Latest News & Blog

‘It was always going to happen’: Sydney’s disappearing freestanding homes

This article was originally published by Matt Wade via smh.com.au on Oct 9th 2017. They have dominated suburban Sydney for generations but the freestanding home with a driveway and a yard is in decline. The total number of traditional detached homes across greater Sydney has fallen by almost 15,000 over the past decade, analysis of the census shows, even though the city's population grew by more than three-quarters of a million people in that time. While many new free-standing homes are still being added, especially on the outskirts of the city, an even bigger number have been demolished...

House prices surge

This article was originally published by EWEN MCRAE via starweekly.com.au on OCTOBER 9, 2017 Median house prices in Sunshine and Albion have gone up an average of 11 per cent a year for the past decade, according to new figures. Figures from property data analysts CoreLogic show Sunshine and Albion as being the equal second most consistently strong housing market, behind East Melbourne which has grown at 12.5 per cent per year since 2008. Average growth across Melbourne was 6.6 per cent a year for the past decade, while Brimbank as a whole grew by 8.8 per cent in the same time....

‘No evidence’ Chinese buyers are driving up housing prices

This article was originally published by Lucy Dean for nestegg.com.au on Oct 5 2017. Despite public perception that the “nefarious actions” of Chinese buyers are pushing up housing prices, there’s “no evidence” of this, an analyst has argued. A new report from China research group, Cross Border Management, argues that Australian housing prices are “much more correlated with interest rates and population growth” than Chinese investment. “The idea of malevolent effects from Chinese investment has gained a significant following in relation to the property market, where it’s become...

