Latest News & Blog

Are you thinking of buying Melbourne Investment Properties in 2024 whilst they are still cheap?

Are you thinking of buying Melbourne Investment Properties in 2024 whilst they are still cheap? Remember that not all Melbourne property is created equal; you need to know where to buy, what to buy, and which suburb represents the best value for money! Dear Fellow Property Investor, Australia’s housing market has had a mixed start to spring, but PropTrack data has revealed a number of suburbs around the country that have seen massive growth over the past 12 months. The data looked at Melbourne suburbs with at least 100 sales for the year, revealing that some areas had experienced...

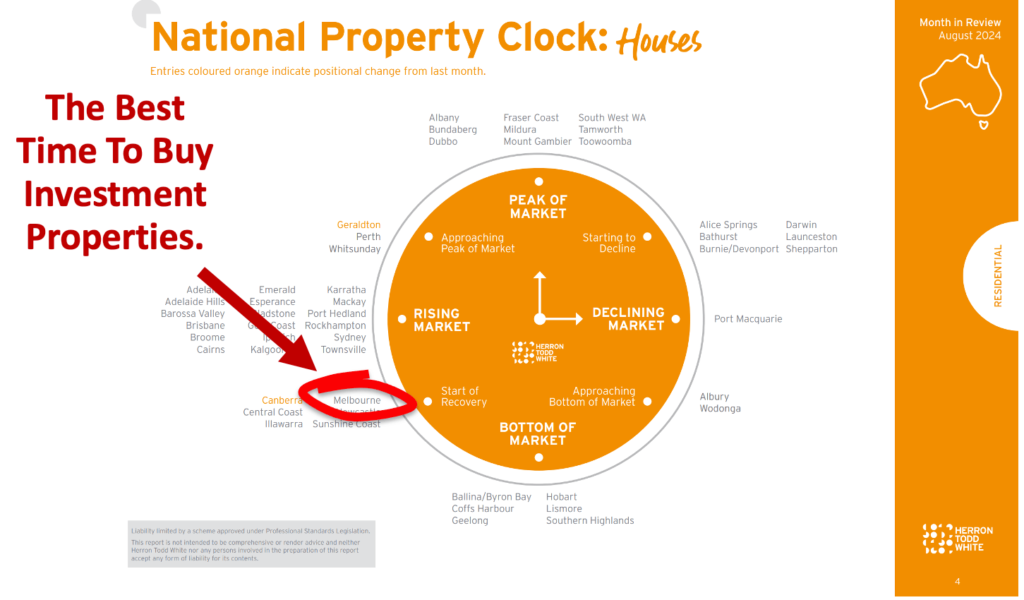

Chart shows Melbourne’s impending property BOOM!

Dear Fellow Property Investor, They say a picture can be worth a thousand words…. Check out the latest HTW Australian National Property Clock for Melbourne! That’s right, Melbourne has been slowly moving though the bottom of the housing market property cycle and is now in the best possible section of the property clock – 8:00 o’clock, moving onto 9:00 o’clock which coincides with the BOOM phase! The BOOM phase starts at 9:00 o’clock and peaks at 12:00 o’clock… Remember… You will ONLY get one opportunity like this every 10 years! So let me ask you a question… Do you have a game plan for...

Melbourne homes are now 41% cheaper than those in Sydney, a $600,000 difference, marking the largest price gap in 20 years.

Dear Fellow Property Investor, Sydney has long been Australia’s most expensive city for homebuyers, but the price difference between Sydney and Melbourne has reached unprecedented levels. PropTrack’s Eleonor Creagh said that as of August, Sydney’s median house price is 70% higher than Melbourne’s, with Melbourne homes now 41% cheaper – a $600,000 difference, marking the largest price gap in 20 years. Housing supply and land constraints drive Sydney’s premium. One significant factor behind Sydney’s rising premium is its constrained land supply. Sydney’s natural features, including its...

[NEW VIDEO]: How To Maximise Your Investment Property Tax Deductions In Australia

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. Dear Fellow Property Investor, Did you know that Tax depreciation is the key to increasing cash flow on your investment property? Every residential property investor should have a tax depreciation schedule to substantiate and claim maximum deductions. As the owner of a residential investment property, claiming depreciation deductions can make a big difference to your cash flow. Of all the tax deductions available to property investors, depreciation is the second largest deduction available after interest....

[NEW VIDEO]: Victoria’s New 2024 Landlords’ Land Tax Explained: The Good, The Bad, and The Ugly!

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. You may need to pay land tax if you own an investment property, holiday home, commercial property or vacant land. What is land tax? Land tax is an annual tax based on the total taxable value of all the land you own in Victoria, excluding exempt land such as your home (principal place of residence). Land tax is calculated using the site values (determined by the Valuer-General Victoria) of all taxable land you owned as at midnight on 31 December of the year preceding the year of assessment. You may have to...

