This article was first published by DAVID SCUTT on 28 Sept 2016 via businessinsider.com.au | Image: Photo by Frazer Harrison/Getty Images

We might not know exactly what prices are doing, and some markets are deemed to be in a bubble, but it’s clear that the vast majority of Australian homes that were sold in the June quarter were done so for a profit.

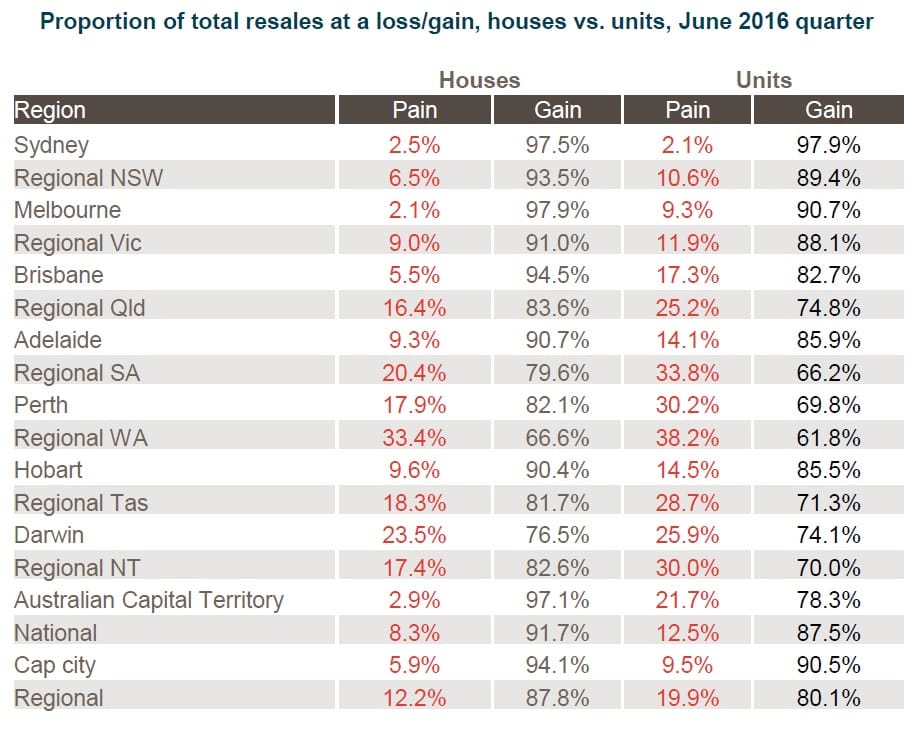

According to the latest Pain and Gain report released by CoreLogic earlier today, only 5.9% of capital city houses, and 9.5% of units, resold at a loss during the quarter.

That means 94.1% of all capital city houses, and 90.5% of apartments, sold for a higher price than what they were initially bought for.

Probably not all that surprising given the scale of the gains seen in recent years, particularly in Sydney and Melbourne.

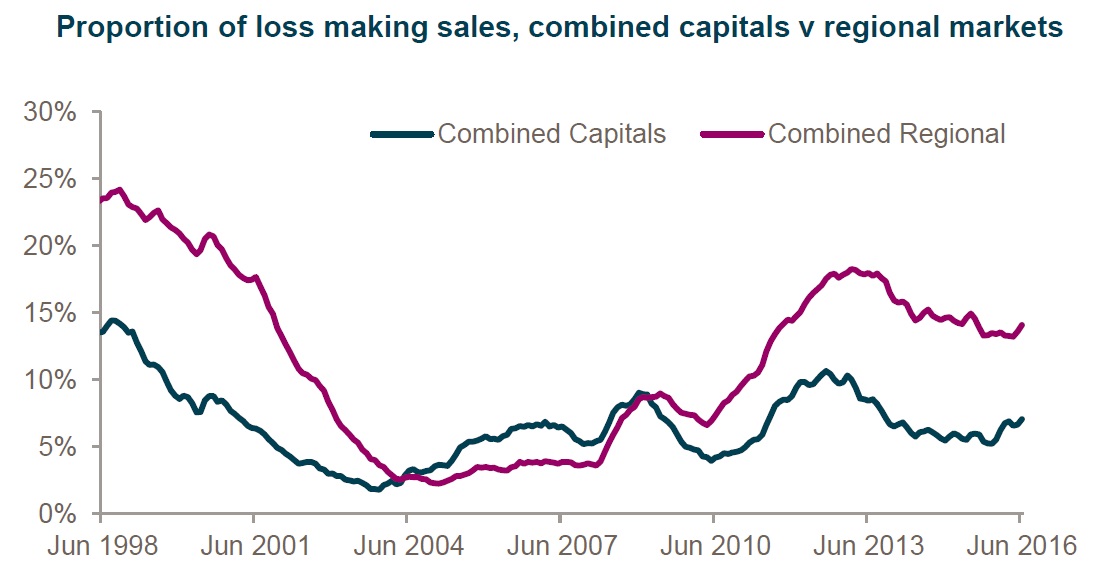

Regional areas, as they traditionally have, under performed the capitals with 12.2% of houses, and 19.9% of units, resold below the previous purchase price.

Combined, 9.5% of all dwellings sold nationally recorded a gross loss when compared to their previous purchase price, slightly higher than the 9.3% level seen in the March quarter.

According to calculations by CoreLogic, the profit on capital houses sold in the quarter totaled $9.953 billion, equating to an average gain of $363,442 per house. For capital city apartments, the profit on those that sold at a higher purchase price totaled $2.828 billion for an average gain of $229,596 apiece.

And that was for just one quarters’ worth of sales.

“While loss-making resales increased over the quarter, historically, most cities are still seeing quite a low instance of homes reselling at a loss,” said Cameron Kusher, a research analyst at CoreLogic.

“However, Perth and Darwin are the exceptions with the proportion of loss-making resales at, or close to historic highs.”

According to Kusher, the proportion of loss-making resales increased across each capital city excluding Melbourne and Canberra.

“Over the period, 20.1 per cent of Perth homes resold at a loss, while in Darwin, 24.2 per cent of homes resold at a loss; the highest proportion since December 2002,” he said.

Across the remaining capitals, the proportion of loss-making resales was Sydney at 2.4%, Melbourne 4.4%, Brisbane 8.4%, Adelaide 10.6%, Hobart 10.8% and Canberra at 9.6%.

Fitting with warnings from the likes of the RBA and Citibank towards overbuilding of apartments in some markets, CoreLogic note that “in Melbourne, Brisbane and the Australian Capital Territory, the proportion of unit resales at a loss over the quarter was more than double that of houses”.

It was a different story for Sydney, one of the largest property bubbles in the world according to analysis from UBS, with the city “the only capital or regional market which had a lower proportion of units reselling at a loss compared to houses”.

Only 2.1% of apartments sold at a loss in the city during the quarter, below the 2.5% level for houses.

This table from CoreLogic has all the details over how each market performed during the quarter.

As you would expect with any long-term investment, CoreLogic also found a relationship between the length that a property was held and its final selling price.

“Across the country, those homes that resold at a loss had an average length of ownership of 6.3 years,” said Kusher.

“Across all sales recording a gross profit the average length of ownership was recorded at 10.3 years, while homes which sold for more than double their previous purchase price were owned for an average of 17.7 years.”

Not quite the seven years figure you often hear bandied around about doubling in value, but a telling statistic nonetheless.

“The data highlights the fact that ownership of property, whether for investment or owner occupier purposes, should be seen as a long-term investment,” Kusher notes.