Dear Fellow Property Investors,

Australia is facing two more years of house price growth, with two standout markets expected to jump the most, according to a bank expert.

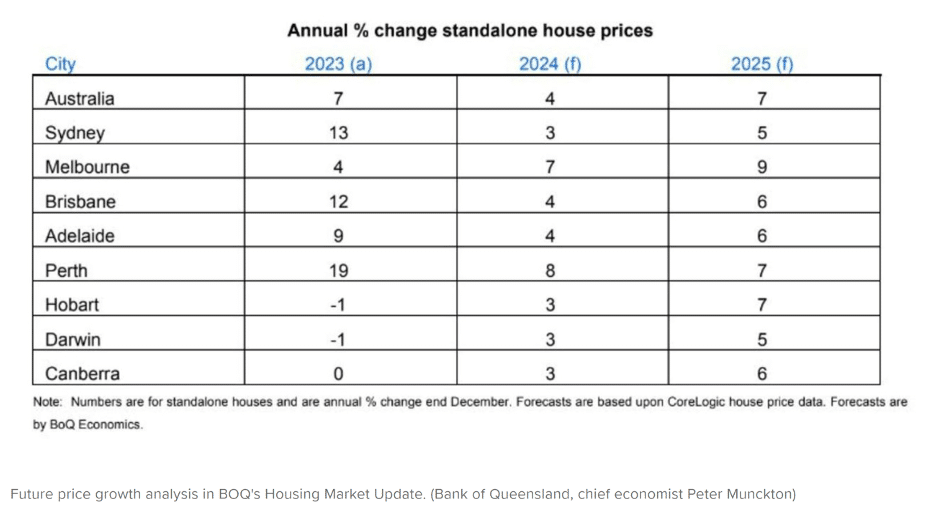

Melbourne and Perth will clock the greatest increases in house prices this year, Bank of Queensland chief economist Peter Munckton found in his new year outlook report.

Depleted listings and few options for buyers will cap how far prices can decline, Munckton wrote in the BOQ’s Housing Market Update.

Prices will go up this year but not by the margins seen in 2023, he predicts.

Munckton is not expecting interest rate cuts until the end of the year. Earlier rate reductions would result in more “aggressive” house price growth, he said.

Price rises will likely continue with gusto in 2025.

“Average house price growth Australia-wide is likely to be lower in 2024 than it was in 2023,” he said in the report.

“The lack of new supply puts a floor as to how far house price growth can slow (at least without substantial changes in interest rates or the unemployment rate).

“Stronger house price growth is likely in 2025 as interest rates are reduced and the economic outlook improves.”

Domain’s latest House Price Report (December 2023), released in January, found record median prices were struck across several capital cities. It has never been more expensive to buy a house or unit in Australia.

At $1,094,539 for houses (up 2.1 per cent over the quarter, or 7.8 per cent over a year) and $638,372 for units (up 2.3 per cent over the quarter and 6.8 per cent over 12 months), the fresh levels inflict further challenges on those striving to get a foot in the market, but reflect capital gains and increased equity for those with mortgages.

Munckton said the bounce of prices in 2023 was a “surprise” to most analysts.

He said the “biggest rise” in standalone house prices in 2024 will be in Melbourne and Perth – markets which he regards as “best value” when comparing rental yield with the level of long-term interest rates.

“Melbourne price performance last year was modest by capital city standards,” he wrote.

Let me ask you something…

Do you have a game plan for 2024?

Or will you watch savvy, educated, market-ready investors snap up all the bargains at the bottom of the Melbourne property cycle (which, in my opinion, already bottomed out in November 2022), again?

Or, will you join them?

So, what are you waiting for?

Reserve your place and join me and 55 like-minded property investors for the first Real Estate Investing Fast Track Weekend for 2024!

Click HERE to reserve your seat now!