Latest News & Blog

CoreLogic is expecting Melbourne home values to rise by up to 14 per cent in 2020!

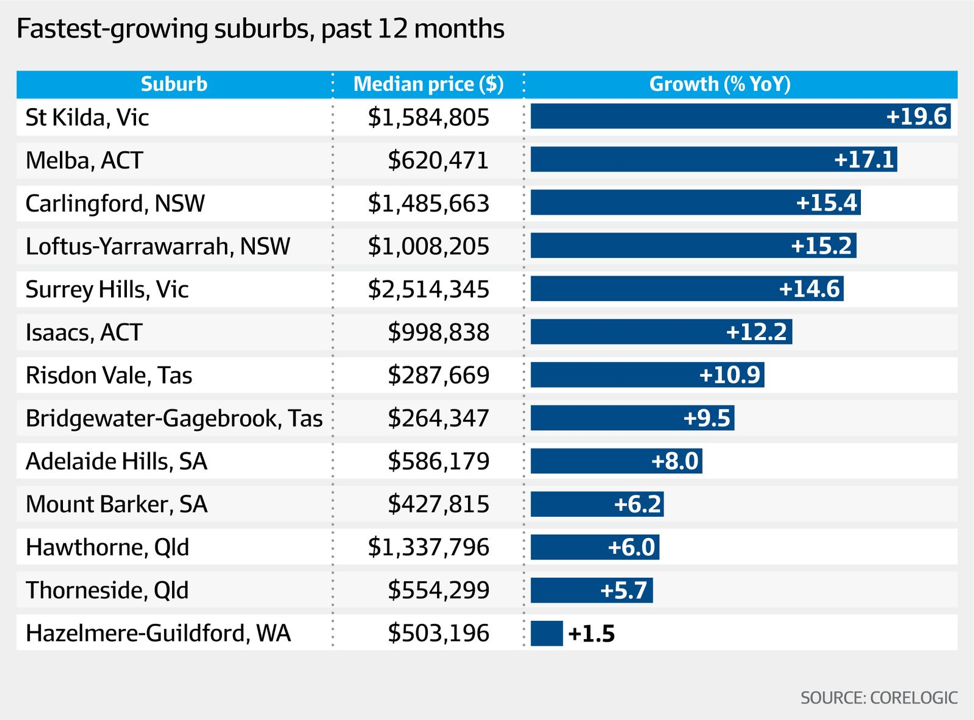

Melbourne's housing market is set to eclipse Sydney's in 2020 fuelled by a stronger economy and higher population growth, although the rapid pace is expected to lose steam as listings rise and affordability worsens. CoreLogic is expecting Melbourne home values to rise by up to 14 per cent in the next 12 months, while Sydney is forecast to grow by up to 12 per cent. "Considering the strong economy and demographic fundamentals, we could see the Melbourne housing market outperform Sydney's in 2020," said CoreLogic's head of research Tim Lawless. Melbourne home values are set to outperform...

A near-record number of cashed-up Australians are rushing back into the booming property market!

After a measly two-year downturn, homebuyers now appear to be back in a big way. The proportion of Australians planning on purchasing a house is back near all-time highs, propelled on by three rate cuts according to the latest Commonwealth Bank research. "The one area where monetary policy stimulus is clearly working is the housing market," CBA chief economist Michael Blythe said in a note issued to Business Insider Australia. "Home buying intentions rose further in October and are now close to the record highs seen in [the first half of] 2017." The "sharp uptrend", recorded in CBA's...

[New Video] How Many Investment Properties Do You Really Need To Retire On A $78,000 Annual Income In Australia?

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. Dear Fellow Property Investor, Here are the 2 key concepts that you must learn at the very beginning of your journey as a property investor: How to smash your current home mortgage in record time!, and How to build a property portfolio that will have the potential to replace your current job income. You see, one of the most important concepts that you can learn in your lifetime is how to correctly structure your personal finances, and create a system that enables you to pay off a typical 30 year principal...

Land values in metropolitan Melbourne as a whole have increased 41.8 per cent since 2014!

Did you know that land values in metropolitan Melbourne as a whole have increased 41.8 per cent since 2014, hitting a median of $1448 per sqm. In the same period, the typical block size has shrunk from 607sqm to 585sqm. Outer Melbourne has seen the biggest decline in land size over the past five years, falling from 660sqm to 600sqm. Here are some of Melbourne's best performers since 2014, so for the past 5 years: CITYWIDE: Land value up 41.8% since 2014 to $1448 per sqm Block size down 2.6% since 2014 to 585sqm INNER RING: Essendon West: 125%, $2573 Parkville: 86%, $7885 Deepdene: 78%,...

