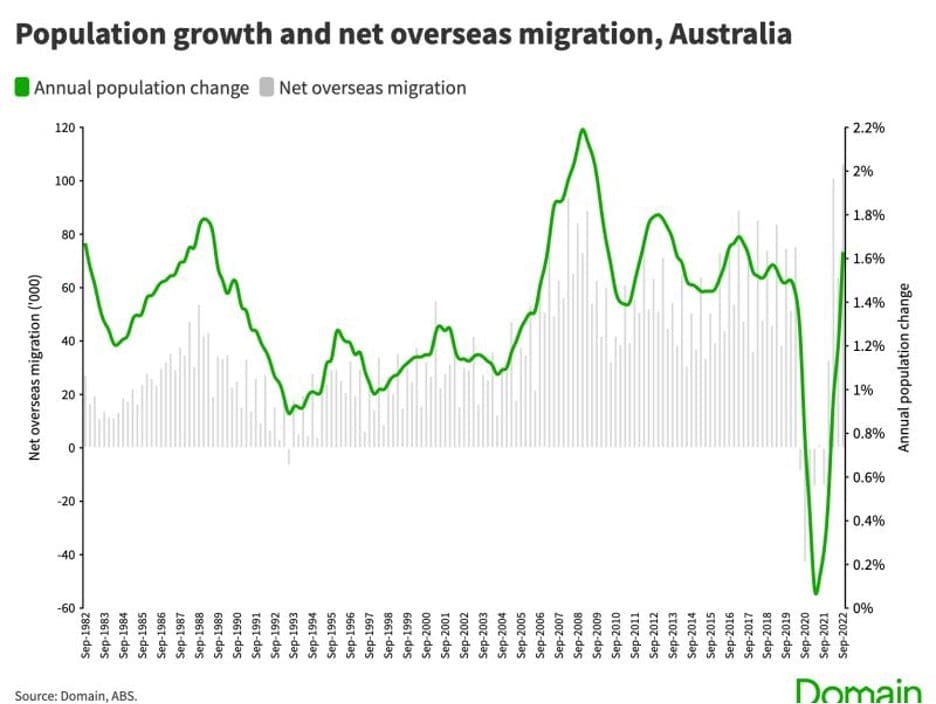

Dear Fellow Property Investor, Big News! The housing price downturn is over for Sydney and Melbourne, according to the key property data analysts, who have called the bottom of the market, saying the record return of migrants would bolster prices. While some housing economists said prices might still have further to fall – if interest rates continued to rise – even those who aren’t yet calling a bottom said the faster-than-expected return of immigration after the pandemic would underpin the housing market. “Immigration is going to be stronger than developers anticipated some 12 to 24...

Melbourne’s Property Market Just Went Up 0.6% in March!

Dear Fellow Property Investor, Did you know that after remaining virtually flat in February (-0.1%), CoreLogic’s national Home Value Index (HVI) posted the first month-on-month rise since April 2022, up 0.6% in March. Dwelling values were higher across the four largest capital cities and most of the broad ‘rest-of-state’ regions, led by a 1.4% gain in Sydney and 0.6% in Melbourne. CoreLogic’s Research Director, Tim Lawless, put the rise down to a combination of low advertised stock levels, extremely tight rental conditions and additional demand from overseas migration. “Although interest...

What’s your Property Investing Game Plan for 2023?

Dear Fellow Property Investor, Let me ask you something. Do you have a game plan for 2023? Or will you simply sit on the sidelines and wait for a clear market recovery to take place before you start buying investment properties? Will you watch savvy, educated, market-ready investors snap up all the bargains at the bottom of the Melbourne property cycle (which in my opinion by the way has already bottomed out in November 2022), or will you join them? You see all the economic indicators are pointing to the Melbourne property market starting to slowly move into the next phase of the property...

Right Now In 2023, The Melbourne Property Market Is Experiencing ‘A Perfect Storm’ Of Buying Opportunities For Educated And Market Ready Investors!

Dear Fellow Property Investor, These are the following reasons why NOW is the Perfect Storm! 1. Chinese buyers return to Australia's housing market and snap up properties, sparking fears prices could rise even further! Foreign buyers are returning to the Australian property market; the fear is, they could drive up the cost of homes for Aussies already struggling to buy one. China was the largest source of investment for residential real estate investment proposals by number and value ($0.6 billion), as it was in 2021-22 and 2020-21. The next two largest sources of residential investment...