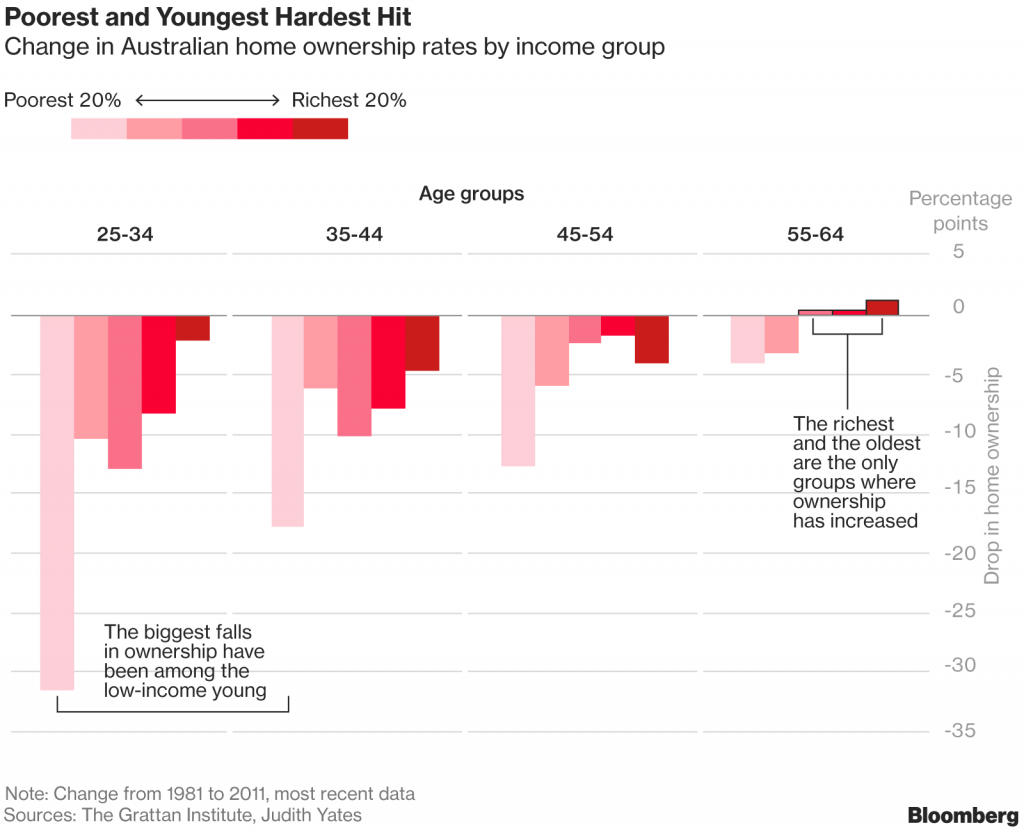

In the World’s Most Livable Cities, Hardly Anyone Can Afford a Home

This article was originally published by Emily Cadman via Bloomberg.com | 5 October 2017 Home ownership among young Australians has fallen to the lowest level on record, as an explosive property boom squeezes out all but the wealthiest. Supercharged by record low interest rates, a lack of supply and a tax system that favours property investors, home prices have surged more than 140 percent in the past 15 years, propelling Sydney past London and New York to rank as the world’s second-most expensive housing market. Melbourne, ranked the world’s most livable city the past seven years by the...

Half Melbourne homes worth double their purchase price

This article was originally published by Samantha Landy, Herald Sun, September 28, 2017. ALMOST half of Melbourne’s homes are worth at least double the price their owners paid for them. CoreLogic data reveals the proportion, 47.3 per cent, is up from 38.1 per cent ten years ago. Experts say homeowners in the city are reaping the benefits of a property market that’s entered “new paradigms” after years of sustained price growth. A substantial 40.8 per cent of regional Victorian homes are also valued at twice as much as their purchase price. On the flip side, just 2.1 per cent of...

Why Taking Out Lenders Mortgage Insurance (LMI) Is Your Best Investment Ever! By Konrad Bobilak

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. Here is what you will learn by watching this video: Whenever investors borrow above 80% LVR in order to buy an investment property, investors will have to pay Lenders Mortgage Insurance (LMI) for the privilege of doing so. At the time of writing this, the highest LVR offered in Australia via standard main stream lenders was 95% LVR plus LMI capitalised, equating to 97% LVR which includes the LMI premium. Essentially, LMI simply refers to an insurance premium that is payable by the borrower, on behalf...

Nine charts that tell the story of the housing market

This article was originally published by Daniel Gradwell and Joanne Masters, Senior Economists at ANZ Research on Sep 25 2017 via bluenotes.anz.com.au The housing market is down - but not out. At ANZ, we see evidence the market is cooling with weaker auction results pointing to slower price growth through 2017. Additionally, tighter borrowing conditions and higher interest rates are likely to weigh on price growth into the New Year. Housing affordability has been steadily worsening, especially in Sydney and Melbourne. First-home buyers have been priced out of the market, with an...

ANZ Bank tightens lending in suburbs of Brisbane and Perth

This article was originally published by TURI CONDON , Property Editor on September 25, 2017 via The Australian ANZ has tightened its restrictions on lending to apartment buyers in 18 suburbs in Brisbane and seven of Perth’s suburbs as regulators continue to warn on the apartment glut, most recently singling out the rash of development in Brisbane. The bank issued a list of postcodes to its mortgage brokers where loan to value ratios must not breach 80 per cent for off-the-plan and existing apartment lending. ANZ’s toughened stance comes on the heels of Reserve Bank assistant...

Weekly clearance rates suggest Melbourne’s housing market is outpacing Sydney

Clearance rates for Australian auctions were little-changed last week, with the Melbourne market driving higher volumes. CoreLogic’s preliminary weekly auction clearance data showed a national clearance rate of 70.3% — just up from 70.2% and 70.0% in the preceding two weeks respectively. The figures were consistent with recent results which suggest that the broader housing market is cooling. However, among the two biggest markets, Melbourne continues to outpace Sydney in both auction volumes and clearance rates. Melbourne also topped the nation with 0.6% price growth across the past...

More Boroondara suburbs set to have $2 million median house price

BOROONDARA suburbs used to be famed as members of the “million dollar” club but today you’d be lucky to get change from $2 million if you want to buy a home in the inner east. Canterbury, Kew, Balwyn, Surrey Hills, Camberwell and Glen Iris all have median house prices of over $2 million, the latest Real Estate Institute of Victoria figures show. And Hawthorn and Kew East looks set to join the club before the year is out. Real estate agent Mark Fletcher from Fletchers Balwyn said he couldn’t see growth slowing any time soon. “The supply and demand is just so strong,” Mr Fletcher said....