Why Melbourne house prices could surge by nearly 20 per cent in 2020

House prices in Sydney and Melbourne are expected to surge by up to 17 per cent next year following a record slump. Real estate data group SQM Research is forecasting price rises in every state capital in 2020, with lending rules now relaxed and interest rates at an all-time low. In the event the Reserve Bank of Australia cut rates again by Easter, to a new record low of 0.5 per cent, Melbourne property prices would skyrocket by 12 to 17 per cent as Sydney prices zoomed by 11 to 16 per cent. This would more than reverse the record slump in real estate values that began in 2017, but there...

CoreLogic: Melbourne property values could reach new heights by January 2020!

Forget the downturn - Melbourne's property values could reach record heights as early as January, with strong spring results promising good times ahead for vendors in 2020. Melbourne's property market is on track to make a full recovery from the downturn and reach record high values by January, new research shows. Rapid improvements in house and unit values over spring means the market may have completely corrected by early in the new year, leading property data firm CoreLogic suggests. Property values have started to improve since June, after an 11.1 per cent drop that began at the...

[New Video] Top Melbourne Suburbs That Are Set To Grow By 18% To 20% Over The Next 3 Years Revealed! …Plus 8 Suburbs You Need To Avoid At All Cost In 2020 And Beyond.

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. After a two-year slide, Australian house prices look to have bottomed out, sending buyers flocking back to the market. The sudden turnaround in sentiment can be traced to three factors: Following the conclusion of the federal election, the property market has regained stability as a result of the securing of negative gearing and capital gains tax, two, the Reserve Bank slashing interest rates to its lowest ever levels and three, the Australian Prudential Regulation Authority (APRA) removing the...

Melbourne house prices will soon be growing at double-digit rates!

Sydney and Melbourne house prices will be growing at more than 12 per cent per annum by the middle of next year, one of the nation's largest banks has forecast as the Reserve Bank talks up the chances of the economy recovering in 2020. Economists with the ANZ believe a change in sentiment along with cuts in interest rates and the federal government's income tax reductions will super-charge Sydney and Melbourne to a point they will effectively wipe out the price falls recorded between 2017 and early this year. Sydney dwelling prices rose by 75 per cent between 2012 and 2017 while over the...

[New Video] The Impact of Supply and Demand on Australian House Prices in 2019 and 2020

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. You probably have heard an old saying; "Land Appreciates and Buildings Depreciate", hence the money is always in land. Which brings me to one of the most important Key Drivers of Capital Growth to appreciate (and there is quite a number of them) is that Not All Land Is Created Equal. That is, 150 square metres of land in Richmond will always outperform 1,000 square metres of land in Sunbury. Always remember that 80 per cent of the growth is based on the location, and only 20 per cent of growth is based on...

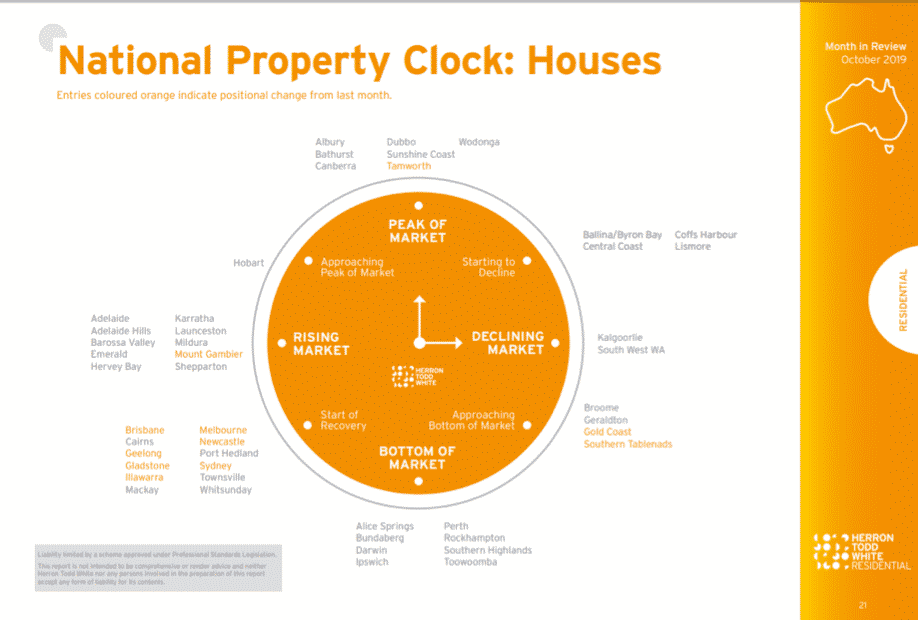

Sydney and Melbourne begin housing market recovery: HTW Property Clock

The housing markets in Sydney and Melbourne are all starting to recover, according to valuation firm Herron Todd White. Their October National Property Clock sees them move from the bottom of the market to starting to recover. Sydney only spent one month at the bottom of the housing market with their bounce back in prices being sharp. The outer suburbs of the capitals are again catching on the coat tails of their bigger neighbours. The likes of Geelong outside of Melbourne and Newcastle and the Illawarra region outside of Sydney are also starting to recover. The Illawarra went straight...