[NEW VIDEO]: How To Use Deposit Bonds Instead Of A Cash Deposit When Buying An Investment Property

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. Deposit Bond vs. Bank Guarantee: Which is Right for Your Property Purchase? Securing your next property is an exciting endeavour, but the financial aspects can sometimes be daunting, especially for retirees looking to downsize and transition to a new chapter in their lives. Whether you’re seeking an apartment by the beach, a cozy townhouse, or a penthouse with a view, the path to securing your ideal property should be as smooth as possible. If you’re in this situation, you may be wondering about the best way...

House prices soar in Altona just like I said they would…

Dear Fellow Property Investor, Recent infrastructure developments and upgrades to local amenities have been key factors in Altona’s recent property price surge, according to a local real estate director. Real Estate Institute of Victoria (REIV) data showed a 25 per cent increase in the median property price to $1.2 million in the June quarter The number of properties sold in Altona has remained steady, with 120 properties sold this quarter compared to 118 in the March quarter. Ray White Altona director Anthony Anile said the steady volume of sales and rising prices indicates a strong...

Melbourne renters paying almost $2,900 more a year in rent compared with 12 months ago, PropTrack data reveals.

Dear Fellow Property Investor, Melbourne renters are now paying almost $2900 more in rent than they were 12 months ago, new data has revealed. According to PropTrack’s latest Market Insight Report, Melbourne rental prices have climbed by 10.6 per cent in the year to June 2024. The median advertised rent increased by $55 a week over the last 12 months, meaning renters on average are having to pay $2860 more a year. Across the board, the median weekly cost of renting a home in Australia’s capital cities has increased by 10.3 per cent. Renters in Sydney are paying the most ($740 a week),...

Melbourne housing boom: Prices set to skyrocket up to $55,000, 6 per cent, in Financial Year 2025!

Dear Fellow Property Investor, Melbourne homeowners are set for an up to $55,000 windfall that could usher in record house prices in the next year. New PropTrack estimates have tipped the city for 3 per cent to 6 per cent home value growth, the biggest uplift in the past two years after multiple interest rate hikes since May 2022 put the Victorian capital’s housing market in the doldrums. For Melbourne’s $921,000 median house price, the growth would mean a $27,630-$55,260 surge. It would also add $18,500-$37,020 to the city’s $617,000 typical unit. At the upper end of the forecast, the...

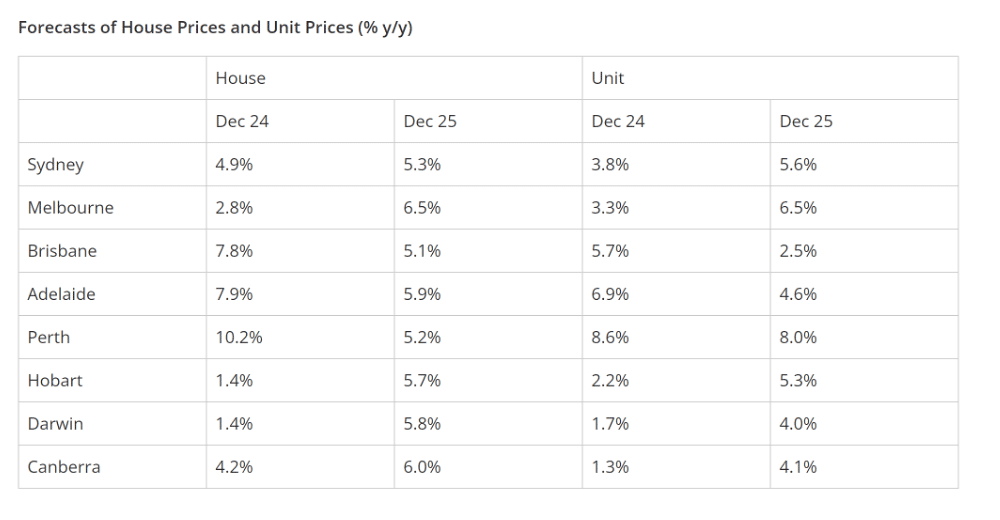

House prices to rise more gradually over next 18 months.

(KPMG Australia releases latest property report) Dear Fellow Property Investor, House prices will rise nationally by 5.3% over the next six months and by 5.6% during 2025, KPMG’s new property report on Australia’s capital cities finds. Apartment prices across the country will see an average rise of 4.5% by December and then match houses by growing by 5.6% in the following 12 months. For the next six months, there will be considerable national variation with Perth house prices rising by over 10% while Darwin and Hobart only experiencing 1.4% growth. For units, the predicted increases range...