Latest News & Blog

[NEW VIDEO]: Why The Smartest Investors Are Back Buying Into The Melbourne Property Market!

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. Did you know that Property Investors are swallowing up even more of the housing market? In Australian politics there are relatively few issues outside of foreign policy that the two major parties can agree on. But there is one issue where both sides ostensibly agree: greater levels of home ownership. In the run up to the last federal election, then Opposition Leader Anthony Albanese promised that a Labor government would help people achieve the “great Australian dream of home ownership”. “For too long...

Why you need to buy NOW (if you can): How Australia’s house prices are about to soar even higher

Dear Fellow Property Investor, Australian big city house prices are tipped to surge by more than a third during the next three years with Sydney's median price set to hit the $2million mark. The increases forecast between now and June 2027 would be even more significant than the price rises since the onset of Covid four years ago, which covered interest rates aggressively rising from record-low levels as immigration soared. Oxford Economics Australia is forecasting that Sydney's median house price will hit $1.934million by June 2027, with Perth reaching $1million. The median price in...

Four years on: How much Australian home prices have surged since the pandemic…

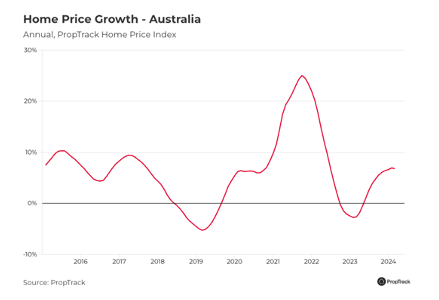

Dear Fellow Property Investor, In the four years since the pandemic began, home prices around the country have staged a remarkable feat. From fears of sharp falls through the pandemic, to predictions of steep declines when interest rates began to quickly climb, home prices have defied the expectations of many, surging 39.9% nationally. Throughout this four-year period, multiple factors have influenced and shifted housing trends, with the housing market cycling through different phases as a result of the pandemic's wide-ranging economic and social impacts. The supply of properties for...

The Top Performing Melbourne suburbs where homes are earning more than their owners!

Dear Fellow Property Investor, With property prices reaching record highs across the country, the humble home has become the main breadwinner in many households. In certain suburbs, homes are earning multiple times the average wage. National property prices hit new record highs in February, up 6.15% compared to a year ago, the fastest annual rise since July 2022, according to PropTrack. For hundreds of thousands of Australians, that growth means their homes may have generated more income than their own salaries over the past year. New analysis has used PropTrack's automation valuation...

Why buying Melbourne CBD apartments is a bad investment, even during the current housing affordability crisis in 2024!

Dear Fellow Property Investor, Apartments are selling at a loss in Australia's two biggest cities even during a housing affordability crisis, new data shows. Record-high immigration has pushed up house prices but more inner-city units are selling at a loss in already-overcrowded Sydney and Melbourne than anywhere else. An ultra-tight rental market and a digit-double surge in rents during the past year is also no guarantee that units will go up in value, especially if they are in a high-rise tower. In the centre of Melbourne, 40.7 per cent of apartments sold at a loss during the December...

[NEW VIDEO]: What Do The New Stage 3 Tax Cuts Mean For The Melbourne Property Market?

Don’t miss out, CLICK HERE to get up to date video education from Konrad Bobilak. Are the Stage 3 tax cuts fair (and will they happen)? On January 15, Prime Minister Anthony Albanese said the Stage 3 tax cuts were here to stay despite Labor’s consistent reservations, according to the Australian Associated Press. Since then, the conversation has swirled about the fairness of the Stage 3 tax cuts, which is set to cost the government $313 billion over 10 years. By January 22, one media outlet had claimed that the tax cuts were not going ahead as planned – although at the time of writing,...

7 Charts explaining why Australia has a rental crisis…bad news for tenants, good news for landlords!

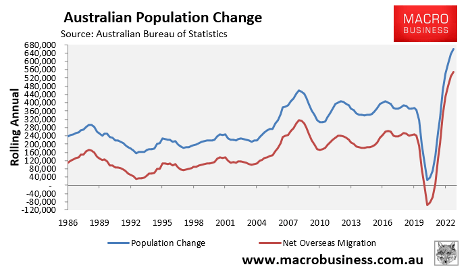

Dear Fellow Property Investor, If you are wondering why Australia is suffering its worst rental crisis in living memory, look no further than today’s official September quarter immigration data from the Australian Bureau of Statistics (ABS). Australia’s population surged by 660,000 people in the year to September 2023, driven by a record-high net overseas migration of 549,000: 145,200 net overseas migrants landed in Australia in the September quarter of 2023, the second highest quarterly figure on record behind March 2023: Net overseas migration as a share of Australia’s month remained at...

The Melbourne suburbs where house prices rose most over five years revealed!

Dear Fellow Property Investor, Did you know that a mix of middle and outer Melbourne suburbs can be revealed as the city’s best performing over the past five years, after the house price medians grew as much as 40 per cent in some locales. Unit prices grew the most in Mitcham, where they jumped 21.3 per cent over the five years to $752,000. It was followed by Highett (19.6 per cent to $658,000) and Brighton (17.9 per cent to $1.2 million). Melbourne’s overall median house price rose 22.1 per cent in the same period. Although it remains below its peak, the market has somewhat improved in...

Melbourne’s median house price will surge more than $110,000 to an almost $1.16m record high in the next 18 months!

Dear Fellow Property Investor, A new report is forecasting Melbourne’s median house price will surge more than $110,000 to an almost $1.16 m record high in the next 18 months – the equivalent of $200 a day. Oxford Economics Australia forecasts that the price recovery will drive Melbourne’s median $1.04 million median house to jump 110,000, or 5.5%, close to $1.157 million by mid-2026, driven by an expected resurgence in migration from both interstate and overseas. And it’s not just house prices, unit prices will also reach a new record. According to the report, Melbourne’s median unit is...

Australia’s luxury homes have outperformed the market!

Dear Fellow Property Investor, Did you know that over the past decade, luxury houses have experienced a far stronger rate of growth than the rest of the market? Median priced houses have increased by 78 per cent. In comparison, houses priced in the top five per cent have doubled. A luxury house has been a good investment over the past decade. Will this strong performance continue? A big driver of luxury house price growth is simply land value. There are only so many properties you can build in our most expensive suburbs, which tend to be located close to beaches, bays and rivers. Anything...