Dear Fellow Property Investor,

New figures show significant growth in Brisbane, Adelaide and Perth with many suburbs seeing increases of more than 15% and Sydney up by 7.5%!

Australia’s property prices have soared to record levels in several capital cities as limited sales volumes and rising populations more than made up for the dampening effect of higher interest rates, two data groups say.

The new figures show significant growth in Brisbane, Adelaide, and in Perth, where five areas have recorded annual gains of more than 15%, while prices in Sydney are 7.51% higher than a year ago.

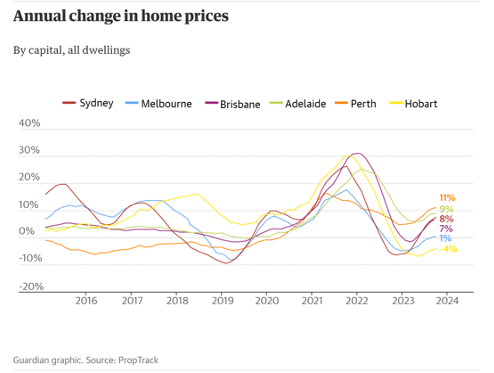

Overall, national home prices crept 0.36% higher in October, bringing the rise to just under 5% for 2023, according to PropTrack. Sydney, Perth, Adelaide and Brisbane values are all at record peaks.

“We’ve seen national prices have now risen for 10 consecutive months,” PropTrack’s senior economist, Eleanor Creagh, said. “It’s certainly a daunting increase for someone [who’s] yet to enter the market.”

Rival data provider CoreLogic said its national home value index rose 0.9% in October alone, accelerating from September’s revised 0.7%. The 7.6% increase from a trough in January left the index just 0.5% below the peak recorded in April 2022, the group said, citing slightly different tracking methods.

“There’s an increasing diversity of capital growth performance,” the head of residential research at CoreLogic, Eliza Owen, said.

“Sydney and Melbourne are loosening up a little bit. Hobart, Darwin and Canberra have been flat or falling in recent months and remain down quite substantially year-on-year,” Owen said. “But then when you look at Brisbane, Adelaide and Perth – those cities are performing quite differently with [price] growth trending at over 1% a month, inventory levels very low, values at peak, and showing little sign of slowing down.”

The rise in property values during 2023 has caught many analysts by surprise, given the Reserve Bank has been lifting interest rates at the fastest pace in three decades including four rate rises in 2023 before a pause in past four months.

For many people housing is their biggest asset. When home prices fall, it tends to dim households’ sense of wealth, cooling their spending, a trend the RBA had been factoring into their economic models.

With most economists now predicting another interest rate rise next Tuesday, CoreLogic and PropTrack expect some of the real estate fizz to diminish.

“I think the re-acceleration in housing [price] growth might be short-lived, given the increasing prospects for a rate rise next week,” Owen said.

A revival in new listings – including a 10.7% rise in Melbourne and 9.3% in Sydney since the start of spring – will also put a brake on the pace of price gains in some markets, she said. A renewed drop in prices can’t be ruled out.

“New listings added to the market across Sydney in the past three months is about 23,000 properties as opposed to 21,000 sales,” Owen said. “The supply/demand position is shifting.”

Creagh said other cities such as Perth, Brisbane and Adelaide may take a lot more to slow them down.

Home prices in the Western Australian capital rose 0.52% alone in October, a 16th month in a row of gains, and are now 10.9% higher than a year earlier. Rental vacancies are less than 1% and landlords average just 16 days to rent out a property.

Let me ask you something…

Do you have a game plan for 2023 and 2024?

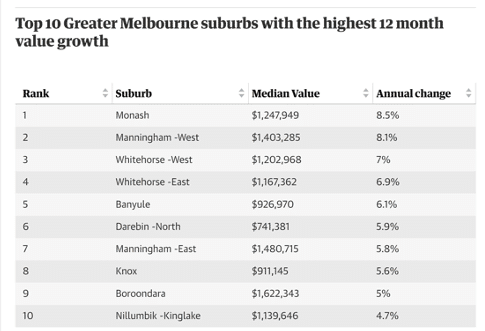

Or will you watch savvy, educated, market-ready investors snap up all the bargains at the bottom of the Melbourne property cycle (which in my opinion by the way has already bottomed out in November 2022),

Or will you join them?

So, what are you waiting for?

Reserve your place and join me and 55 like-minded property investors for the last Real Estate Investing Fast Track Weekend for 2023!

Click HERE to reserve your seat now!